A shorter version of this interview appears in the fall issue of IR Magazine as part of a wider piece looking at IR in a bear market. Click here to read that feature now.

We all know what good IR should look like – and have a good idea of how IR should respond to a crisis or a market downturn. But what actually happens when the market shifts?

Nick Mazing, director of research at financial and corporate research platform Sentieo, uses the energy sector – ‘because the fossil fuel space has been in a recession for a few years’ – as a case study to examine how sentiment and communications really change.

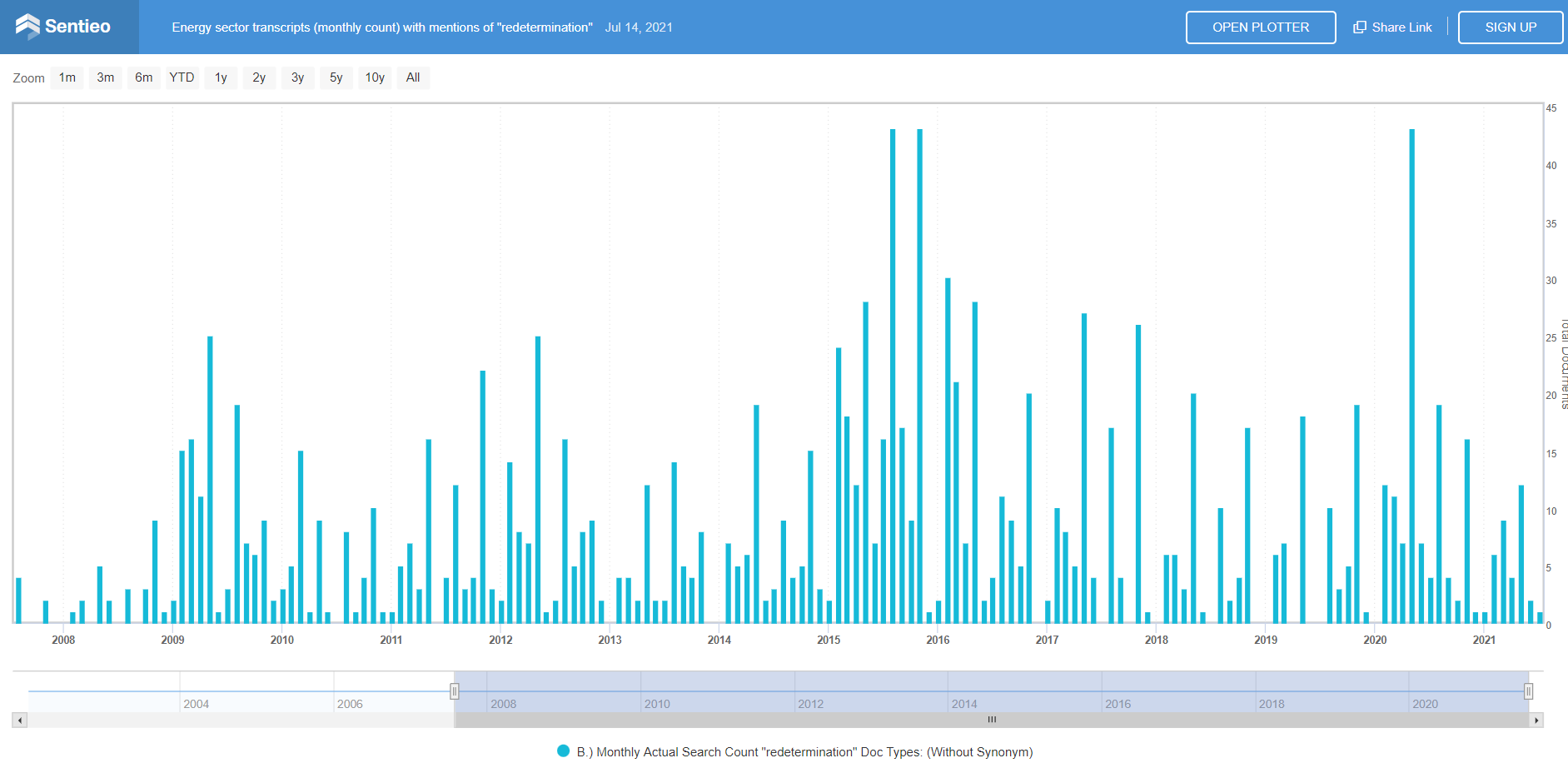

Looking at transcripts, the data shows a spike in immediately pressing issues being addressed on earnings calls, he explains. ‘For example, we can see that energy sector transcripts with mentions of ‘redetermination’ [a secured lending term related to the industry] spike during times of distress,’ he says. This increase is seen after the global financial crisis, again in the 2015-2016 energy turmoil and then again during Covid-19, when oil futures actually turned negative.

Source: Sentieo

Click on the images for interactive versions of each chart

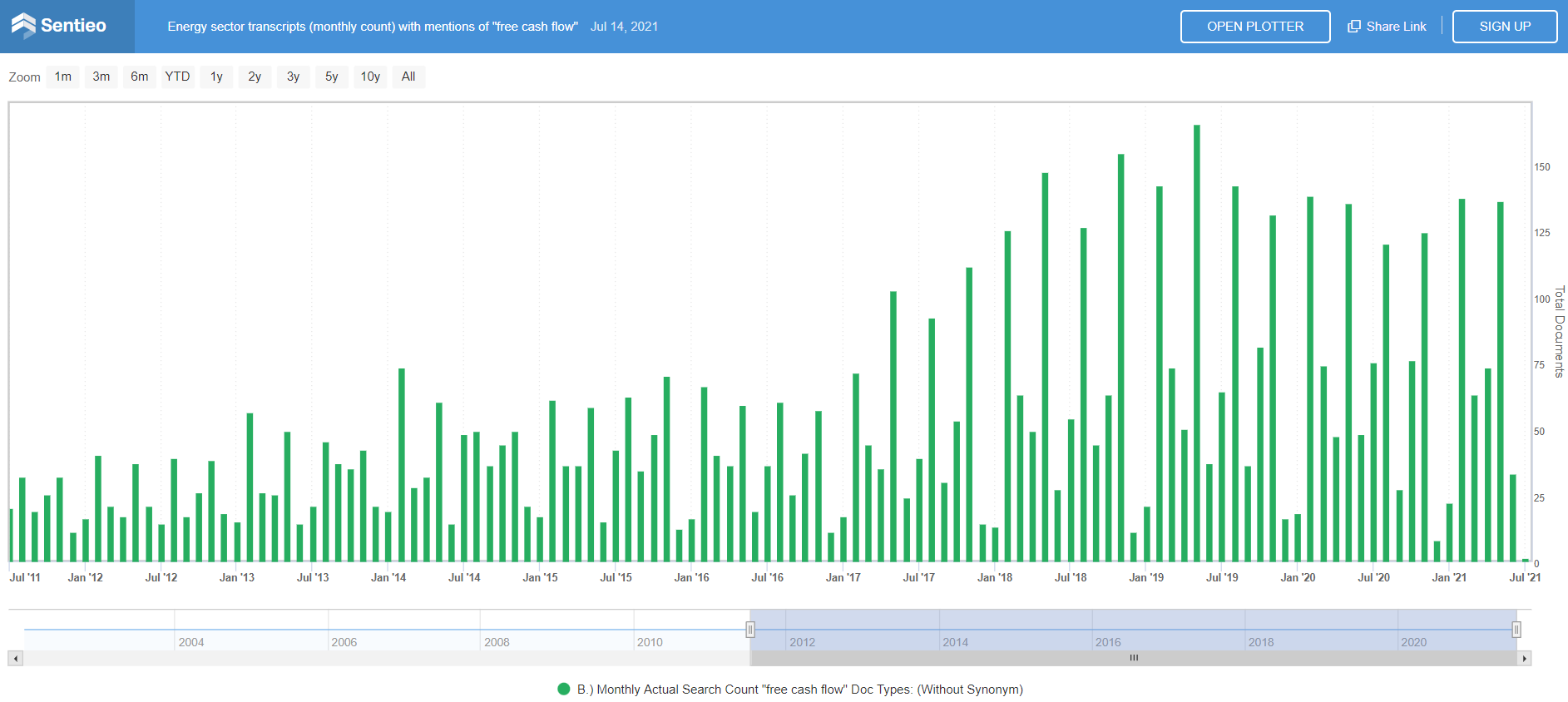

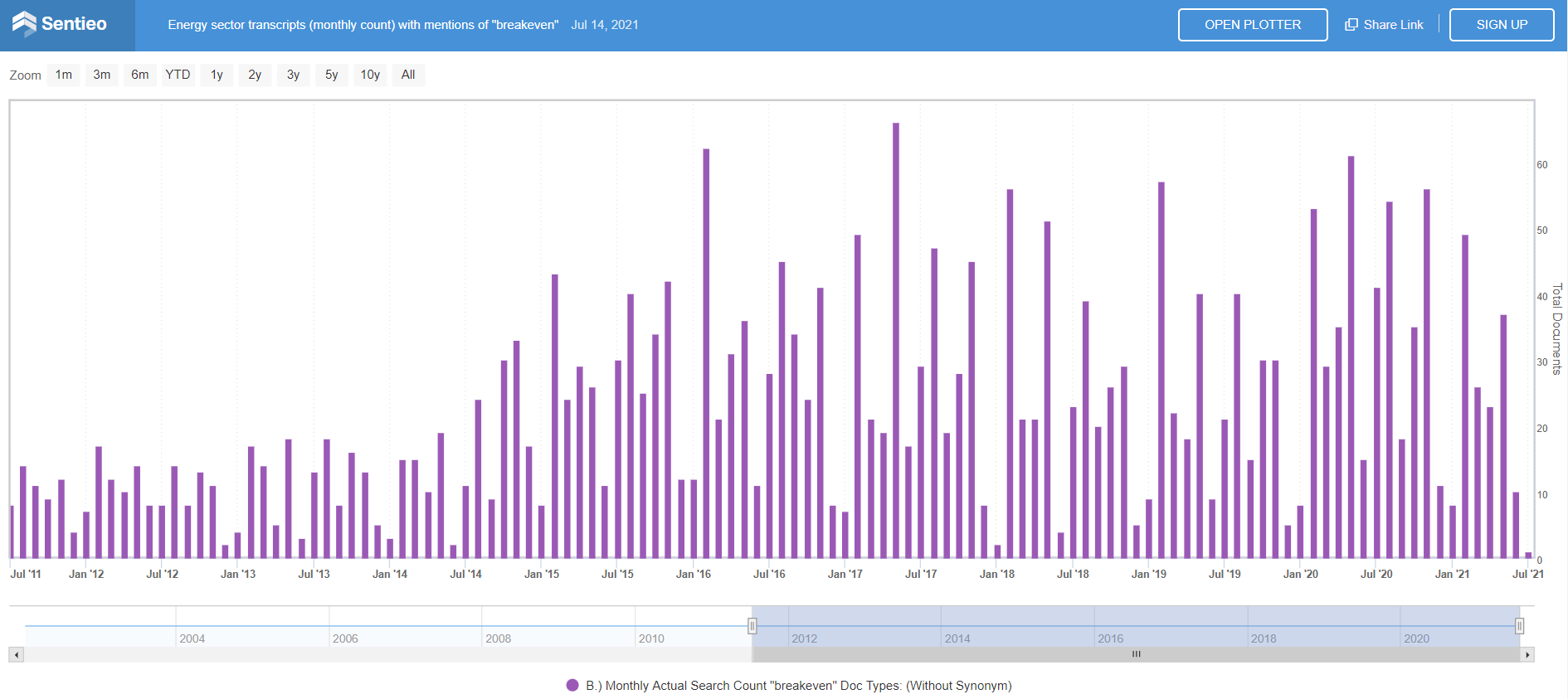

There are more permanent changes, too. ‘As the capital markets soured on the energy sector, we can see that ‘free cash flow’ and ‘break even’ are now frequent topics in energy sector transcripts,’ notes Mazing.

Source: Sentieo

Click on the image for an interactive version of this chart

Sentieo can search transcripts for individual terms but it also tracks sentiment. ‘Changes in language around crises are observable at both the individual word level and at the broader sentiment level,’ explains Mazing. ‘We can see the oil industry turmoil in our transcript sentiment models.

‘For example, looking at management sentiment for two oilfield services names, Schlumberger and Halliburton, we can clearly see the 2015-2016 crisis and then Covid-19. Revenues and sentiment declined during these two crisis periods but, more recently, we can see both revenue change inflecting and sentiment bouncing back.’

Source: Sentieo

Click on the image for an interactive version of this chart

Taking a broader view of the sector, Mazing says things played out as you’d expect. ‘Investors spent more than 10 years financing the US shale boom but eventually wanted some money back,’ he says, pointing to other sectors today, such as software as a service, where investors are currently looking only for growth. ‘Eventually, this will change’.

Read We’re going on a bear hunt: IR in a bear market from the fall issue of IR Magazine now