News and analysis

-

How advanced data and analytical tools are elevating IROs to be strategic leaders

The IR role is entering a new era, one defined by data, speed and strategic influence. In a world where financial markets are driven by real-time insights and rapidly shifting narratives, IR professionals are no longer just corporate messengers. They are increasingly expected to be analytical thinkers, competitive strategists and trusted advisors to the C-suite and board.

-

SEC steps back from no-action reviews, leaving proxy season on unstable ground

Regulator will reduce oversight of shareholder proposal disputes in a step critics say will leave investors in ‘legal limbo’ The SEC has changed its rules around how companies seek permission to exclude certain shareholder proposals from proxies, in a move that will make it more difficult for activists to force votes on contentious issues. Earlier […]

-

‘We’re listed in the US but still haven’t had the chance to go to’: China’s ATRenew on engaging US investors when you can’t meet face-to-face

As a company that facilitates the buying, selling and recycling of pre-owned consumer electronics in China, ATRenew is counter-cyclical, with a model that stands to benefit when consumers look to save on that ‘new’ phone or tablet. Here, Xiaoyi (Jessie) Jin, financial communications and IR at ATRenew, talks to IR Impact about engaging local and international investors, ramping up analyst coverage and planning a trip to meet US-based shareholders – more than four years after listing on the NYSE. ATRenew is nominated in two categories at the IR Impact Awards – Greater China 2025: best buy-side management, best investor event…

-

How companies can build a smart defense against takeovers

Public market valuations remain subdued, particularly across the UK mid-cap universe, while private equity firms continue to hold record levels of capital. In 2024 and into 2025, this imbalance has created fertile ground for takeover activity.

-

Five things IROs can learn from the 2025 Corporate Governance Forum

The New York event brought together top governance professionals in an era when change can be quick and new stakeholders are entering the arena The 2025 Corporate Governance Forum brought together governance professionals, board members and advisers for discussions that included proxy disclosure, shareholder activism and the politicization of corporate decision-making. Across all panels, one […]

-

People moves: Honeywell switches up IR leads ahead of aerospace business spin-off

US automation and technology firm Honeywell has appointed a new head of IR as its existing chief leaves to head up a new team at a soon-to-be spun-off company.

-

‘We have radically rethought how to look at sustainability’: Christian Granquist on AP7’s new outlook

Christian Granquist joined AP7, one of Sweden’s national public pension funds – into which some 6 mn Swedes pay – in August 2025. Working alongside Jessica Eskilsson Frank, Granquist is senior portfolio manager, impact investments, climate transition at the globally invested fund that has total assets of around $150 bn. Before joining AP7, Granquist – who has a master’s in economics from Uppsala University – had a 10-year stint at Lancelot and worked at Handelsbanken for 13 years in a number of roles including chief investment strategist and co-head, equities. He talks to IR Impact about how the fund is…

-

How pre-IPO investor relations shapes long-term market success

The IPO journey doesn’t start on listing day. Companies that treat investor relations as an afterthought until the opening bell often find themselves scrambling to build credibility when it matters most. The statistics tell a sobering story: approximately only one third of newly listed companies outperform their already-listed peers over the long term. Poor financial communication sits at the heart of this underperformance. Building relationships before you need them Establishing an effective IR function well before your IPO creates something money can’t buy on demand: trust. When analysts and investors already know your story, understand your business model and have…

-

‘Show me the before-and-after, not just the highlight reel’: Jeannie Ong on what she looks for as an IR Impact Awards judge

Multi-award winner shares her thoughts on the Greater China and South East Asia judging Jeannie Ong, managing director, operating partner, investor relations at Temasek, is a seasoned IR Impact Award judge – this year taking on the mammoth task of both the Greater China and the South East Asia entries. She talks to IR Impact about how her own experience in investor relations helps her find the winners, the categories that are harder to judge and how IR across the region is evolving.

-

The AI-empowered IRO: the three personas that can help you understand how best to approach AI

Investor relations is entering a period of rapid transformation. Investors are already using AI to screen disclosures, detect sentiment and benchmark performance across their portfolios. This growing analytical power on the buy side is changing expectations for speed, accuracy and insight. For IROs, the question is no longer whether to use AI, but how to harness it to match the sophistication of the investors they serve.

-

Nuance over polish: Leveraging the conference calendar and other top tips for your 2026 meeting schedule

What do investors want when it comes to capital markets days (CMDs)? Or other Street-facing events for that matter? It was with that investor view in mind that Sylvie Harton, chief business strategy officer at Lumi Global – partner on the IR Impact Briefing: Making your 2026 investor meetings count – kicked off the conversation.

-

Tesla: How do you get support for a $1 trn pay package? Give shareholders a slice of the pie

ISS is recommending against Tesla CEO Elon Musk’s $1 tn compensation package. Glass Lewis too. CalPERS and NBIM, manager of the world’s most valuable sovereign wealth fund, have each come out publicly against. But with the Tesla AGM happening today online and at Tesla’s Gigafactory Texas, one small, family-run proxy advisory firm – whose ESG-skeptic voting guidelines are offered by ISS, and which boasted the $57 bn Texas Permanent School Fund as the first state fund to sign up – is backing Musk’s compensation. ‘We’re strongly focused on the alignment of incentives,’ says Jerry Bowyer, CEO of Bowyer Research, who…

-

People moves: Cabot Corporation promotes Robert Rist to be vice president of investor relations

Specialty chemicals and performance materials company Cabot Corporation has promoted Robert Rist to be its new vice president of investor relations and corporate planning.

-

ANTA Sports Products leads pack with eight nominations at IR Impact Awards – Greater China 2025

ANTA Sports Products is leading the pack ahead of the IR Impact Awards – Greater China 2025 with eight awards nominations, with a trio of companies hot on their heels for a podium finish. The footwear manufacturer, which is based in China, is shortlisted across categories including best IR impact, best buy-side management and best overall investor relations (large cap). In a three-way tie for a close second place for the most nominations are Hon Hai Precision Industry Co and Primax Electronics, both based in Taiwan, and Hong Kong-based KLN Logistics Group.

-

Why IROs need to understand generative engine optimization, or GEO: a beginner’s guide to the AI best practice

I probably shouldn’t admit this, but while I was gardening the other day – pruning a rather unruly hydrangea – I found myself mentally reviewing my IR program for the year. Yes, I do have a life outside of investor relations, but sometimes the brain wanders where it pleases. There I was, shears in hand, quietly checking off the usual suspects: upcoming press releases and investor campaigns, roadshows, the media strategy, stakeholder engagement, ESG reporting, etc. It all felt satisfyingly under control – until I realised there was one thing I didn’t know much about: generative engine optimization (GEO).

-

PTT Exploration and Production scores seven nominations at IR Impact Awards – South East Asia 2025

Leading the nominations in seven distinct categories, PTT Exploration and Production once again tops the shortlists with the most nominations ahead of this year’s IR Impact Awards – South East Asia. The Thai oil major is in the running for seven awards, including best overall investor relations (large cap), best investor event and best sell-side management. Tied for a close second with the most nominations – with six shortlists each – are CP Axtra, Berli Jucker and Global Power Synergy from Thailand and Stoneweg Europe Stapled Trust, United Hampshire US REIT that are based in Singapore.

-

‘It’s not necessarily about coming up with a brand-new thing’: Janet Craig on what she looks for as an IR Impact Awards judge

As we gear up for the IR Impact Awards in both South East Asia and Greater China, our teams of expert judges have been sifting through the many entries from companies talking about everything from how they have implemented AI into their programs to the memorable investor events they’ve put on for analysts. IR Impact catches up with Janet Craig – herself a multiple IR Impact Award winner and now a judge for our events – to find out what marks an entry out as special.

-

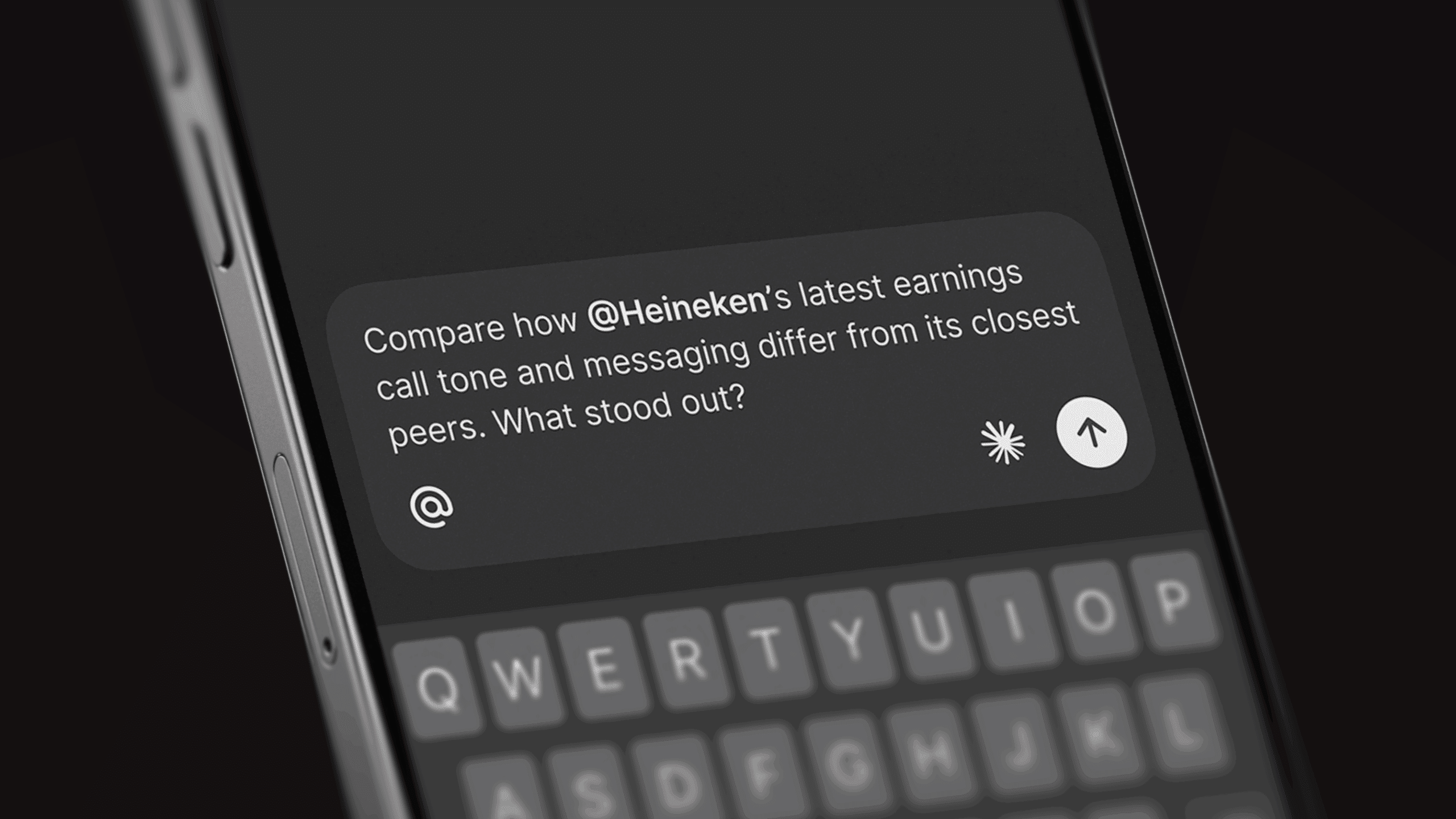

Philosophy and numbers: IR Impact briefing explores how AI is – and isn’t – changing earnings

‘Investors, analysts – everyone in financial markets – is consulting a vast amount of increasing data sources to inform their investment decisions,’ said Laurie Havelock, IR Impact editor, kicking off the recent briefing that brought together Jesse Rose, head of IR at Reddit, Dave Bezanson, vice president of IR and pensions at EMERA and Christopher Napolitano, account executive at AlphaSense, the event partner. While data opens up a world of insights, Havelock pointed to the added pressure it brings when IROs must distil everything that is out there into something they can deliver to the board. This, said Napolitano, is…

-

People moves: Novo Nordisk brings in analyst who covered it for 15 years as new head of IR

The Danish drugmaker Novo Nordisk has hired one of the country’s top equity analysts to serve as its new head of IR. Michael Novod, formerly of Nordea Bank in Copenhagen, will leave his position by May 2026 to take over the IR team at Denmark’s most valuable company.

-

The CFO: ‘IR professionals are like Swiss Army knives,’ says Unite Group’s finance chief Mike Burt

The student accommodation finance chief on an exciting acquisition, why IROs need to be good listeners and why analysts are like sports commentators who never played the game For many students in the UK and further afield, your first year of study is spent in a halls of residence – or purpose-built student accommodation (PBSA), […]

-

Introducing Quartr’s AI chat on mobile – purpose-built for public market research

Numbers are everywhere. But numbers alone don’t tell the full story. That’s why we launched Quartr’s AI chat on mobile, purpose-built for IR and public market research.

-

Enhancing valuation: optimizing your equity story for the right investors

In Asia’s dynamic capital markets, the challenge for listed companies is clear: how to enhance valuation and ensure the right story resonates with the right investors. High ownership concentration, regional shareholder dominance and fragmented analyst coverage mean that earning the attention – and conviction – of global investors requires more than traditional broker-driven outreach or routine disclosures. What’s needed is an integrated approach built around three collar pillars: independent investor feedback, rigorous investor targeting and high-impact capital markets events.

-

People moves: Ziff Davis appoints former US Department of State diplomat as head of IR

Plus new IROs at Expedia Group, ATS and Abnormal AI Magazine publisher and digital media company Ziff Davis has brought in a former US Department of State official as its new director of investor relations. JT Farley, whose last role saw him work as a foreign service officer (vice consul) at the US Department of […]

-

‘Profit and purpose have been our yin and yang’: TPXimpact’s Luke Murphy on a first IR Impact award win

When the small-cap UK firm TPXimpact cropped up on the shortlists ahead of the IR Impact Awards – Europe 2025, it was a name unfamiliar to many of the judges – and perhaps many other onlookers. The company, which enables digital transformation projects for a range of organizations, including public sector bodies in the UK, may not be well-known in general, but Luke Murphy, head of IR and chief of staff, was among the names for the rising star award. The company’s annual and ESG reporting were also nominated.

-

Meira Muscat 2025: From the role of the exchange to SWFs and debt IR

Over the past few years, the IR platform in the Middle East has been evolving quickly. Exchanges are maturing, listings are more regular and IR is moving beyond ‘results day’ toward a steadier focus on access, liquidity and clear communication. We’re seeing more structured targeting, more emphasis on guidance and capital allocation and better use of data that investors can actually work with. Sovereign funds are engaging in more targeted ways and many issuers are doing a better job of aligning the equity and debt stories. This came through clearly in Muscat. With more than 1,200 attendees in town, the…

-

Building an IR function: a strategic roadmap to success

From getting management buy in to running an IR audit and building an investor pipeline – a break down of the essentials that elevate the IR program Investor relations has come a long way. What used to be a compliance checkbox is now a strategic discipline that directly impacts your cost of capital, liquidity and valuation. The question isn’t whether IR adds value anymore, it’s whether you’re building the function correctly. This evolution changes how you build your team for success – whether you are expanding the IR department, coming in fresh, building out the team from scratch or growing…

-

What can you do when the US Government becomes a shareholder in your company?

When the Trump administration announced it would take a 10 percent stake in Intel to securitize the government’s funding of the company under the CHIPS Act, the markets were stunned. Many questioned this new course, asked how effective the government could be at owning stocks and wondered how the administration could help or hinder Intel. Moreover, how would US taxpayers benefit?

-

The new era of sustainability reporting: global shifts, practical lessons and strategic opportunities

Sustainability reporting is entering a new era. Regulatory shifts, evolving standards and rising stakeholder expectations are reshaping the landscape, creating both challenges and opportunities for organizations worldwide. Demand for consistent, comparable and decision-useful information continues to push voluntary standards toward harmonization, while jurisdictions move closer to mandatory frameworks. The result: a reporting environment that is more complex, but also more transparent, globally aligned and investor-focused.

Spotlight Content

Off-season engagement highlights shifting views on ESG

Companies ponder how to keep talking about sustainability We’re coming to the end of ‘off season’ – when many companies go out on the road to engage with key institutional investors ahead of their annual shareholder meeting. According to a recent IR Magazine survey, around two thirds of IR teams say they have a program…

quick Guides to key ir issues

New to IR?

Looking for career advice?

Don’t know where to start with AI or ESG?

Get a curated briefing in these key areas and more with our starter guides!