Sell-side analysts talk about coverage numbers, initiating research and the IR opportunities to be had around research and access

In a series of anonymous conversations – with identities protected in order to get frank responses – IR Impact talked to sell-side analysts about their relationships with IR professionals. In part one, we looked at the value of research – from both the IR viewpoint and from the sell side, including advice from analysts on how they felt IR could improve data sharing, face time, responsiveness and more – all the elements that go into a good IR-sell-side relationship.

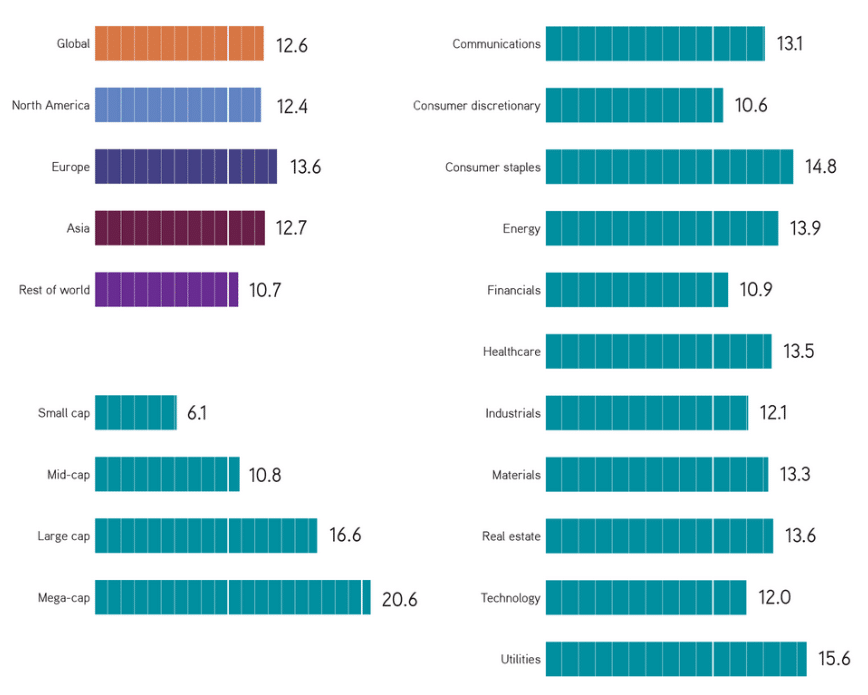

Here we focus on the numbers, from how many analysts are covering a company – often used as a measure of successful IR – to the kind of coverage IROs would like to have (and yes, some feel they have too much). Analysts share their thoughts on what goes into a new coverage decision and we look at numbers around paid-for research.

Enjoy access to this and more – for free!

Log in or create your free My IR – Essentials account to:

- Get access to 3 free IR deep dives

- More than 100 pieces of insight, plus our exclusive CFO interviews

- Save favorites and get personalized content on your dashboard

- Enjoy 10% off all IR forums