News

-

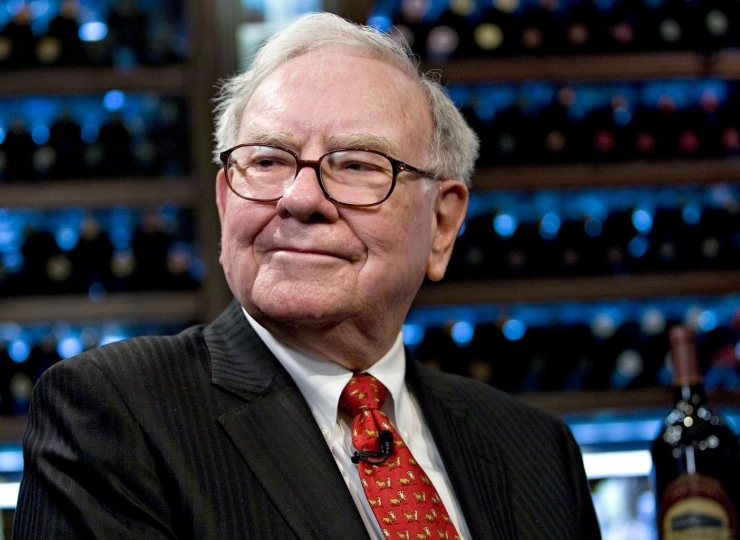

IR lessons from Warren Buffett as Berkshire Hathaway’s ‘Oracle of Omaha’ retires

Berkshire Hathaway’s charismatic chief executive Warren Buffett, the much-vaunted ‘Oracle of Omaha’, enjoyed two significant career milestones this week. The first was helming his 60th annual meeting for the fund, which shed light on where the trillion-dollar-investment manager will be focusing its attentions in the near future. Almost 20,000 people attended the event, which sees attendees spend hundreds of thousands at concession stands alone.

-

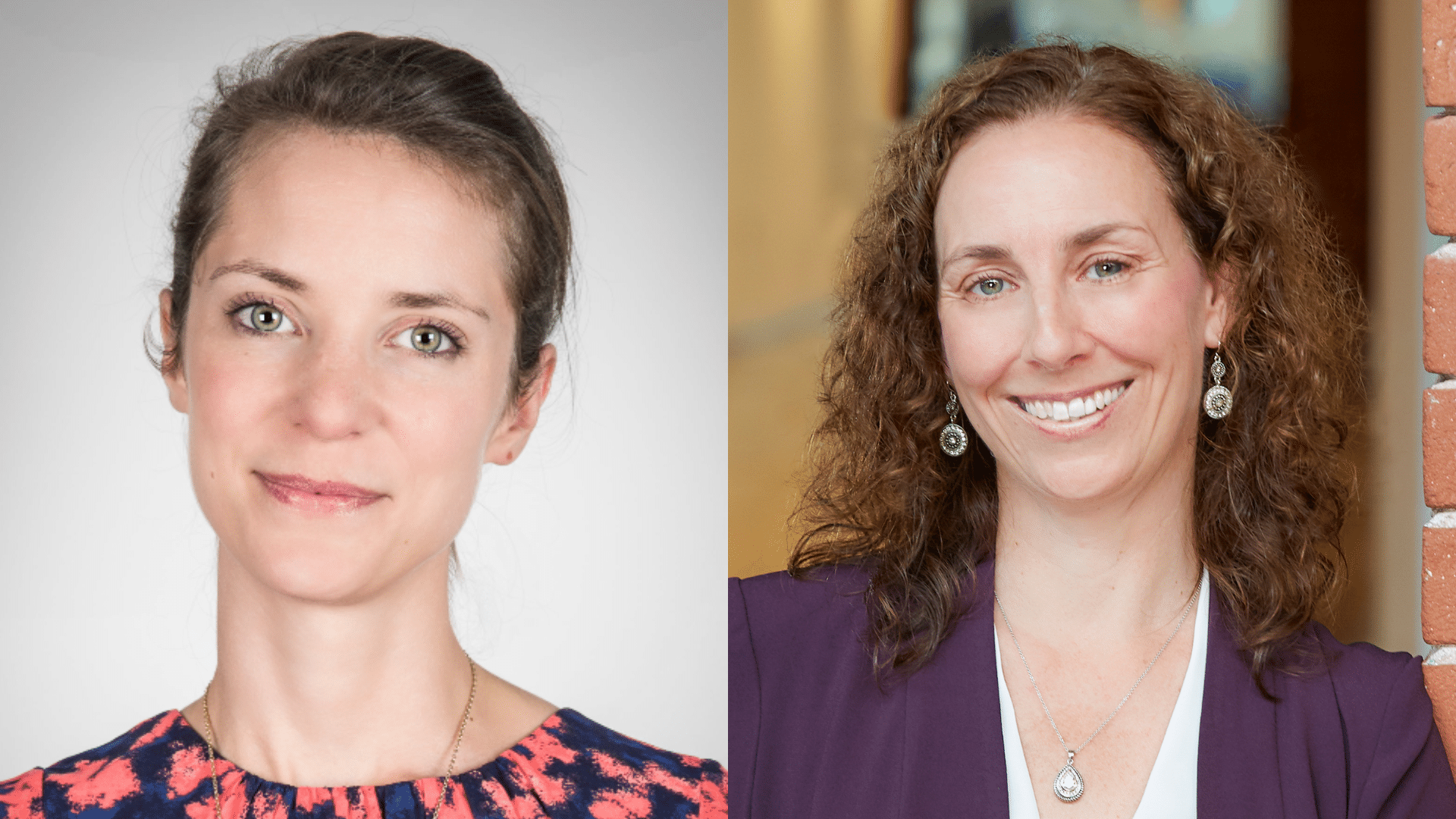

Struggling for survival amid the noise: biotech webinar offers wider lessons for the IR community

While not everyone in the IR profession will be working in the environment that biotech IROs find themselves in today, everyone seemingly everywhere is battling the noise and uncertainty generated by tariff talks, geopolitical tensions and other macro headwinds. IR Impact recently sat down with Angela Bitting, senior vice president, corporate affairs at Twist Bioscience, Aron Feingold, vice president IR and corporate communications at Geron Corporation and Lynn Pieper Lewis, founder and CEO of webinar sponsor Gilmartin Group, to talk about the challenges the sector is facing. The fascinating discussion that followed is as useful to those in the broader…

-

Patrick Möller eyes new opportunity at optician Fielmann and Stephen Nightingale steps down from Britvic

Experienced German IRO Patrick Möller has taken up a new role at Hamburg-based optician group Fielmann as its new director of investor relations. He joins the company after 17 years as vice president of investor relations at New Work, formerly known as Xing, during which time he was nominated for the award for best overall IR – small cap at the IR Magazine Awards – Europe 2016. He left his role at New Work following the company’s delisting from the Frankfurt Stock Exchange earlier this year.

-

‘I wanted to set a new standard for investor days’: Rebecca Gardy of Campbell’s on an award-winning event

At the recent IR Impact Awards – US 2025, we spoke to Rebecca Gardy, chief investor relations officer at Campbell’s, about how exactly they planned last year’s investor day

-

ESG: Over or in it for the long haul? IR Impact Forum takes debate to Canada

Whether ESG is over or increasingly relevant, in need of reform or greater standardization is the great debate. Has the term become too ‘woke’? Is it too much of a political hot potato? Does good ESG equate to better share price performance, or has it been hijacked under the pretense of improving returns? Prabh Banga of Aecon Group (left) and Jack Mintz from the University of Calgary (middle) debate ESG with IR Impact’s Steve Wade These were the topics up for debate when Prabh Banga, vice president of sustainability at Aecon Group and Jack Mintz, president’s fellow of the school…

-

Huntington Bank names Eric Wasserstrom as IR lead and a flurry of posts open up across the profession

New names at Huntington Bank. Atos Group and Konecranes, while a flurry of posts open up across the profession. Eric Wasserstrom has been named as the new vice president, head of investor relations at Huntington National Bank, a $210 bn asset regional bank operating across 13 US states.

-

How broker insights can transform your earnings process

As data continues to flood the market, IROs are finding it both challenging and time-consuming to gauge market perceptions of their companies. Increasingly, IROs are looking to their data platform providers to help them collect all the available, granular insight from brokers in one place, where it can be sorted, analyzed and better understood. But how can that data be passed through into the earnings process overall and be used to improve the impact of a company’s latest figures on various stakeholder audiences?

-

Earnings season: Navigating financial guidance amid macroeconomic uncertainty

In the current climate it is the transparency and rigor of guidance rather than the precise figures that matters most. And, as public companies prepare to report earnings for the March 2025 quarter, it is important to evaluate how best to communicate financial guidance and manage investor expectations in the context of ongoing market volatility and geopolitical disruption.

-

Wall Street caught between a rock and a hard place as tensions between US and China rise

The trade war between China and the US has spiraled into unchartered territory. On April 10, Donald Trump’s administration imposed a tariff of 125 percent on all Chinese imports. China called the actions unfair and responded with similar measures. Within the broader debate around unravelling economic ties between the US and China, where economic interdependence has increasingly been viewed as a threat to US national security, this escalation raises questions about whether global finance is also reducing its presence in China.

-

Enhancing decision quality through advanced investor intelligence: the hidden engine of competitive advantage

In today’s volatile and hyper-competitive markets, the difference between a market leader and an also-ran often comes down to one crucial factor: decision quality. While product innovation, brand recognition and capital access are still important, it is the consistency and accuracy of decisions — particularly strategic, operational, and financial ones — that sets enduring winners apart in terms of valuation. For public companies, this is especially true at the management team and IR level, where every choice can ripple across long-term growth trajectories, investor perception and ultimately valuation.

-

Small (and a mid) caps hit big: Aecon, Calian and TransAlta take three apiece at the IR Impact Awards – Canada 2025

In an event packed with the highest achieving IR teams in Canada, it was two small-cap companies and a mid-cap firm that punched hardest, with Aecon Group, Calian Group and TransAlta Corporation each taking home three IR Impact Awards at the black-tie ceremony in Toronto last night. TransAlta took the trophy for best overall investor relations and best investor relations officer for Tamara Cook – both in the mid-cap category – as well as winning its sector award in utilities. The two small-cap companies also won some of the most prestigious awards of the night, with Aecon claiming best overall…

-

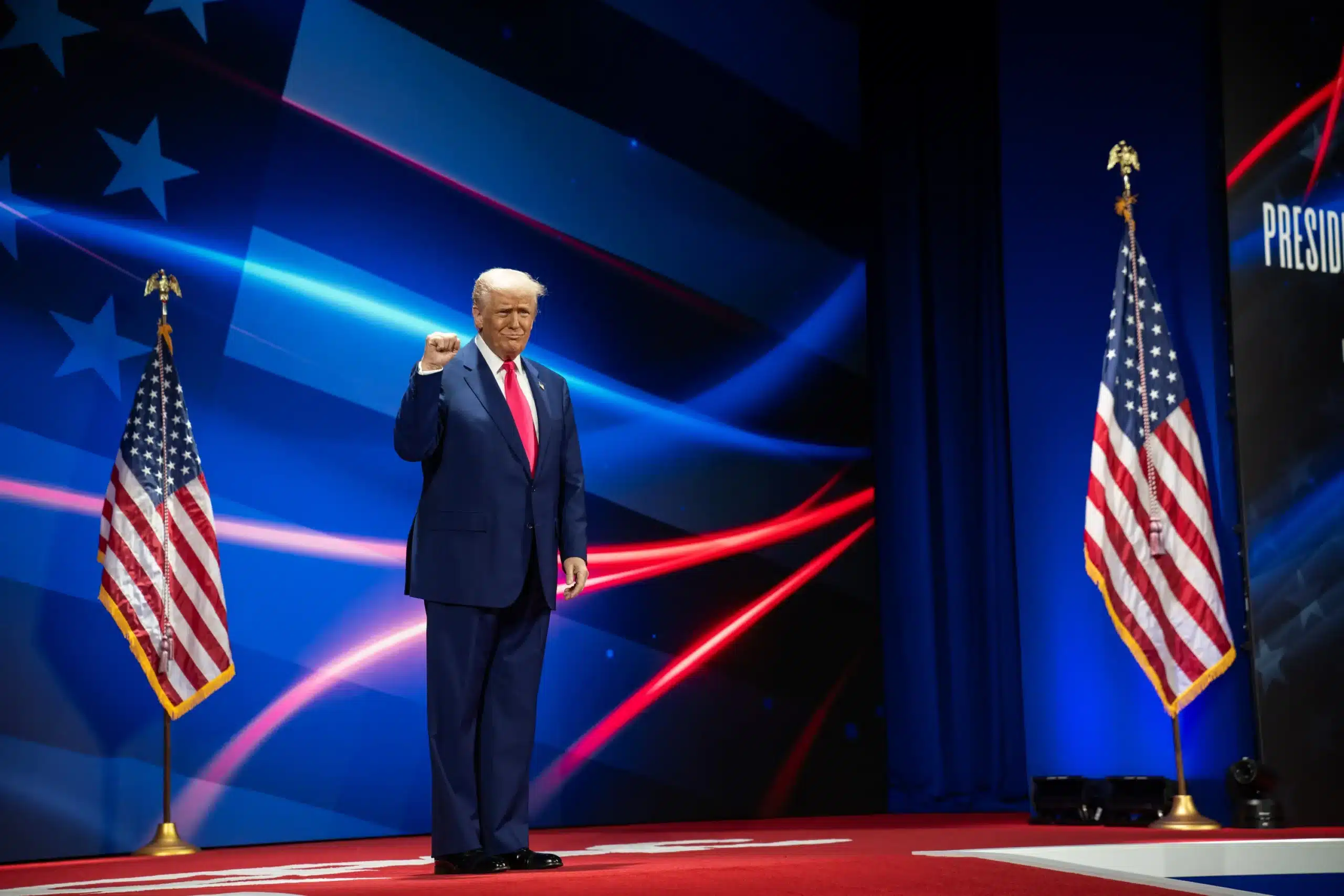

What does Trump’s so-called ‘Liberation Day’ mean for IR?

After weeks of warnings, Donald Trump finally revealed his full suite of new industry tariffs from the White House Lawn on Wednesday. Announcing the slew of trade measures as ‘Liberation Day’, the US president said that the economic policies would mark the day American industry was ‘reborn’ and the day the country was ‘made wealthy again’. For many IROs, it will herald a period of volatility and uncertainty as they scramble to find out what the implications of those moves will be on their companies.

-

Building from a baseline: how IR teams are using new data sources to unlock smarter decision-making

As any IR professional knows all too well, the market is awash with a wealth of data from myriad sources. Everything from earnings calls to websites to press releases – both from your company and from your peers – can help inform strategic IR work. But where do you start without becoming completely overwhelmed? This was what panelists Erik Carlson, chief operating officer at Notified, Glenn Schulman, founder and head of IR at Z3 BioCommunications, and Amanda Tang, head of IR at TMX Group, tackled in a recent IR Impact Webinar, held alongside Notified.

-

‘Err on the side of transparency’: Dave Bezanson on how to execute a successful earnings

Ahead of our upcoming IR Impact Forum – Canada, set to be held in Toronto on April 3, we have caught up with some of the event’s leading speakers to understand their outlook for investor communications in Canada.

-

Fluent in the language of IR: Duolingo wins big at IR Impact Awards – US

Language-learning giant Duolingo was the big winner among a room full of IR excellence at the IR Impact Awards – US in New York on March 26. The firm took home two of the most coveted gongs of the night: best overall investor relations (mid-cap) and best investor relations officer (mid cap) for Debbie Belevan. Duolingo also topped its sector category, winning the best in technology trophy against fierce competition.

-

SEC releases decisions on DEI proposals under new 14a-8 guidance

The SEC’s initial decisions on whether companies may exclude shareholder proposals under new guidance continue to suggest no blanket indicators of how the agency’s staff will land on certain topics – including in the high-profile diversity, equity and inclusion (DEI) space. That’s according to another provisional analysis by IR Impact sister site Governance Intelligence of 14a-8 decisions published by the division of corporation finance since it released Staff Legal Bulletin (SLB) No 14M on February 12

-

People moves: Debbie Hancock joins Lamb Weston and Caroline Dawson moves to Reckitt

Debbie Hancock, the former senior vice president of investor relations at toy maker Hasbro, has taken up a new IR role at French fry producer Lamb Weston. Hancock, who left her position at Hasbro in February 2024 after 15 years at the company, has a career in investor relations that spans 30 years, including a 15-year stint as director of IR at APC by Schneider Electric. She has been a member of NIRI since the mid-90s.

-

Amid such a complex environment, IR’s job is to keep things simple

It’s certainly a wild time to be an IRO. While uncertainty is always present in the market, companies are dealing with major surprises far more frequently at the moment. On any day, corporate strategies and financial guidance could be thrown into doubt by a policy announcement, geopolitical shift or another factor.

-

How long do you have to be ‘short’? Recent debate puts spotlight on the movements of short sellers

Short seller reports can have a huge impact on the stocks they target. Everyone from regulators to law firms and even Netflix are looking to the impact of shorting stocks – with one law firm arguing free speech is being put at risk In the stock market, the traditional way to make money is to buy shares in a company and wait for the share price to rise. Another way is to short a company and wait for the share price to go down and buy back the cheaper shares. If the share price goes up, those shares must quickly…

-

Why anxiety is your biggest enemy in communications

How much time and thought have we spent building scenarios and thinking about the reception of a report, a press release or a statement on a current issue where our company or client is expected to have – or even required to have – an opinion? Knowing your subject too well is often the big risk when it comes to communications: it presents the risk that your story will be far too detailed and ultimately incomprehensible. The point of your story will disappear in a cadre of details that do not contribute to the overall picture, much less to the…

-

People moves: FactSet names Kevin Toomey as head of IR

Financial data provider FactSet has named Kevin Toomey as its new head of IR. He takes over from Yet He, the current interim head of investor relations, who will continue in his role as treasurer and head of financial planning and analysis. Most recently, Toomey was vice president of IR at Secureworks. Before that, he ran IR at Latch, which focuses on keyless security systems. Overall, he has more than 20 years of experience across IR, equity research and finance.

-

CIBC and Calian Group lead the pack ahead of the IR Impact Awards – Canada 2025

Canadian Imperial Bank of Commerce (CIBC) and Calian Group will be the favorites ahead of the IR Impact Awards – Canada 2025, with both companies featuring on the short lists for seven awards apiece. The gala event, which will take place in Toronto this April, aims to recognize Canada’s leading publicly listed companies and IR practitioners across a wide range of categories.

-

The valuation engine: thriving in the age of infinite momentum

We have entered the ‘Age of Infinite Momentum’, where disruption unfolds faster than understanding. Strategic adaptability is the indispensable skill of the elevated IRO as they find themselves on fluid terrain, as market forces, technological disruption, geopolitical shocks, regulatory changes and shifting investor expectations converge at an exponential pace.

-

People moves: Darren Snellgrove to head Johnson & Johnson’s IR team as Jessica Moore takes CFO role

Plus new IROs at Essential Utilities and Liberty Latin America

-

‘Without my Bloomberg screen, I have to be creative’: Five things we learned from IROs who switched from the sell side

It’s news to no one that investor relations is increasingly appealing to former sell siders. Events from the financial crisis to the introduction of Mifid II in Europe have combined with trends around the increase of passive investing and a squeeze on the sell side to drive some to look elsewhere – with many landing on IR

-

How to leverage generative AI to transform your research

One of the biggest challenges in many research fields is keeping pace with rapid advancements

-

Reddit leads nominations just one year after its IPO ahead of the IR Impact Awards – US 2025

Other companies topping the shortlists include Duolingo, Moody’s Corporation, JPMorgan Chase & Co and GE Aerospace The IR team at Reddit will hope to turn a successful IPO year into a successful night of award wins, after the social media company picked up six nominations at the upcoming IR Impact Awards – US 2025. The […]

-

Driving growth: unleashing Saudi Arabia’s investor relations potential

As Saudi Arabia continues to take solid steps to achieve a number of strategic objectives under the Vision 2030 umbrella, the role of IR in the Kingdom is undergoing a major transformation.

-

‘AI is not a singular tool but an entire ecosystem’: Isabel Vilela on how her approach to AI has grown in a year

GoviEx Uranium’s Isabel Vilela speaks ahead of the AI and Technology Forum – Europe