Macroeconomy

-

Navigating volatile stock price movements: a playbook for public company executives and boards

Corporate executives often wake up to unsettling stock price swings with no clear catalyst, news, filings or obvious events. In today’s markets, volatile price movements frequently extend well beyond the fundamentals. Algorithmic trading, macro-overlay strategies and ETF flows often drive disconnects, making market reactions appear irrational.

-

‘Nothing short of an investor relations telenovela’: How 2025 has treated IROs so far

If somebody could have plotted out the broad strokes of the past 12 months – ongoing international crises, political unrest, economic uncertainty to name but a few – I don’t think many of us would have believed what was in store. But, as it is, the capital markets have experienced quite the rough ride in 2025 so far. For IR professionals, that’s meant an even higher burden when it comes to keeping their investors, analysts and other stakeholders informed.

-

Innovation and capital raising: the engine for UK long-term sustainable growth

To develop an innovative idea and scale into a competitive business, entrepreneurs need capital; investors seek a vision, a way to market, credible execution, defined deliverables and risk-adjusted returns, all of which underpin long-term growth. When innovators succeed, they create growth and catalyse a broader market expansion, as seen in the US in recent years.

-

Yes, Taylor Swift’s engagement is making ripples in the stock market – here’s what it means for you

In a decade already defined by wide-ranging macroeconomic shocks, IR teams may be forgiven for ignoring the news that pop princess Taylor Swift has announced her engagement to Kansas City Chiefs tight end Travis Kelce. After all, this sort of thing usually doesn’t have much more impact than the celebrity sections of news sites and the social media ecosystem. However, this is Taylor Swift we’re talking about: arch-capitalist, savvy marketeer and industry-defining brand, whose net worth is estimated to be $1.6 bn (that’s enough to make her a small-cap company, in market terms). So naturally, when she makes such a…

-

What can IR teams do when Donald Trump makes demands of your CEO?

Not every company has had to field a complaint in a public forum from one of the leaders of the free world. That is until Donald Trump started his second term.

-

As Rachel Reeves urges bankers to be less ‘negative’ on selling shares, is the UK due a retail boom?

As the UK’s Labour party deals with its fair share of crises this summer, the chancellor Rachel Reeves has outlined her intention to promote long-term equity investing for retail investors.

-

Geopolitical volatility has made the IRO presence more important than ever

IROs are at the frontline for communication and engagement with shareholders. The role is as complex as it is satisfying while navigating the constant turbulence. At any given time, new regulatory requirements, shareholder tendencies or political factors demand a response.

-

How Canada’s IROs are preparing for a storm on the horizon

CIRI’s annual conference brings together hundreds of IROs from across the ‘true north’, from Toronto-based multinationals through to tiny mining companies based in the wilds.

-

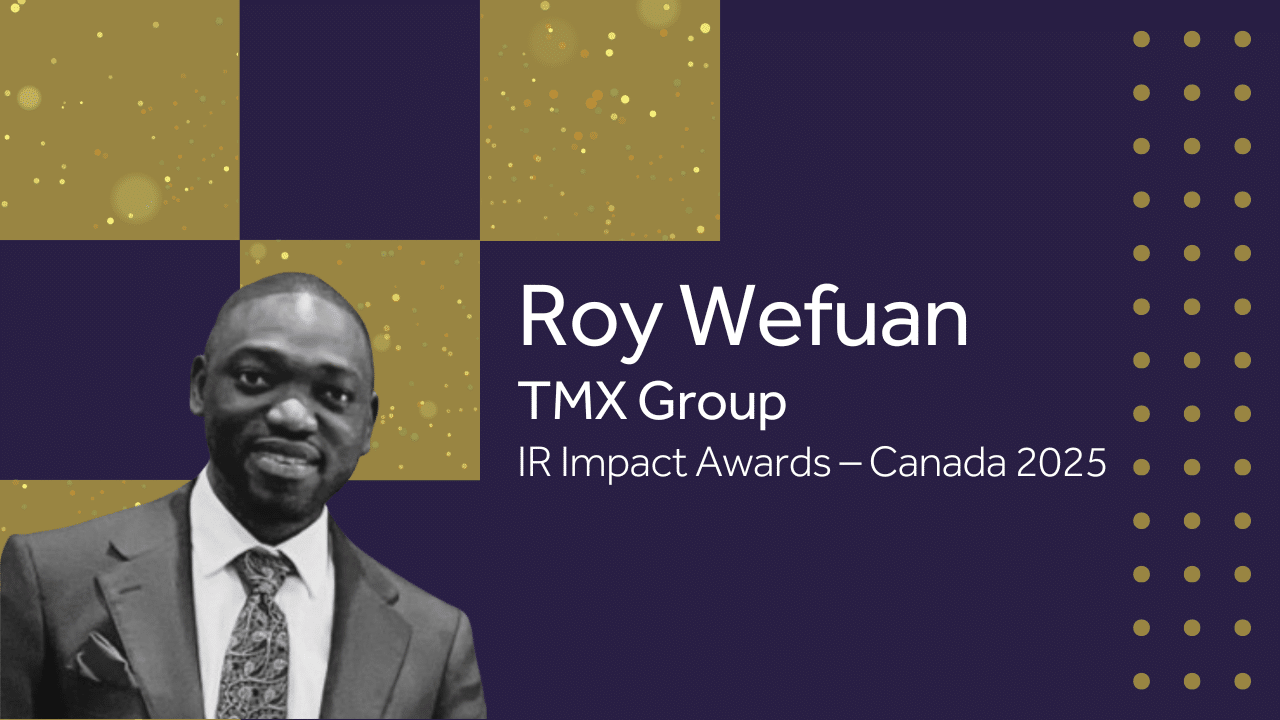

‘Best-in-class IR is about creating a clear vision’: Roy Wefuan at the IR Impact Awards – Canada 2025

What are the hallmarks of a best-in-class IRO? For Roy Wefuan, head of client success at TMX Group, it comes down to prioritizing clear, consistent and proactive communication with your various stakeholder audiences.

-

Struggling for survival amid the noise: biotech webinar offers wider lessons for the IR community

While not everyone in the IR profession will be working in the environment that biotech IROs find themselves in today, everyone seemingly everywhere is battling the noise and uncertainty generated by tariff talks, geopolitical tensions and other macro headwinds. IR Impact recently sat down with Angela Bitting, senior vice president, corporate affairs at Twist Bioscience, Aron Feingold, vice president IR and corporate communications at Geron Corporation and Lynn Pieper Lewis, founder and CEO of webinar sponsor Gilmartin Group, to talk about the challenges the sector is facing. The fascinating discussion that followed is as useful to those in the broader…

-

Tariff Impact Tracker: How companies are quantifying, mitigating, and navigating 2025 tariff challenges

Tariffs are reshaping global trade dynamics — and businesses across every sector are feeling the pressure. The Tariff Impact Tracker from AlphaSense captures a comprehensive, data-driven view of how leading companies are quantifying business and financial impacts, adjusting supply chains and implementing mitigation strategies in response to evolving trade policies. Download this exclusive resource to access recent insights from earnings calls, quantify company-specific impacts and uncover how organizations are planning for uncertainty in 2025. Whether you’re an investor, strategist or business leader, this tracker will give you the critical intelligence needed to stay ahead of the disruption.

-

IR Impact Awards – Canada 2025 Interview with Jenny Holland on the top issues facing Canadian IROs in 2025

Holland speaks to IR Impact editor Laurie Havelock about tariffs, AI and Irwin’s new partnership with FactSet At the IR Impact Awards – Canada 2025, we caught up with Jenny Holland from Irwin, a Factset Company. At the time of recording, US President Donald Trump was announcing a series of trade tariffs prompting Havelock and […]

-

Exports, exchange rates and trade: Brazil under the ‘cascading effect’ of US tariffs

What happens in Washington has significant repercussions in Brasilia The volatility of the Brazilian capital market is a natural consequence of its dependence on external factors. Global dynamics directly influence investments, making it essential for companies and investors to understand these impacts and adopt strategies to mitigate risks and seize opportunities in an environment of […]

-

Top market trends for 2025

In this new report from AlphaSense, discover the dominant trends and themes for the upcoming year, the macroeconomic factors posing sector-relevant implications, and complementing insights from within the AlphaSense platform. Download it for free below for insights on what experts are expecting regarding recession risks, IPO and deal activity and much more.

-

How to talk tariffs: IR in the new era of uncertainty

The US economy is in ‘a period of transition,’ US President Donald Trump told Fox News on Sunday. By close of trading on Monday, the US S&P 500 had dropped almost 3 percent, with tech stocks taking a particularly heavy hit. Weeks of back and forth as Trump threatened tariffs, paused tariffs, reintroduced tariffs – and saw retaliatory levies by affected markets – finally came to a head.