New tool lets Iros get instant answers

We’ve all been there: scrolling through PDFs, trying to find that one data point; re-listening to earnings call Q&As; sifting through 50-page slide decks packed with bullet points, just to find a single sentence that might confirm or kill your thesis.

It’s time-consuming, it’s manual and, in a high-stakes environment where every second and decision counts, it’s frankly no longer good enough.

We have just launched something purpose-built to fix this: a powerful AI chat designed specifically for investor relations and finance professionals. It lives inside our research platform, Quartr Pro, and lets you ask literally anything across more than 13,000 public companies and get instant answers.

Our AI draws exclusively from verified investor relations material such as earnings call transcripts, filings, reports and slide presentations. This ensures sharper and more reliable answers than all-purpose large language models (LLMs) drawing from mixed sources. Every result is directly linked to the source document – allowing you to find what you need faster, trust every finding, and act with conviction.

Why we built this

There’s been a lot of talk about AI lately. While we’re excited about the possibilities, we’re also cautious – because trust isn’t optional in investor relations and finance. The idea started as a simple question: ‘Why do general-purpose LLMs fall short when it comes to finance?’

The answer was obvious to anyone in the industry: they’re not built for it. They use broad data, lack company filings or event transcripts and often hallucinate or miss the nuance that professionals rely on.

We didn’t want to build another generic chatbot – we wanted to solve a real problem for the finance industry: the countless hours professionals spend manually digging through PDFs and documents, searching for data that matters. So we focused on three things:

- Speed – because time spent searching is time lost thinking

- Trust – because bad data leads to bad decisions

- Focus – because every second spent on noise is a waste of time.

Now, instead of manually skimming transcripts or slide decks, you can simply ask:

- ‘What has Adobe said about its AI strategy recently?’

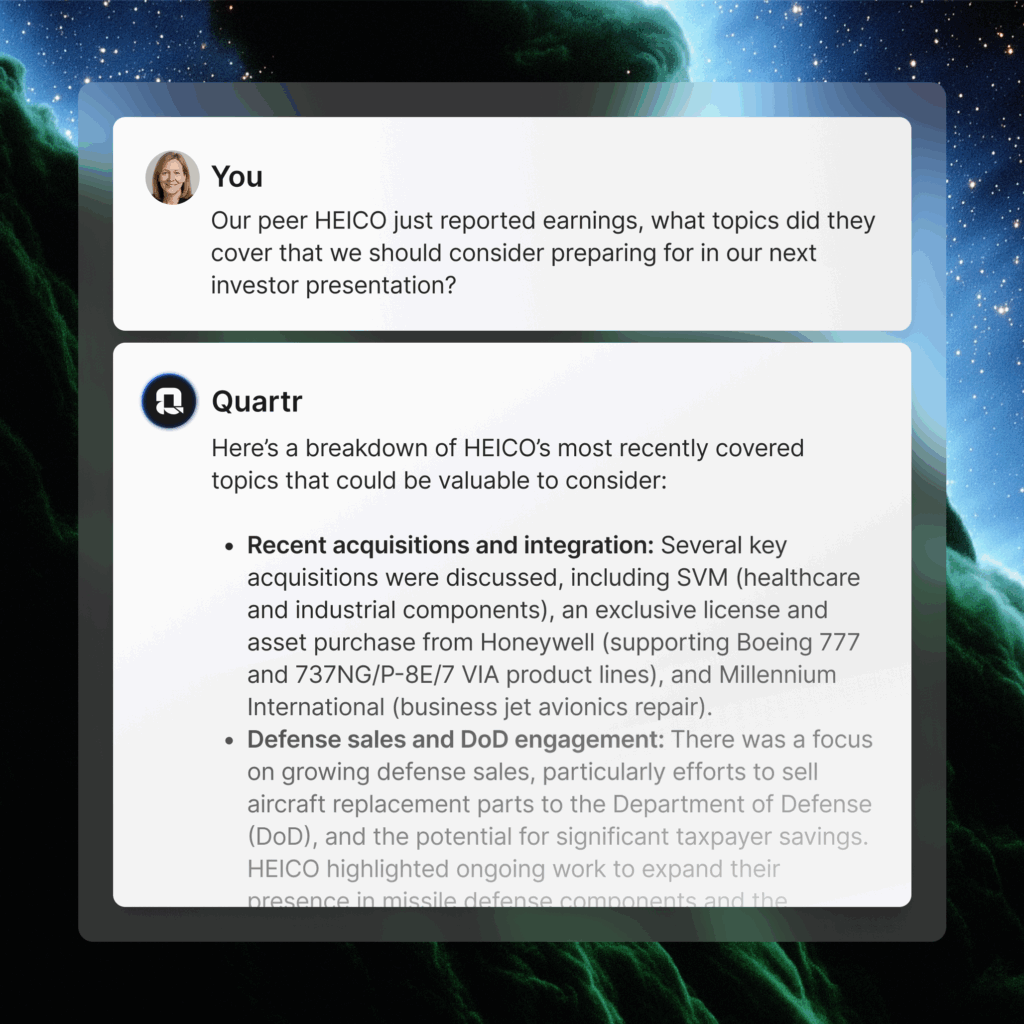

- ‘Our peer HEICO just reported earnings, what topics did they cover that we should consider preparing for in our next investor presentation?’

- ‘What KPIs has Spotify introduced or stopped emphasizing in its last eight quarters?’

- ‘What language does PepsiCo use to frame market share gains, and how does it differ from Coca-Cola?’

You get instant answers, you verify it and you move forward.

Who it’s for

Many of our investor relations clients already report immediate value, using the chat to track how their company’s narrative and messaging compares to peers, to benchmark KPIs and to ensure consistency in messaging over time.

But we also built this for:

- Hedge funds, striving to spot shifts in tone and identify trends early

- Asset managers, who need to eliminate blind spots and reduce manual work

- Sell-side analysts, working under pressure to move fast while staying accurate.

At its core, this tool is for anyone who needs answers they can trust, fast.

Turning data into action

The real value of information lies in what it helps you achieve. That’s why we didn’t stop at just returning text. You can also visualize trends, export custom data sets and explore how competitors are framing key strategic bets – in charts, tables, or plain text.

It’s more than just finding information faster: it’s a new way to think.

The AI chat is fully integrated into the overall Quartr Pro workflow. You get all IR material from public companies in one intuitive interface. In practice, that means you can ask anything, jump to the original source for additional context with one click and view documents side-by-side with the chat. Once you’ve tried researching like this, there’s no going back.

The new standard for public market research

I’ve spent the last few years building Quartr with one goal: to make the world’s public market information more accessible, more useful and more aligned with how modern professionals actually work.

This new chat is a major step in that direction. It’s fast, focused and, most importantly, it’s as close to the truth as you can get. Primary sources only, no speculation.

We’re proud of what it can do – but we’re more excited about what it helps you do. Whether that’s crafting a sharper equity story, spotting a shift in a competitor’s strategy or simply saving lots of time.

Ask anything, verify everything and act with confidence. That’s the future of financial research and it’s now here.

Want to see it for yourself? Learn more and book a demo here.

Oscar Küntzel is the CEO and co-founder of Quartr