News

-

Corporate art: The annual report as an object of design

Annual reports serve a legal purpose – to report on a company’s accounts and operations. But it has also become a graphic object that describes the company’s narrative in both words and design. The report is a central part of ‘telling the company story’, its business and sometimes the investment case, while also satisfying the needs of governance hawks. Using Sthlm Kom, we take a closer look at what graphic and design trends we can see in this ‘dry corporate document’ over the last 20 years.

-

From IR to finance chief: Sinclair Names Narinder Sahai as CFO

Media firm Sinclair – which owns, operates or provides services to 185 television stations in 85 markets – has announced former IR professional Narinder Sahai as its new executive vice president and CFO. Sahai joins from Arcis, a leading leisure and hospitality operator, where he led financial planning, accounting, tax, treasury and debt investor relations as the company’s CFO. He was also previously CFO at powersports platform RumbleOn, a role that saw him work on transformative acquisitions. Before working at RumbleOn, Sahai was at Amazon Web Services, where he serves as head of worldwide go-to-market finance for compute and AI/machine…

-

Activist nominees, ESG Trojan horses and tangible investor days: five things we learned at the IR Impact Think Tank – Europe 2025

Europe’s top IR leaders gathered in London to debate, discuss and learn in a series of panels, sessions and roundtables ahead of the IR Impact Awards – Europe 2025 What did more than 170 IR professionals head to London to talk about at the IR Impact Think Tank – Europe 2025? Everything from volatility and uncertainty (of course) to what makes an award-winning IR team and how to untangle yourself from the spilled alphabet soup of ESG and making the most of AI for IR. Panels were mixed with live polls, roundtable discussions, collaborative sessions and networking. We’ve picked five…

-

‘Prevention is better than remedy’: majority of investors say governance gaps attract activists, research shows

The majority of institutional investors credit poor governance practices as the biggest driver of shareholder activism, a new study from shareholder advisory firm SquareWell Partners has found. Some 84 percent of investors polled, who hail from North America, Europe (including the UK) and Asia, said that poor governance was the main driver of activist investor attention. The findings of SquareWell’s report, titled The Long and the Short of It: Institutional Investors’ Views on Activism, center around three key themes, views on activism, evaluation criteria and engagement dynamics. This finding means that the quality of a company’s governance framework is paramount and…

-

‘She significantly shaped IR in Germany’: in memory of Magdalena Moll

Magdalena Moll, or Maggie as many called her, recently passed away. She remains at the top of the IR Impact Awards league tables, having dominated the most prestigious positions in the Europe Awards year after year as the lead for German chemicals giant BASF. Some years there were humorous groans as she stepped up to claim yet another trophy. Once, when this writer asked for her views (yet again), she said quite seriously that she had nothing left to say, having been tapped for her thoughts on IR best practice too many times. Laurie Havelock, IR Impact editor, recalls Moll…

-

All wrapped up: how Deutsche EuroShop sparked conversation with AI action figures

What did it take to turn Patrick Kiss, IR Impact Award-winning investor relations lead at Deutsche EuroShop, into a fully boxed action figure? Well, it needs a spark of creativity, a ChatGPT Pro account plus a lot of patience. ‘To give you an idea of the work involved, the final optimized prompt for my own action figure had 304 words in 66 lines with more than 2,200 characters,’ says Kiss. This is something of a side step from the usual conversations around AI for IR, where the focus is on saving time for IROs paddling against the current of increasing…

-

Three trophies apiece for eDreams ODIGEO, Iberdrola and Infineon Technology at the IR Impact Awards – Europe 2025

German semiconductor firm Infineon Technologies won three trophies at the IR Impact Awards – Europe 2025, with two Spanish firms – Iberdrola and eDreams ODIGEO – also matching the tally.

-

People moves: Standard Lithium charges up IR with new hire

US lithium producer Standard Lithium has announced two new names to its executive team, including a new investor relations lead. David Rosen joins the Arkansas and Texas-focused firm as its new vice president of strategy and investor relations, with the company also naming Tim Sobel as vice president of health, safety, social and environment (HSSE). Rosen joins Standard Lithium from a director of integration role at Rio Tinto, a position that saw him play a ‘key role in the post-acquisition integration of Arcadium Lithium’ into the mining company, according to a press statement. In that capacity, Rosen led ‘cross-functional initiatives…

-

How IR teams can master analyst consensus

Analyst consensus – the aggregated estimates from analysts on a company’s upcoming results – is a critical part of the financial communication landscape and an essential tool for IR teams. Yet for many investor relations professionals, working with analyst consensus is time-consuming, difficult to analyze and too often based on incomplete data.

-

Geopolitical volatility has made the IRO presence more important than ever

IROs are at the frontline for communication and engagement with shareholders. The role is as complex as it is satisfying while navigating the constant turbulence. At any given time, new regulatory requirements, shareholder tendencies or political factors demand a response.

-

People moves: Autodoc names new IR lead as $2.8 bn IPO looms

Stefanie Steiner has taken up the IR reins at Autodoc as it prepares an IPO expected to value it at $2.8 bn. Writing on LinkedIn this week, she says: ‘I am excited to share that I will embark with #AUTODOC on the next stage of my journey. About a week ago, I joined the new team and had a very warm welcome. In such a technology-driven company I have to familiarize myself not only with business model, strategy, financials and the large market that has enormous potential in the years to come, but also with many new programs and tools.…

-

Investor relations in Europe: uniting a fractured landscape

Across Europe, the landscape of IR societies is diverse and highly decentralized, with most countries having their own independent associations. While these national IR societies effectively support local professionals, there is no singular pan-European body that unifies these efforts. In most European markets, you can find well-established societies like Germany’s DIRK or France’s CLIFF.

-

IR time management: the holy grail for today’s investor relations professionals

It’s no secret that the IR workload has been expanding – even as resources fail to match pace. At the same time, market uncertainty has made the day-to-day less predictable. The result is that the modern IRO is busier than ever. This was something Erik Carlson, chief operating officer at Notified pointed to early in a recent webinar titled: Strategic time management for today’s IRO. ’If look at the challenges in the market, the rise in distrust of the media, the proliferation of content – it’s becoming harder and harder to cut through the noise, to synthesize information and do…

-

Navigating market volatility: A data-centric approach

This year, market volatility has surged dramatically, fueled by dynamic US trade policies and ensuing responses from governments around the globe. The market landscape is shifting almost daily, leaving companies scrambling to provide clear forecasts amid a sea of uncertainty. Meanwhile sell-side analysts, traditionally reliant on stable, predictable data, now find themselves venturing into new data sources to recalibrate their projections on the fly.

-

IR Playbook: Maximizing your return on time now available

IR Impact research shows that IROs are increasingly taking on tasks outside of the traditional investor relations role, with resources failing to match pace. We look at where they are spending most time and which tasks they find the most value in to uncover where efficiencies can be found.

-

‘Best-in-class IR is about creating a clear vision’: Roy Wefuan at the IR Impact Awards – Canada 2025

What are the hallmarks of a best-in-class IRO? For Roy Wefuan, head of client success at TMX Group, it comes down to prioritizing clear, consistent and proactive communication with your various stakeholder audiences.

-

People moves: Jutta Mikkola takes over at Stora Enso and Greer Aviv joins Cognex

US machine vision system maker Cognex has brought in Greer Aviv as its new head of investor relations. In a move effective from June 2, 2025, Aviv will join the Nasdaq-listed firm to serve as the ‘primary liaison between Cognex and the investment community,’ a press release states.

-

People moves: Angela Catlin steps back from The Co-operative Bank as B&M’s head of IR David McCarthy retires

Angela Catlin, head of investor relations, corporate affairs and brand at The Co-operative Bank, has announced she is stepping back after two years at the company. Catlin, who has spoken at several IR Impact events about ESG and other topics in recent years, joined The Co-operative Bank in 2023 as its head of investor relations, adding corporate affairs and brand duties to her job in 2024.

-

EDGAR Next: what public companies need to do before September 15

New SEC FILING RULES REPRESENT A BIG SHIFT EDGAR Next represents the most significant shift in SEC filing access in over two decades. Beginning September 15, 2025, public companies must transition to a more secure, role-based access system that replaces shared credentials with individual login.gov accounts. Failure to comply may result in loss of filing […]

-

The new standard in financial research: A purpose-built AI chat for finance and IR professionals

We’ve all been there: scrolling through PDFs, trying to find that one data point; re-listening to earnings call Q&As; sifting through 50-page slide decks packed with bullet points, just to find a single sentence that might confirm or kill your thesis. It’s time-consuming, it’s manual and, in a high-stakes environment where every second and decision counts, it’s frankly no longer good enough.

-

Activists: the last defenders of the retail shareholder

What is good for an activist is often good for other shareholders In October 2017, Procter & Gamble (P&G), one of the largest US companies, announced that shareholders had rejected the proposal of activist fund Trian Partners to join its board of directors. The difference in votes for or against the request was so small – a meagre 0.2 percent on more than 2 bn shares, that Trian asked for a recount. In December of that year, the company announced that Nelson Pretz, chairman of the fund, would join the board of directors after all. After the recount, the fund…

-

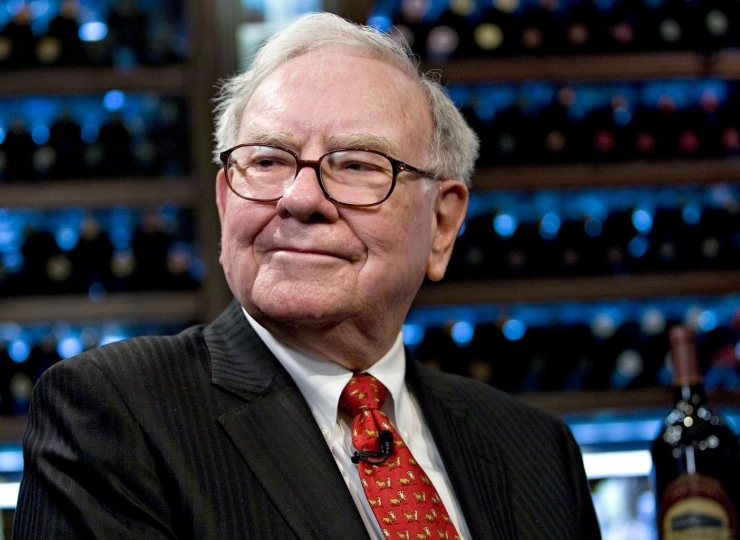

IR lessons from Warren Buffett as Berkshire Hathaway’s ‘Oracle of Omaha’ retires

Berkshire Hathaway’s charismatic chief executive Warren Buffett, the much-vaunted ‘Oracle of Omaha’, enjoyed two significant career milestones this week. The first was helming his 60th annual meeting for the fund, which shed light on where the trillion-dollar-investment manager will be focusing its attentions in the near future. Almost 20,000 people attended the event, which sees attendees spend hundreds of thousands at concession stands alone.

-

Struggling for survival amid the noise: biotech webinar offers wider lessons for the IR community

While not everyone in the IR profession will be working in the environment that biotech IROs find themselves in today, everyone seemingly everywhere is battling the noise and uncertainty generated by tariff talks, geopolitical tensions and other macro headwinds. IR Impact recently sat down with Angela Bitting, senior vice president, corporate affairs at Twist Bioscience, Aron Feingold, vice president IR and corporate communications at Geron Corporation and Lynn Pieper Lewis, founder and CEO of webinar sponsor Gilmartin Group, to talk about the challenges the sector is facing. The fascinating discussion that followed is as useful to those in the broader…

-

Patrick Möller eyes new opportunity at optician Fielmann and Stephen Nightingale steps down from Britvic

Experienced German IRO Patrick Möller has taken up a new role at Hamburg-based optician group Fielmann as its new director of investor relations. He joins the company after 17 years as vice president of investor relations at New Work, formerly known as Xing, during which time he was nominated for the award for best overall IR – small cap at the IR Magazine Awards – Europe 2016. He left his role at New Work following the company’s delisting from the Frankfurt Stock Exchange earlier this year.

-

‘I wanted to set a new standard for investor days’: Rebecca Gardy of Campbell’s on an award-winning event

At the recent IR Impact Awards – US 2025, we spoke to Rebecca Gardy, chief investor relations officer at Campbell’s, about how exactly they planned last year’s investor day

-

ESG: Over or in it for the long haul? IR Impact Forum takes debate to Canada

Whether ESG is over or increasingly relevant, in need of reform or greater standardization is the great debate. Has the term become too ‘woke’? Is it too much of a political hot potato? Does good ESG equate to better share price performance, or has it been hijacked under the pretense of improving returns? Prabh Banga of Aecon Group (left) and Jack Mintz from the University of Calgary (middle) debate ESG with IR Impact’s Steve Wade These were the topics up for debate when Prabh Banga, vice president of sustainability at Aecon Group and Jack Mintz, president’s fellow of the school…

-

Huntington Bank names Eric Wasserstrom as IR lead and a flurry of posts open up across the profession

New names at Huntington Bank. Atos Group and Konecranes, while a flurry of posts open up across the profession. Eric Wasserstrom has been named as the new vice president, head of investor relations at Huntington National Bank, a $210 bn asset regional bank operating across 13 US states.

-

How broker insights can transform your earnings process

As data continues to flood the market, IROs are finding it both challenging and time-consuming to gauge market perceptions of their companies. Increasingly, IROs are looking to their data platform providers to help them collect all the available, granular insight from brokers in one place, where it can be sorted, analyzed and better understood. But how can that data be passed through into the earnings process overall and be used to improve the impact of a company’s latest figures on various stakeholder audiences?

-

Earnings season: Navigating financial guidance amid macroeconomic uncertainty

In the current climate it is the transparency and rigor of guidance rather than the precise figures that matters most. And, as public companies prepare to report earnings for the March 2025 quarter, it is important to evaluate how best to communicate financial guidance and manage investor expectations in the context of ongoing market volatility and geopolitical disruption.