Event in New York saw leading IROs discuss various applications for the burgeoning technology

Unsurprisingly for those who read IR Impact regularly, AI is still considered one of the most transformative forces, not just for the IR profession, but for the capital markets in general.

That may explain why more than 150 IR professionals gathered in New York in November to gain exclusive access to real-world case studies and insights from leading IROs, tech innovators and companies already using AI in their IR programs.

With hands-on demonstrations of the latest AI-enabled platforms and interactive workshop sessions led by award-winning IROs, attendees were given skills and tools they could immediately apply to their daily workflows.

But for those who could not attend, we’ve rounded up four of the biggest lessons we learned from a packed day of discussions.

Award-winning IR leans on AI assistants

The opening panel of the day saw Debbie Belevan, vice president of IR at Duolingo, and Ryan Wallace, vice president of IR at PayPal, give attendees an overview of AI’s main use cases in their IR programs – and in the wider profession.

For Belevan, a multiple IR Impact award winner, it’s long been an integral part of her work. Recent applications include ‘using it to summarize information, whether it’s meeting notes, analyst research and sharing that on Slack,’ through to increasingly treating it as an ‘IR assistant,’ where she asks it for quick drafts and suggestions.

‘I treat it like an IR assistant and I can tell it exactly what I’m what I’m looking for,’ she says of AI. ‘These are the areas that save me a ton of time and add a lot of value.’

It clearly works: the company won best overall investor relations (mid-cap) and best investor relations officer (mid cap) for Belevan at the IR Impact Awards – US 2025. Duolingo also topped its sector category, winning the best in technology trophy against fierce competition.

A reputation as the ‘AI expert’ is invaluable

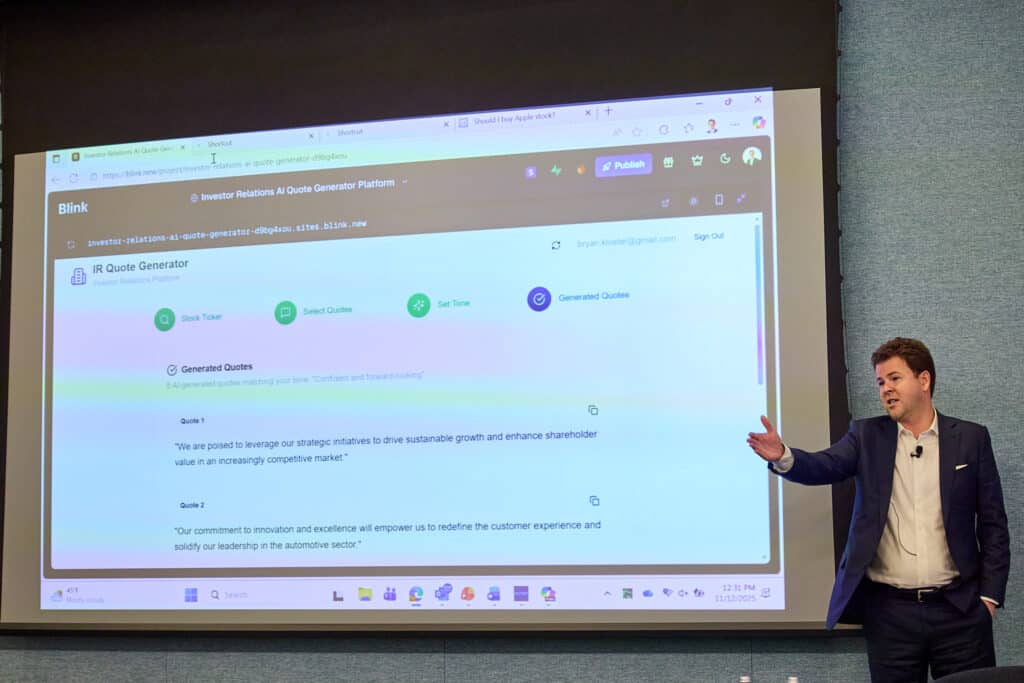

The day featured in-depth demonstrations from service providers and IROs who showed the room the best ways to use various AI tools to transform their daily workflows. Bryan Kloster, investor relations manager at AutoNation and Gregg Lampf, vice president of investor relations at Ciena (and the inaugural winner of the best use of AI for investor relations award at the IR Impact Awards 2024) spoke on a later panel about demonstrating the value of AI investment to their management teams.

Both agreed that being able to position themselves as AI experts is a valuable move. Kloster described this as valuable from an internal perspective: ‘If you get that reputation and people are going to come to you, you’re going to see natural advancement opportunities within the organization, because you’re theoretically ahead of people and you’re championing it,’ he explained. ‘Don’t shy away from it and you’ll find yourself being pushed by it when you otherwise wouldn’t be pushing yourself.’

Lampf added that investors will come to expect this proficiency, too. ‘We’re getting to a point where you could have an investor asking are you using AI as part of your IR program?’ he said. ‘And if your answer is no, they’re going to say, Well, why not? I know IR departments that are that are doing it. Then you’re leaving money on the table.’

Both IROs later gave demonstrations of their AI use cases. Kloster’s presentation showcased so-called ‘vibe coding’, whereby IROs can utilize natural language coding to create tools that communication teams can use to generate CEO quotes – which demonstrates huge potential for IR teams to be more productive.

Be clear on your use case

But what if you’re still at the first stage of adoption, facing your fear of AI head on? A later session saw Lori Chaitman, global head of IR at Kyndryl, Amit Kaura, head of Irwin engineering at FactSet, Heather Livingston, manager, IR at ONEOK and Ronen Tamir, vice president IR at Pfizer, discuss exactly this.

In Livingston’s IR team at ONEOK, she has had to bridge conversations between one colleague in their 20s and another ‘older soul’ who is hesitant to use the technology. Those discussions must be ‘clear and defined’, she said, adding: ‘When I think about how we’ve had to talk to the team, we all need to know how we’re using AI, what we’re doing with it and when something works, well, great.’ That approach also helps Livingston get buy-in from IT, governance and other departments.

For Tamir – whose team picked up the award for best use of AI and technology at this year’s IR Impact Awards – success has only come after a long and careful process. After years of iteration, Pfizer’s internal Q&A preparation tool runs well enough to advise his IR colleagues without any internal bias. ‘We believe now, as do our executives, that they are much more prepared for the feedback that they’re going to get during the Q&A from the market, ’ he added.

AI won’t change what investors care about

In one of the final sessions of the day Thaddeus Pollock, executive vice president, head of equities at Mutual of America Capital Management, revealed how he – and his colleagues – were using AI to look at companies.

He said that there were two real use cases that the buy side had for AI. The first is ‘grunt work automation, like drafting and downloading information and updating models, extracting KPIs from quantitative and qualitative information – from all the information you put out to us.’ The second is ‘dot connecting’ or establishing consensus and attempting to predict the future to make effective investment decisions, namely by taking that information and comparing it over time against a company’s disclosures and those of their peers.

What does that mean for IR teams? Despite these uses, the fundamentals still apply, Thad noted. ‘AI is not going to change the perspective of whatever the story is you’re trying to tell,’ he added. ‘It needs to be very explicitly stated and it can be repeated over and over again.’