In a moment of transformation, IR teams must decide if the technology is a threat or an upgrade

Investor relations is entering a period of rapid transformation. Investors are already using AI to screen disclosures, detect sentiment and benchmark performance across their portfolios. This growing analytical power on the buy side is changing expectations for speed, accuracy and insight. For IROs, the question is no longer whether to use AI, but how to harness it to match the sophistication of the investors they serve.

At the same time, IR teams face rising pressures: limited bandwidth, fragmented data and heightened scrutiny over disclosure quality and transparency. Traditional workflows can no longer keep pace with these demands. AI offers a way forward – a practical bridge from manual processes to strategic influence.

Across leading IR departments, AI is already reshaping how teams prepare earnings, analyze sentiment and engage with the market. By automating the routine, interpreting information at scale and advising with sharper insight, it enables IROs to operate with the same intelligence and agility as the markets they engage with.

Despite this potential, the conversation often begins with fear and many IROs remain hesitant to engage. In practice, it is doing the opposite for those willing to experiment, empowering IROs to become more strategic partners to management and more trusted interfaces with the market.

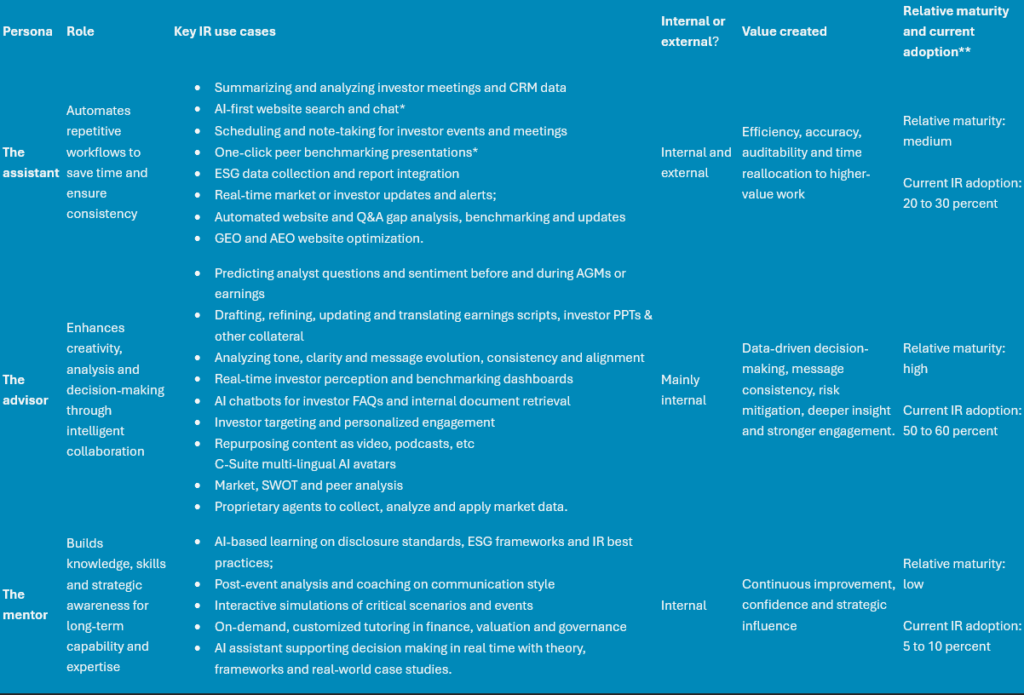

This evolution can be understood through three complementary personas: The assistant, which automates to save time; the advisor, which interprets and enhances judgment; and the mentor, which builds lasting capability. Together, they define what it means to be an AI-empowered IRO.

From early adopters to leaders

Over the last two years since launching aiiro, we’ve had hundreds of conversations with IROs around the world and found that the new divide in the profession is not about budget or team size, but is about AI adoption. The IROs who understand how to use AI are moving faster, producing better insights and earning stronger recognition from their boards and executive teams.

According to a 2024 NIRI survey, 44 percent of IR professionals had already integrated AI into their programs – and anecdotally the number is closer to two thirds as of Q4 2025. While there has been a Cambrian explosion of consumer AI tools, fewer enterprise grade tools have hit the market as of yet. Nevertheless, there are already many ways for IR teams to apply AI across the function and adoption will undoubtedly accelerate as fit-for-purpose tools become more plentiful and accessible.

In general, IROs have three ways to leverage AI:

- Using general tools, such as ChatGPT, Claude, Perplexity or Microsoft Copilot (always remember that anything you put into a public tool can be used in its training and searches);

- Developing custom in-house applications or agents; or

- Partnering with off-the-shelf enterprise-grade platforms specialized for IR, such as aiiro AI or AlphaSense.

Each path has trade-offs in cost, data control and precision, but the common denominator is clear. IROs who engage early and learn how to apply AI responsibly will create more value for themselves, their businesses, their shareholders and other key stakeholders.

But with so many use cases and so little time, how should IROs think about where to start?

The three personas for the AI-empowered IRO

AI plays three complementary roles in the IR function: executing, advising and teaching. Together, these AI personas free time, expand insight and build long-term capability – helping IROs become more effective, informed and indispensable to their organizations.

The assistant – automation in action

The assistant persona represents AI as a reliable digital aide. It handles structured, repeatable workflows that keep the IR function running smoothly. From meeting summaries to CRM updates and ESG data pulls, it performs tasks that would otherwise consume hours of administrative time. Once configured, it works quietly in the background, delivering consistency, auditability and speed. The assistant’s real value lies in the time it returns to the IRO – time that can be reinvested in analysis, storytelling and stakeholder engagement.

The advisor – insight and collaboration

The advisor persona is the thinking partner of the modern IRO. It helps interpret information, test ideas and refine communication. By combining large language models with domain-specific analytics, it gives real-time feedback on tone, sentiment and message clarity. It can analyze investor behavior, model scenarios or benchmark peers to guide decision-making. Acting as an always-available strategist, the advisor enhances judgment and enables the IRO to move from reactive communication to proactive leadership.

The mentor – learning and growth

The mentor persona transforms every interaction into an opportunity to learn. It draws patterns from data, transcripts and market behavior to help IROs strengthen skills and deepen expertise. Whether reviewing past disclosures or studying investor trends, the mentor promotes continuous improvement and builds long-term confidence. It turns AI into a mentor that expands capability, helping IROs become more strategic leaders and ensuring they evolve in lockstep with the technology itself.

Together, these three AI personas create a framework how the AI-empowered IRO can approach and engage with AI: automation that saves time, augmentation that improves quality and education that builds mastery. They also form a continuum of decision empowerment: the assistant enables faster access to information, the advisor interprets and contextualizes it for better judgment, and the mentor strengthens the IRO’s expertise and long-term decision-making capability.

*Delivered by aiiro AI

**Current AI adoption as measured by the estimated percentage of IR professionals using at least 1 use case at least monthly.

Trust, data and the human advantage

Across all these areas, trust remains the single most important factor in determining how far and how fast IROs adopt AI. Accuracy and reliability are non-negotiable in a field built on compliance and precision. Research by AlphaSense found that 74 percent of professionals trust specialized, industry-specific AI tools more than generic consumer versions. The closer an AI system is to the data, language and governance frameworks of investor communication, the more confidence users place in it.

Specialized, fit-for-purpose platforms, such as aiiro AI, combine large language models with structured financial, investor and ESG datasets. This reduces the risk of hallucinations and ensures that outputs remain fact-based, compliant and auditable. In practice, this means safer automation of disclosures, faster analysis of investor sentiment and greater visibility into risk signals that might otherwise go unnoticed.

For a function that is naturally risk averse, this positioning matters. AI should be viewed not as a disruptor but as a risk mitigation partner, one that operates in real time, maintains audit trails and provides early warnings on shifts in perception or regulation. The IRO remains in control, while AI provides the reach and context that make better control possible.

AI governance as a competitive advantage

For most IROs, the barrier to AI adoption isn’t interest – it’s trust. IR operates in a regulated environment, where precision, disclosure integrity and message control are non-negotiable. Responsible use of AI depends on clear governance that protects data, preserves oversight and reinforces accountability.

An effective governance approach does more than manage risk – it creates confidence. By defining boundaries around data access, maintaining visibility over every AI-assisted output, and embedding review and approval into daily workflows, IR teams can innovate safely while staying in full control of their communications.

This is where purpose-built platforms such as aiiro AI stand apart. They integrate trust directly into the workflow, combining efficiency and control so IROs can adopt AI confidently within the same frameworks that safeguard their disclosures. In this way, governance becomes not a constraint but a competitive advantage, enabling progress grounded in accountability and trust.

With strong governance in place, AI can move beyond risk management to become a true performance driver: one that learns, adapts and improves through every interaction.

Data as the foundation of progress

Every interaction between companies and investors generates data. Historically, much of it remained unstructured: meeting notes, call transcripts, analyst commentary and ESG metrics scattered across systems. AI turns this data into an engine of continuous improvement. Automated assistants capture it, analytical models interpret it and learning systems feed insights back to the team.

The effect is cumulative. Over time, the IRO gains a living map of investor priorities, messaging performance and disclosure effectiveness. Instead of operating on anecdote and instinct, they can rely on evidence. Data becomes the foundation for better strategy, stronger storytelling and more accountable decision-making. This continuous loop of capture, analysis and learning will make AI a key enabler of modern IR performance.

The empowered future

The AI-empowered IRO is a vision of elevation of the IR function and its practitioners. Freed from manual process and administrative burden, IROs will focus on the higher-value dimensions of their craft: deep understanding of investors, data-driven shaping of narratives and meaningful contributions to strategy.

The combination of human judgment and machine precision represents a new balance of strengths. AI performs the mechanical tasks with speed and accuracy. The IRO applies empathy, experience and context. Together they form a partnership that makes investor relations faster, smarter and more strategic.

Given the current adoption and increasing maturity of fit-for-purpose platforms, technologies and tools, we expect all but a very small percentage of IROs to be using AI daily over the next couple of years, as it is integrated into almost every workflow across the IR function. The same way we depend on the internet for information and our phones for communication, we will rely on AI in countless ways, often without even thinking about it.

Those who embrace this shift will find themselves at the center of decision-making, driving insight across finance, strategy and communications, shaping disclosure quality, board reporting and investor trust. The rise of the AI-empowered IRO – applying mature AI use cases across the assistant, advisor and mentor personas – signals a new chapter in the profession, one where technology amplifies credibility, sharpens judgment and reinforces the human connection that sits at the heart of every investor relationship.