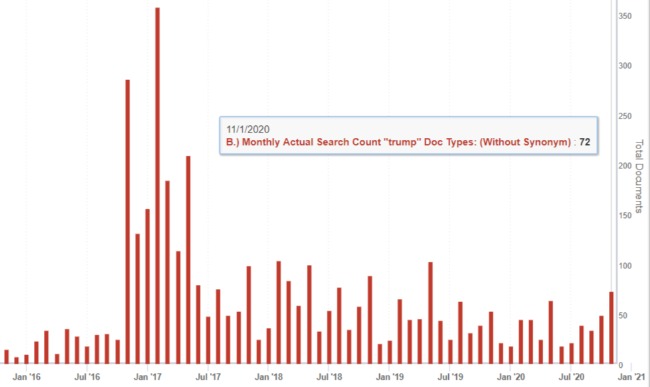

Transcripts with mentions of ‘Trump’ have been steadily declining since early 2017, according to data from financial and corporate research platform Sentieo. Mentions of Trump hit an all-time high in January 2017 when US President Donald Trump entered the White House, with 356 mentions on earnings calls. This was down to 48 in October and only up to 72 for November so far.

Source: Sentieo

Now, however, as Trump’s hopes of an election legal challenge look less likely, not only are mentions of Trump falling, but ‘Trumpisms’ are also on the decline. ‘Fake news’ peaked at 18 transcripts in early 2017 but was mentioned just once per month in the last two months,’ Nick Mazing, director of research at Sentieo, tells IR Magazine. ‘Make (anything) great again is also out: we have not heard [Maga] since May when Hain Celestial last said it was making Hain great again.’

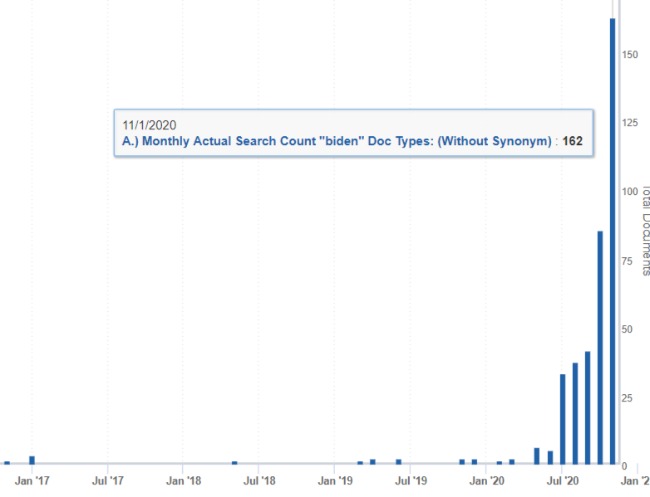

Unsurprisingly, Joe Biden is ascending. The president-elect has gone from barely any mentions in earnings transcripts – just five as recently as May – to 85 in October and more than 160 so far in November.

Source: Sentieo

More surprising for Mazing, however, is the fact that ‘mentions of elections within five words of uncertainty are not at all-time highs. Mainstream media narratives are not reflected on the calls,’ he says.

A vaccine explosion

Of course, mentions of vaccine/s have ‘just exploded,’ says Mazing, describing the news in the past two weeks from Pfizer/BioNTech and then Moderna as a ‘game changer’.

‘This used to be a niche topic on healthcare calls but now we are at more than 700 transcripts, month-to-date in November.’

The announcement was, of course, also a boom for markets. ‘Markets continued their upward trajectory as clarity on the US election was supplemented by a sharp bounce on Monday, November 9 [when] Pfizer announced [its] coronavirus vaccine was more than 90 percent effective in preventing the virus among those without evidence of prior infection,’ writes Nasdaq IR Intelligence in a new weekly mini-series of market analysis.

The increased certainty also translated into a ‘sharp rotation out of growth/momentum stocks and into cyclicals, value and small caps. Corporate earnings have been another pocket of support with 84 percent of S&P 500 companies beating consensus EPS expectations.’

Nasdaq’s analysis further features comments from the asset management community. ‘Investors are likely to welcome both the removal of electoral uncertainty (which will be cemented when and if Trump concedes) and better news on the pandemic,’ David Page, head of macroeconomic research, and Chris Iggo, chief investment officer at AXA Investment Managers, are quoted as saying.

‘This should translate into strong investment performance by stocks in those sectors most impacted by shutdowns in recent months: travel, leisure, hospitality and real estate, among others. A more cyclical and value-driven market with slightly higher bond yields could boost overall equity markets into year‐end.’