Best Practices

-

‘The tolerance for inconsistency is zero’: Four things we learned at the IR Impact Forum – South East Asia 2025

The Singapore event brought together 100 senior IR experts to examine how the IR function is evolving The IR Impact Forum – South East Asia 2025 brought around 100 IR professionals to the Singapore Stock Exchange (SGX) on December 2 to discuss how the IR function is evolving in the region. A series of panel […]

Published 8 hours ago -

The IR Benchmarking Report 2026 Global & Europe available now

A new year, a new name. In recognition of our flagship IR Benchmarking Tool, launched in early 2025, our long-running Global Practice Report has become the IR Benchmarking Report Bringing you research from several hundred IR professionals, it offers insights into everything from budgets and IR team analysis to sell-side coverage across markets caps and […]

-

The IR Benchmarking Report 2026 Global & Europe

The IR Benchmarking Report 2026 is a new-look, refreshed version of the Global Practice Report that we have been publishing for 14 years. It looks at: IR budgets, outsourcing, team size, gender breakdown, how much time senior management spends on IR and what percentage of investor meetings they attend. It takes in investor base, analyst […]

-

The IR Benchmarking Report 2026 Global & North America available now

This year we bring you a brand new, revamped IR Benchmarking Report that couples our survey research with interview and data from our flagship IR Benchmarking Tool. Alongside the data – covering everything from budgets to gender breakdowns, from analyst numbers to senior management attendance at virtual and in-person meetings – this report offers a […]

-

The IR Benchmarking Report 2026 Global & North America

The IR Benchmarking Report 2026 takes in everything that our Global Practice Report has looked at over the years – from budgets to the shareholder base, from the gender split within the profession to how often companies are meeting investors face-to-face or virtually and much more. RESERVED FOR ADVANCED SUBSCRIBERS Sign in or upgrade to […]

-

Inside IR at Itron: ‘Part of IR’s DNA is being immune to being surprised,’ says Paul Vincent

How do IROs leverage their expertise within their companies? For Paul Vincent, VP of IR at Itron, the core of IR lies not only in conveying the company’s message but doing so in a way particular to each investor and analyst. Itron supplies innovative technologies that help utilities and cities manage energy and water. Vincent believes IR should help management shape strategy based on its own best judgment, not by deferring to investors’ views. IR’s job, he says, is to understand every individual investor and analyst so thoroughly as to communicate management’s thinking in the way each is prepared to…

-

What goes into winning an IR Impact Award – live from the red carpet in Europe

What exactly goes into winning an IR Impact Award? We spoke to four nominees – and one of the judges – at this year’s event live on the red carpet. Hear what goes into the IR programs at Rheinmettal, Purcari Wineries, BAT and eDreams ODIGEO, as well as what one of our judges considers most important in an entry.

-

‘It makes you realize how impactful the IR profession is’: Purcari Wineries’ Victoria Moldovan on being named Europe’s 2025 rising star

One of the best parts of our awards, wherever they may be, is giving IROs the chance to catch up with their peers, many of whom they may not see throughout the rest of the year. This is particularly true for the next generation of IR professionals, many of whom we recognize with our award for the rising star of the year, which picks out early-career IROs who are ones to watch for the future.

-

‘We’ve tried to make the accessibility of our IR story much improved’: Victoria Buxton on innovating BAT’s communications

Keeping your communications with the financial markets fresh can be a challenge for even the most established brands. For a company like British American Tabacco (BAT), which is repositioning itself as an enabler of a post-smoking society, it has formed a cornerstone of its IR team’s ongoing evolution.

-

‘It’s an opportunity to bridge two fast-growing markets’: Lessons from Emsteel Group on engaging Middle Eastern investors

As IROs look beyond traditional financial hubs to diversify their shareholder base, the Middle East represents a new and strategic capital venture. But with sovereign wealth funds, family offices and institutional investors playing an increasingly influential role in international markets, many companies still find the road to meaningful engagement in this region unclear.

-

How pre-IPO investor relations shapes long-term market success

The IPO journey doesn’t start on listing day. Companies that treat investor relations as an afterthought until the opening bell often find themselves scrambling to build credibility when it matters most. The statistics tell a sobering story: approximately only one third of newly listed companies outperform their already-listed peers over the long term. Poor financial communication sits at the heart of this underperformance. Building relationships before you need them Establishing an effective IR function well before your IPO creates something money can’t buy on demand: trust. When analysts and investors already know your story, understand your business model and have…

-

‘It’s not necessarily about coming up with a brand-new thing’: Janet Craig on what she looks for as an IR Impact Awards judge

As we gear up for the IR Impact Awards in both South East Asia and Greater China, our teams of expert judges have been sifting through the many entries from companies talking about everything from how they have implemented AI into their programs to the memorable investor events they’ve put on for analysts. IR Impact catches up with Janet Craig – herself a multiple IR Impact Award winner and now a judge for our events – to find out what marks an entry out as special.

-

‘Profit and purpose have been our yin and yang’: TPXimpact’s Luke Murphy on a first IR Impact award win

When the small-cap UK firm TPXimpact cropped up on the shortlists ahead of the IR Impact Awards – Europe 2025, it was a name unfamiliar to many of the judges – and perhaps many other onlookers. The company, which enables digital transformation projects for a range of organizations, including public sector bodies in the UK, may not be well-known in general, but Luke Murphy, head of IR and chief of staff, was among the names for the rising star award. The company’s annual and ESG reporting were also nominated.

-

Building an IR function: a strategic roadmap to success

From getting management buy in to running an IR audit and building an investor pipeline – a break down of the essentials that elevate the IR program Investor relations has come a long way. What used to be a compliance checkbox is now a strategic discipline that directly impacts your cost of capital, liquidity and valuation. The question isn’t whether IR adds value anymore, it’s whether you’re building the function correctly. This evolution changes how you build your team for success – whether you are expanding the IR department, coming in fresh, building out the team from scratch or growing…

-

What can you do when the US Government becomes a shareholder in your company?

When the Trump administration announced it would take a 10 percent stake in Intel to securitize the government’s funding of the company under the CHIPS Act, the markets were stunned. Many questioned this new course, asked how effective the government could be at owning stocks and wondered how the administration could help or hinder Intel. Moreover, how would US taxpayers benefit?

-

From intuition to impact: How ROI thinking can transform investor relations

Across boardrooms, investment decisions are increasingly driven by rigorous financial analysis and measurable outcomes. While marketing debates attribution models and sales scrutinizes conversion funnels, the IR function, though central to connecting companies and capital markets, often relies on intuition and anecdotal evidence when justifying budgets and strategic initiatives. IR now has the opportunity to adopt the ROI mindset that drives decision-making across the enterprise.

-

‘Investors are ready for us to make an impact’: eDreams ODIGEO’s David de la Roz Fernandez on standing out as a small cap

How do you stand out against the market as a small-cap company? For eDreams ODIGEO’s head of IR, David de la Roz Fernandez, it’s about making sure your investor community is as educated as possible so that when you have some crucial news to share, the impact is maximized.

-

The summer’s over, it’s back to school time – even for IROs

Welcome back, everybody, to the world of work! Yes, it’s that time of year – for our US readers, Labor Day is over and, for our European friends, the summer holidays are officially done. That can only mean one thing: the pitter-patter of tiny feet as they scamper energetically back to educational establishments heralding the ‘back to school’ season. It’s a good time of year to reflect on your own professional development – as well as making sure your workwear is up to scratch.

-

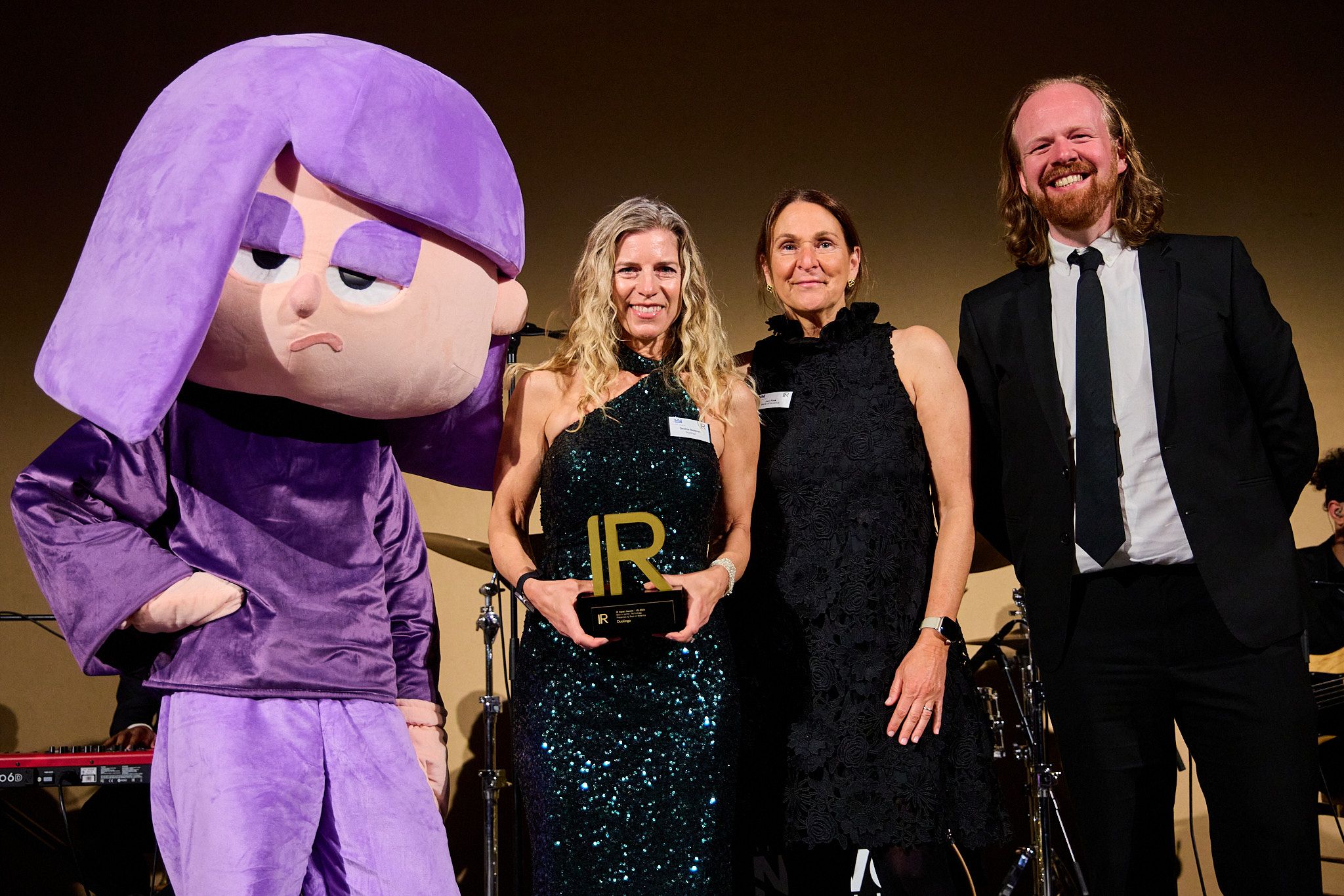

‘I love when investors start a meeting by showing me their streak’: Duolingo’s Debbie Belevan on life after an IPO

At this year’s IR Impact Awards – US 2025, Duolingo’s head of IR Debbie Belevan swept the board, picking up trophies for best overall IR – mid cap, best IRO – mid cap and best in sector – technology. All of this came just a few years after Belevan joined the language learning app in 2021 as its VP, IR two weeks before the company’s IPO. Since then, Duolingo has seen exponential growth in both its share price and subscriber base. Debbie has become an active member of the IR community, serving as a board member for NIRI.

-

How does your team approach scenario planning? We want to know!

Another week, another series of macroeconomic developments that are likely keeping IROs around the world on their toes. Whether it’s the latest round of proposed US government tariffs – this time on Japanese goods – or renewed conflict in South East Asia, listed companies will be working quickly to understand the potential impacts on their operations.

-

Awards – US

About the event The IR Impact Awards – US will take place on Wednesday, March 25, 2026 in New York. This very special event honors excellence in the investor relations profession across the US. WHEN WHERE Cipriani 25 Broadway, New York Celebrating IR excellence Since the annual event first launched…

-

Awards – Canada

About the event The IR Impact Awards – Canada will take place on Thursday, April 2, 2026 in Toronto. This very special event will honor excellence in the investor relations profession across Canada. WHEN WHERE Fairmont Royal York, Toronto Celebrating IR excellence Since the annual event first launched in 1996,…

-

Activist nominees, ESG Trojan horses and tangible investor days: five things we learned at the IR Impact Think Tank – Europe 2025

Europe’s top IR leaders gathered in London to debate, discuss and learn in a series of panels, sessions and roundtables ahead of the IR Impact Awards – Europe 2025 What did more than 170 IR professionals head to London to talk about at the IR Impact Think Tank – Europe 2025? Everything from volatility and uncertainty (of course) to what makes an award-winning IR team and how to untangle yourself from the spilled alphabet soup of ESG and making the most of AI for IR. Panels were mixed with live polls, roundtable discussions, collaborative sessions and networking. We’ve picked five…

-

IR time management: the holy grail for today’s investor relations professionals

It’s no secret that the IR workload has been expanding – even as resources fail to match pace. At the same time, market uncertainty has made the day-to-day less predictable. The result is that the modern IRO is busier than ever. This was something Erik Carlson, chief operating officer at Notified pointed to early in a recent webinar titled: Strategic time management for today’s IRO. ’If look at the challenges in the market, the rise in distrust of the media, the proliferation of content – it’s becoming harder and harder to cut through the noise, to synthesize information and do…

-

IR Playbook: Maximizing your return on time now available

IR Impact research shows that IROs are increasingly taking on tasks outside of the traditional investor relations role, with resources failing to match pace. We look at where they are spending most time and which tasks they find the most value in to uncover where efficiencies can be found.

-

Playbook: Maximizing your return on time

In this playbook, written in association with Notified, we look at how IROs divide their time and what tasks they consider most valuable.

-

What IR teams can learn about responding to a cyber attack from M&S

Our UK readers – and shoppers – will no doubt have been keeping up with the news that high-street stalwart Marks & Spencer has been targeted by a widespread cyber attack. It comes in the same week that fellow retailer Co-op, as well as London’s luxury department store Harrod’s, had been forced to shut down IT systems and restrict internet access to thwart similar attacks.

-

IR Impact Masterclass: How to navigate mergers, acquisitions and other corporate transactions

Welcome to IR Impact’s Masterclass video series, where leaders and experts from across the capital markets share their insights, strategies and experiences to provide you with in-depth knowledge and practical skills to excel in your IR journey. Each IR Impact Masterclass will delve into critical topics, offering valuable perspectives and actionable advice. Whether you are looking to enhance your expertise, stay ahead of industry trends or gain a competitive edge, these long-form videos are your gateway to achieving these goals.