News

-

People moves: Disney brings in Benjamin Swinburne as Airbus promotes Jean-Christophe Henoux

Global entertainment giant The Walt Disney Company has appointed Benjamin Swinburne as executive vice president of investor relations and corporate strategy.

-

Why IR websites are moving from ‘platform-first’ to ‘flexibility-first’ in 2026

Most corporate investor websites were built for a simpler digital era. What used to be a dedicated IR microsite – hosted separately, updated through a vendor portal and managed via templated pages – no longer meets the demands of today’s digital environment.

-

How overseas investors are shaping the future of Brazil’s capital markets

No economy can develop without infrastructure. Roads, energy and technology underpin production, entrepreneurship and wealth creation. In capital markets, however, there is a less visible – yet equally essential – form of infrastructure that remains persistently underestimated: investor financial literacy.

-

People moves: Karen Blomquist joins Albany International as GoldMining appoints Martin Dumont

Karen Blomquist has joined NYSE-listed materials science developer Albany International as its new director of investor relations. Formerly an investor relations consultant for BD Emerson, Blomquist joins Albany after two years as vice president of investor relations at P3 Health Partners.

-

Use of the word ‘diversity’ in corporate disclosures drops sharply in 2025, research shows

New disclosure data shows how quickly corporate language can shift as boards respond to legal, regulatory and investor pressure Only 36 percent of the top 100 US companies mentioned the word ‘diversity’ in human capital management disclosures – compared to 96 percent who did so in 2024 – according to a new report which demonstrates […]

-

A material focus: BlackRock refocuses its 2026 voting stance in a tumultuous proxy landscape

BlackRock’s updates its stewardship expectations for 2026 following criticism of its decarbonization plans in New York BlackRock will renew its focus on long-term financial performance and take a more pragmatic approach to environmental policies at investee companies in 2026, according to its updated US Stewardship guidelines for 2026, as proxy advisers and companies continue to […]

-

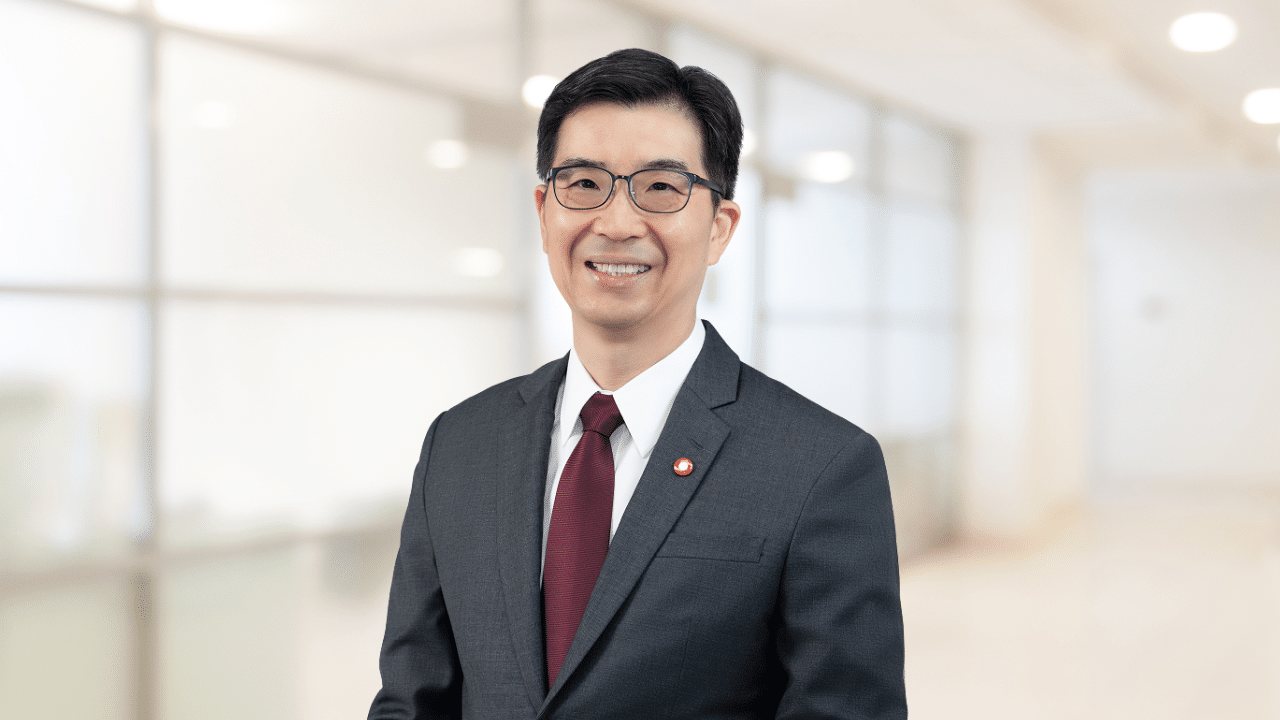

People moves: Former head of IR takes over as CFO at Bank of Singapore

Bank of Singapore has appointed Collins Chin, formerly the head of IR of its parent company Oversea-Chinese Banking Corporation (OCBC), as its new CFO. Chin joined OCBC in July 2009 as the head of group financial and management reporting, assuming the position of head of investor relations in May 2013. There, he led the Singapore Stock Exchange-listed bank’s engagement with the investment community and oversaw shareholder communications around capital raising and M&A initiatives.

-

From shareholder to managerial capitalism: how proxy firm regulation and 14a-8 reform will define IR in 2026

In October 2025, Tesla CEO Elon Musk deployed provocative language characterizing proxy advisors as ‘corporate terrorists’ following ISS’s recommendation that shareholders reject his proposed $1 trn compensation package. Musk argued that ISS and Glass Lewis ‘have no actual ownership themselves’ yet effectively control corporate governance outcomes through their recommendations to investors. This identifies a genuine agency problem: proxy advisors bear no economic consequences from their recommendations.

-

People moves: Joris Silon takes over as head of IR at AstraZeneca as Dollar Tree brings in Daniel Delrosario

London-listed biopharmaceutical company AstraZeneca has brought in Joris Silon as its new head of IR, in a move effective from 1 March. Silon, who previously served as the firm’s country president for AstraZeneca US, will replace Andy Barnett, who is taking up another internal position.

-

Managing expectations in 2026: Why valuation stability depends on perception, not just performance

As companies move through 2026, one lesson stands out clearly: delivering strong results is no longer sufficient to protect valuation. Across markets in 2025, share-price volatility was driven less by execution and more by misalignment between investor expectations and management’s forward-looking narrative. In this environment, the IR function has become a strategic discipline. Beyond communicating performance, IR teams are increasingly responsible for aligning market perception with a company’s long-term value creation path. When that alignment breaks down, even earnings beats can result in sharp corrections, elevated volatility and weakened investor confidence.

-

The six hats shaping the IRO role in 2026

Investor relations has never been a static function, but the pace and breadth of change now shaping the role today underscore a redefinition of how IR contributes to enterprise leadership. What once felt like incremental role expansion is becoming a structural rewrite of the job itself.

-

‘I want us to have influence on the big issues IROs are facing,’ says Investor Relations Society’s new CEO

Having taken the society’s CEO reins from Laura Hayter in October last year, Matt Hall spent his first months in listening mode, keen to hear what the UK’s IR professionals need from the body that represents them, learning about the big issues that are changing investor relations and thinking about how he can shape a society that delivers ‘value and insight’ at every touchpoint. Prior to taking on his new role, Hall held senior roles at various other representative membership organizations within financial and professional services, including UK Finance, the Chartered Insurance Institute and TheCityUK. Here, he tells IR Impact…

-

IR in the age of AI: How answer engine optimization will transform content visibility

Content visibility and engagement are always key priorities for IR professionals. As AI and large language models (LLMs) become a primary source of information for buy-side and sell-side analysts, content visibility and narrative control are constantly shifting, creating new challenges in how audiences discover and engage with IR corporate content.

-

Janet Craig: Ten things I am doing to up my IR game in 2026

Predictably, as I moved into the New Year, I thought about what I wanted to accomplish over the coming 12 months. There are many opportunities for professional development, but my focus is on areas where I can hone my craft, build relationships and pay it forward. Here are 10 IR things I want to do in 2026:

-

What makes an equity narrative compelling? An investor survey offers clear perspective

In today’s competitive capital markets, crafting a compelling equity narrative is more than a communications exercise; it is a strategic imperative. But what distinguishes the enduring from the generic? BNY’s Market Insights and Initiatives team, in partnership with S&P Global, surveyed 40 institutional investors across six continents, representing $2 trillion in equity assets under management, to answer this question.

-

Responsible AI adoption in IR: from intimidation to impact

AI is everywhere in investor relations today. Yet for many IR teams, the journey from curiosity to confidence is anything but straightforward. The ’empty prompt window’ syndrome and uncertainty around where to start and how to trust the technology remain real.

-

‘Market volatility necessitates a more thoughtful approach’: Four things we learned at the IR Impact Forum – Greater China 2025

The Hong Kong event brought together IR professionals and capital market experts to explore how the IR function should adapt When volatility and concentration risk become part of the backdrop for Chinese IROs targeting investors globally, new challenges emerge. From tailored engagement strategies to navigating unfamiliar capital market expertise, securing long-term investors requires consistency, long-term engagement and market insight. The IR Impact Forum […]

-

IR for video games, AI for engagement and the Big Three’s voting policies: What you read in 2025

As 2025 draws to a close, it feels like we are wrapping up a particularly momentous year in the capital markets. In the past 12 months, we’ve seen the global markets grapple with seismic macroeconomic shifts – including Donald Trump’s return to the White House, ongoing instability in Europe and the Middle East, plus the ever-evolving role of AI – as well as more localized changes to the day-to-day of IROs.

-

‘The tolerance for inconsistency is zero’: Four things we learned at the IR Impact Forum – South East Asia 2025

The Singapore event brought together 100 senior IR experts to examine how the IR function is evolving The IR Impact Forum – South East Asia 2025 brought around 100 IR professionals to the Singapore Stock Exchange (SGX) on December 2 to discuss how the IR function is evolving in the region. A series of panel […]

-

The IR Benchmarking Report 2026 Global & Europe available now

A new year, a new name. In recognition of our flagship IR Benchmarking Tool, launched in early 2025, our long-running Global Practice Report has become the IR Benchmarking Report Bringing you research from several hundred IR professionals, it offers insights into everything from budgets and IR team analysis to sell-side coverage across markets caps and […]

-

The IR Benchmarking Report 2026 Global & North America available now

This year we bring you a brand new, revamped IR Benchmarking Report that couples our survey research with interview and data from our flagship IR Benchmarking Tool. Alongside the data – covering everything from budgets to gender breakdowns, from analyst numbers to senior management attendance at virtual and in-person meetings – this report offers a […]

-

People moves: CBIZ brings in Christopher Sikora as Reinsurance Group of America appoints Ryan Krueger

Professional services company CBIZ has brought in Christopher Sikora as its new vice president, investor relations and corporate finance. The NYSE-listed firm describes Sikora as ‘an accomplished investor relations professional with extensive experience in finance, strategy and corporate development’ in a press release announcing the move.

-

Passive investors driving active opportunities: how fund flows are shaping how IR teams direct their time

Recent IR Impact briefing, held alongside Nasdaq, explores the implications of the ongoing passive shift As passive ownership continues to grow, how companies interpret trading activity and allocate their investor engagement efforts is shifting in parallel. A recent IR Impact briefing, in association with Nasdaq, brought together Jacquelynn Bohlen (head of IR, Columbia Banking System), Stephanie Bui (co-head, investor engagement, Americas, Nasdaq) and Prabhdeep Sagoo (senior director, market and shareholder […]

-

People moves: Medtronic’s Ryan Weispfenning to lead IR at diabetes spin-off

Ryan Weispfenning, head of IR at the multiple IR Impact award-winning team at Medtronic, is taking up a new role in the team at the medical device company’s diabetes spin-off. The news comes as Ingrid Goldberg has been named as Weispfenning’s replacement, with both changes coming into effect as of December 8.

-

Glass Lewis tightens US oversight of board powers in broader 2026 proxy rethink

Glass Lewis released its 2026 Benchmark Policy Guidelines on December 5, setting out notable changes for its policies for companies in the US, Canada, the UK and continental Europe. The updated guidelines, which apply to shareholder meetings held after 1 January 2026, indicate a shift away from rigid, uniform voting prescriptions and towards one with more customization and sees proxy advisors act more as research providers than as standard setters.

-

IPOs, crypto and deregulation: The SEC prepares for a shift in 2026

Hot off the heels of his NYSE address, SEC chair lays out his vision for the Commission in 2026 and beyond On December 2, 2025, SEC chairman Paul Atkins rang the opening bell at the NYSE and delivered a keynote address titled Revitalizing America’s markets at 250. In a sweeping vision for the future of […]

-

Hon Hai Precision Industry sweeps to victory with five trophies at the IR Impact Awards – Greater China 2025

Taiwanese electronics manufacturer Hon Hai Precision Industry Co almost made a clean sweep at the IR Impact Awards – Greater China 2025 after its team picked up five awards. The New Taipei City-based firm picked up the trophies for best in sector – technology, best CEO letter and best buy-side management.

-

From the sell side to the buy side and into IR, William Houston starts a new role at Unilever

‘It’s a company I’ve long admired, having analyzed it on the sell-side at UBS and Rothschild & Co Redburn and invested on the buy side as a portfolio manager at Norges Bank Investment Management,’ writes William Houston on LinkedIn as he joins the Unilever IR team. As well as his time on both the buy and sell sides, Houston spent almost six years at BAT, most recently as head of investor sustainability, investor relations. He has also been a regular voice in IR Impact articles – talking about the evolution of ESG data, for example – as well as sharing…

-

Do ISS and Glass Lewis have too much influence? Yes, say most – but that doesn’t mean it’s not political

I’ve spent much of the past week having conversations with governance people – and one very small proxy advisory firm – about their takes on the debate raging around the influence of the big two: ISS and Glass Lewis. Recent weeks have seen talk of the ‘weaponization of shareholder proposals’; Elon Musk has famously described them as ‘corporate terrorists’; the Wall Street Journal reported that US President Donald Trump is considering an executive order to curb the power of the proxy advisors, as well as the fact that these two behemoths are facing an anti-trust investigation for their roles in…