Moving beyond non-financial indicators can give a better indication of IR success

Traditionally, the effectiveness of IR has been measured using non-financial indicators such as the number of investor calls, events attended, analyst coverage, share price performance or social media sentiment.

While these metrics provide insights, they often fail to account for external factors beyond IR’s control, such as a broader market downturn, sector-wide challenges or competitor-related issues.

In such cases, how can IR truly measure its success? And if the IR function’s efforts mitigated a potential decline, shouldn’t that be recognized?

To accurately assess IR’s effectiveness, financial quantification is essential. Moving beyond assumptions and qualitative metrics, companies can leverage AI and advanced analytics to express IR’s impact in dollars and cents.

The missing financial link

Like other corporate functions such as HR, ESG, R&D and communications, IR plays a crucial role in shaping a company’s financial future. However, its impact is rarely quantified in financial reports. This gap in measurement becomes increasingly problematic as investor expectations evolve, transparency increases and social media accelerates stakeholder reactions.

Consider the Volkswagen emissions scandal of 2015. Within days, the company lost 30 percent of its market capitalization, and by 2020 the scandal had cost Volkswagen €31.1 bn ($34.69 bn) in fines, legal costs and lost revenue. This illustrates how external forces can swiftly impact company value and why IR’s role in mitigating such risks must be properly calculated.

To better understand and quantify IR’s impact, three categories of performance data should be tracked:

- Company Performance KPIs – financial metrics, ESG indicators, and operational resilience.

- IR Performance KPIs – investor sentiment, analyst opinions, and buying/selling trends.

- Macroeconomic & Political KPIs – market trends, sector fundamentals, and geopolitical risks.

By isolating IR performance from company-wide and macroeconomic influences, companies can measure IR’s true contribution to investor confidence and company valuation.

Step 1: AI for data collection and sentiment analysis

Advancements in AI and large language models (LLMs) allow companies to gather, structure, and analyze vast amounts of data in real time. These technologies can:

- Track financial reports, market trends, and investor sentiment.

- Assess the relevance and impact of specific events on company valuation.

- Score each KPI daily, monthly, and quarterly to identify trends and risks.

IROs can track the performance, sentiment and relevance of all available data for each specific indicator almost daily. This can help break down which specific KPIs need to be managed and are likely to have motivated investors to buy or sell a company’s stock, for example.

The AI large language model assesses each bit of data as well as text according to its sentiment and relevance for each individual indicator over time. The result are performance scores for each KPI per day, month, quarter and year — and, perhaps more importantly, the total impact on the company’s performance of all KPIs.

Data gathering, structuring and scoring per indicator using AI is step 1 in calculating the financial impacts of IR, among other stakeholder management areas.

Step 2: translating data into financial impact

Once performance data is collected, sophisticated algorithms can quantify IR’s effect on financial indicators such as revenue, profit margins, cost of capital and analyst valuation estimates.

For example, consider the impact of IR on a company’s cost of capital, a key driver of intrinsic value. A lower cost of capital translates to a higher company valuation. If IR efforts successfully enhance investor confidence through effective communication and transparency, the company may experience a reduction in risk perception, leading to a tangible financial benefit.

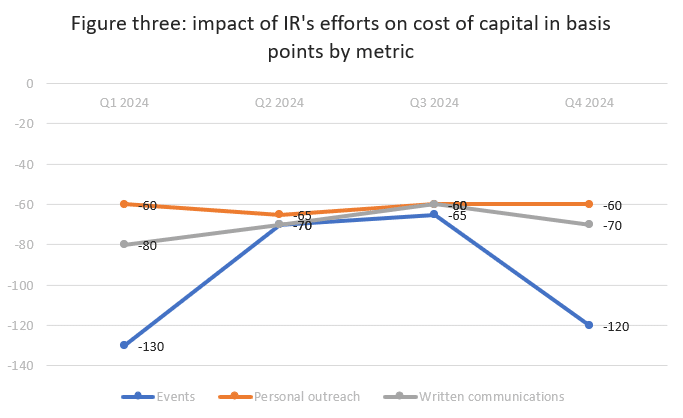

Let’s take a look at a few hypothetical examples of outputs.

The first chart below defines the positive impacts of three KPIs on a company’s cost of capital (risk level) in basis points (hundredth of a per cent). It shows that board governance declined in Q4 while the pipeline of new products and the CEO’s performance have reduced the company’s cost of capital and thus improved its intrinsic value.

The key point to remember is that these data reflect both facts and sentiment in the market. Thus, it’s important for IROs to know which KPIs are doing well and which need work.

The second chart tracks three macro level risks. While IROs cannot do much to influence these risks, knowing them serves two purposes: Firstly, it separates macro impacts from those of company performance (figure one) and IR performance (figure three). IR will get credit for its specific performance, untainted by exogenous factors. Secondly, IR and the C-level can consider and track these risks, developing strategies to mitigate them.

The key point to note is to look out for KPIs where the trend is negative or changing.

The impacts are per KPI and are estimates of how effective IR worked in driving a company’s reputation and value in the market. If done properly, these impacts have a minimal overlap with the actual good or bad news of the kind shown in figure one (impacts of company performance).

The bottom line

This matters for IROs for several reasons:

- AI-powered IR analytics can separate IR’s real contributions from external noise (like market downturns and company performance)

- Companies can quantify how IR efforts improve valuation and financial stability

- IR teams can prioritize high-impact areas and manage risk better.

IR teams need to go beyond traditional, non-financial metrics and start calculating their impact in dollars and cents. With AI and financial modeling, they can calculate how IR efforts, investor confidence and buying and selling behavior influences a company’s cost of capital, valuation and investor confidence.

Dr William Cox is CEO of Yieldrive AG, a fintech in Switzerland specializing in calculating ESG in dollars and cents.

Michael Poisson managing director of IdealRatings and is the author of ‘The ESG Data Revolution: Sustainable Fuel for Tomorrow’s Business’.