Trend-following analytics give IR professionals clearer insight when strategizing and communicating

By now you’ll know that institutional investors and their decision-making processes have evolved to become more data-driven and systematic, using strict mathematical rules for portfolio construction. Discretionary stock and bond picking is increasingly an investment style of past, being rapidly replaced by quants, big-data sets and algorithms that can better select stocks and bonds compared to humans.

One in two investors – or half of global assets under management – now selects stocks and bonds based on either passive or statistical factors. Increasingly insignificant is the fundamental strength of your company’s earnings, balance sheet or cash flow.

This has been a creeping and significant change to the long-standing ‘active management’ paradigm that had dominated the IR community for decades. The new question is this: how should IR teams adapt to these newer investment styles that have almost no regard for an IRO’s data or story?

Trend Intelligence’s answer is for the IR profession to understand trend-following models and algorithms in the same way that these investors do. Armed with this new statistical insight, IR professionals can follow and accurately anticipate major price trends in their company’s stock.

IR professionals are also empowered to better manage the future by considering statistical price trends in the major stock indices, their industry peer group, or commodities or currencies that impact their business.

‘Trend-following’ is seeing the future

Trend-following investors seek to mathematically uncover and then capitalize on visible trends in asset prices that occur over time. This is a highly predictive, data-driven investment strategy. Many famous investors and economists have added their expertise to this investment genre over the last century, with trend-following being adopted by many of the world’s largest and most successful hedge funds since the 1980s.

IR professionals need to understand trend-following algorithms for two main reasons:

- All prices, across all assets, trend. Understanding the status of a price trend in your company stock (or peer’s stock) is powerful knowledge and facilitates effective company decision-making and investor communication – either as a trend plays out or as it changes direction.

- Trend-following indicators can be substantial inputs into complex investor algorithms. In understanding price trends, you can better understand what your quantitative and passive investors will likely do next with your company stock.

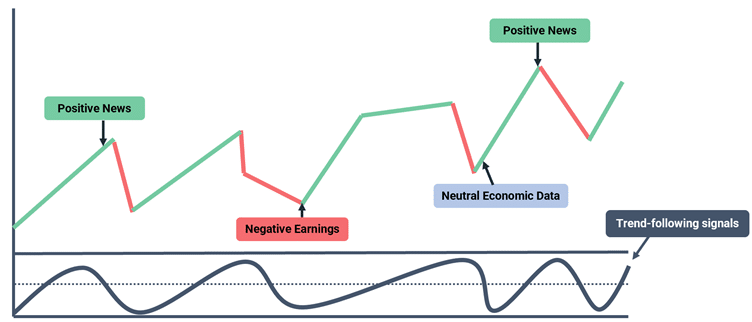

Uniquely, trend-following does not incorporate any interpretation of news or fundamental information. It’s well known that company and economic news do not reliably predict stock prices, and that stock prices frequently move counter-intuitively to new information (see chart below). The advantage of trend-following is that, as these models only rely on statistics from the price of a security, they cannot mislead the user. Instead, trend-following models create an unbiased predictability of price expectations that cannot be ignored. When used properly, trend-following can counter an IRO’s intuition and beliefs about how new information will be interpreted by the market.

For IR professionals, access to trend-following analytics can be a significant and differentiating advantage. For one, expectations about the future stock price of a company are made clearer. If a company’s price can be shown to be trending positively despite bad news, IR professionals can now communicate with existing and future stockholders with confidence and build new company storylines around this positive price trend.

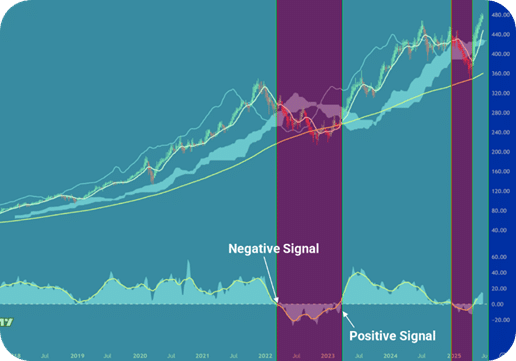

The chart above reveals two significant periods of negative trending activity (in red) over the past 5 years for Microsoft stock. These were warning signs to corporate stakeholders and entry opportunities for short sellers.

How IROs can use trend-following

IR professionals should know that they can use trend-following analytics to their advantage in several ways:

- Cultivating an equity story: Build a tighter equity storyline based on the quantitative analytics of price, in addition to company fundamental narratives.

- Quantitative investor analysis: Build an understanding of the general trend signals of quantitative investors and what they may do next with your stock.

- Peer analysis: Understand statistical trends in peer stock prices, and where they are trending compared to your company.

- Index and ETF analysis: Understand the statistical trends in major indices and ETFs that include your company. Build an understanding of where those prices are trending to and how moves in those instruments will impact your company’s stock price.

- Commodities and FX: Stay ahead of statistical trends in commodities and currencies that impact your business.

- Mutual fund analysis: Understand the trends behind the NAV of your largest investors.

- Stock buyback timing: Empower treasury teams to buy back stock when prices are attractive.

- Short-selling signals: Spot short-selling signals on your company stocks, anticipating new short interest and start working with your long-only investor base to turn the tide.

- Analyst targets: Understand if your stock price is trending toward or away from key sell-side analyst targets.

- Board reporting: Trend-following analysis can provide invaluable insight to corporate boards every quarter on statistical price behaviour and can often contradict qualitative narratives from other investors.

Adrian Dacruz is CEO and founder of Trend Intelligence. You can email him here.