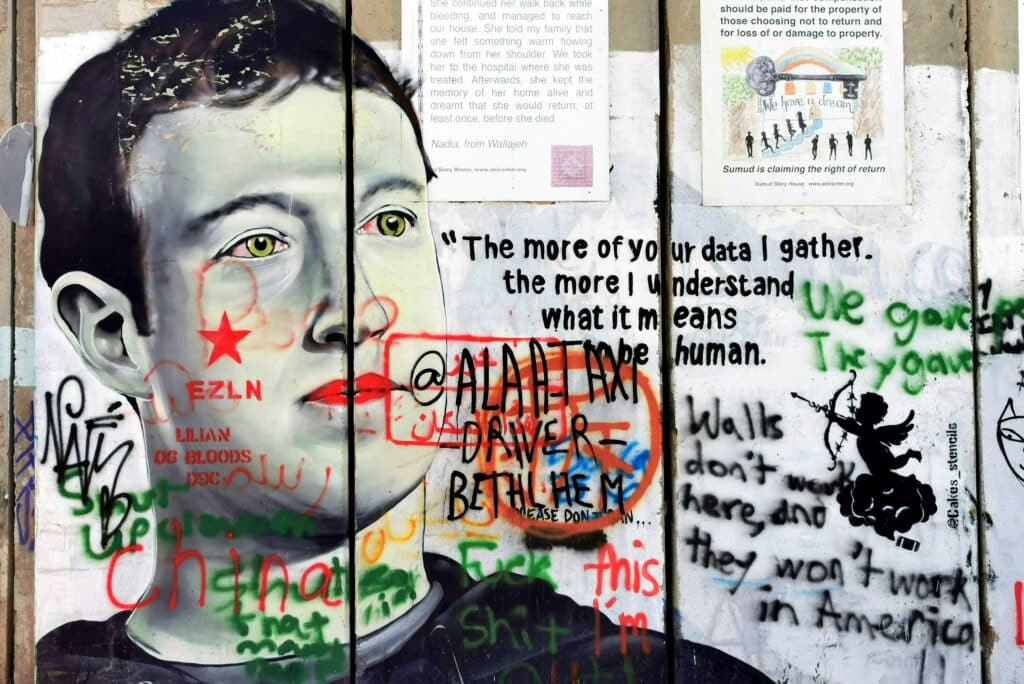

CEO Mark Zuckerberg claimed that workplaces need more ‘masculine energy’

All eyes are currently on Washington DC ahead of Donald Trump’s inauguration. Business leaders of the world – and particularly in the US – are lining up to curry favor with the returning US leader after Elon Musk became a part of the president-elect’s inner circle.

Last week, Meta Platforms – the company which owns social media giants Facebook, WhatsApp and Instagram – said it would scrap its diversity, equity and inclusion (DEI) efforts amid a ‘shifting legal and policy landscape’.

This move included eliminating Meta’s equity and inclusion programs, as well as changing its hiring and supplier diversity practices. Now the company will no longer prioritize hiring candidates from underrepresented backgrounds and will scrap efforts to work with minority-owned vendors and suppliers.

It all reflects signals from Trump that he will dismantle federal DE&I programs and revoke related requirements through measures like the Dismantle DEI Act.

‘The Supreme Court of the US has recently made decisions signaling a shift in how courts will approach DEI,’ wrote Meta’s vice president of human resources, Janelle Gale, in a post announcing the move. ‘It reaffirms longstanding principles that discrimination should not be tolerated or promoted on the basis of inherent characteristics.’

It follows similar moves made by McDonald’s, Ford Motor Company, Jack Daniels, Molson Coors, Tractor Supply, John Deere, Amazon and Walmart. But what exactly does Meta hope to achieve?

In an episode of Joe Rogan’s podcast – a hotbed for sensible corporate governance chat – Meta CEO Mark Zuckerberg decried DE&I policies for having ‘culturally neutered’ companies that he described as abandoning ‘masculine energy’ in their organizations. He added that it was better when an employer ‘celebrates the aggression a bit more’.

So, bringing a bit of the locker room atmosphere back to the company. Presumably it dovetails with Meta’s recent decision to abandon fact-checking on its posts, another move that will likely appeal to Trump’s new administration.

But the business case for DEI policies has long been clear to companies. For example, a recent study of DEI practices at US credit unions by McKenzie Preston has surfaced further evidence that taking a strategic approach that integrates DEI into business processes is linked to better financial performance in terms of return on assets and net income.

Anecdotally, companies with a broader range of opinions close to the top of the tree generally make better decisions and avoid groupthink.

What’s more, the public – if not those who vote Republican – value such programs highly, particularly younger customers: research from Deloitte shows that Gen-Z and Millenial recruits favour purpose-led businesses with inclusive cultures.

Though there may well be a sound business case for scrapping expensive policies that do not deliver the expected results – which Gale’s post tried to lay out in sensible fashion – Zuckerberg’s soundbites have undermined that perception and generated a new wave of headlines that won’t disappear for a while (at least until January 20).

After all, one need only look as far as Trump’s other best friend, Elon Musk, and his stewardship of the social media platform X. Social media audiences will vote with their feet and leave if they disagree with a company. Facebook, Instagram and WhatsApp may be facing that very same risk themselves.

What do you think about the future of corporate DEI programs? Will your company reassess theirs under the next Trump administration? Let us know your thoughts, either via email at [email protected] or on LinkedIn.