Deep Dives

-

The CFO: ‘IR professionals are like Swiss Army knives,’ says Unite Group’s finance chief Mike Burt

The student accommodation finance chief on an exciting acquisition, why IROs need to be good listeners and why analysts are like sports commentators who never played the game For many students in the UK and further afield, your first year of study is spent in a halls of residence – or purpose-built student accommodation (PBSA), […]

-

‘Profit and purpose have been our yin and yang’: TPXimpact’s Luke Murphy on a first IR Impact award win

When the small-cap UK firm TPXimpact cropped up on the shortlists ahead of the IR Impact Awards – Europe 2025, it was a name unfamiliar to many of the judges – and perhaps many other onlookers. The company, which enables digital transformation projects for a range of organizations, including public sector bodies in the UK, may not be well-known in general, but Luke Murphy, head of IR and chief of staff, was among the names for the rising star award. The company’s annual and ESG reporting were also nominated.

-

Meira Muscat 2025: From the role of the exchange to SWFs and debt IR

Over the past few years, the IR platform in the Middle East has been evolving quickly. Exchanges are maturing, listings are more regular and IR is moving beyond ‘results day’ toward a steadier focus on access, liquidity and clear communication. We’re seeing more structured targeting, more emphasis on guidance and capital allocation and better use of data that investors can actually work with. Sovereign funds are engaging in more targeted ways and many issuers are doing a better job of aligning the equity and debt stories. This came through clearly in Muscat. With more than 1,200 attendees in town, the…

-

The sell side talks IR – part three: when and how analysts want to be engaged

There is no denying the ways in which Covid-19 and the rapid shift to virtual changed investor relations – most notably engagement. Driving home just how dramatic that change has been, one of our anonymous analyst interviewees – anonymous in order to encourage openness – says this: ‘Before 2020, I think I’d done probably two video calls in 20 years. This call is the third one of the day. So that’s changed dramatically.’ In the third part of our series on the sell-side-IR-relationship, we look at how IR teams interact with their analysts, how often analysts want to hear from…

-

‘I felt a mix of respect and fear’ going into IR, says Infineon’s multiple award-winning IR lead

German semiconductor firm Infineon Technologies has had a busy year. To start with, as revealed in the latest instalment of The CFO column, Dr Sven Schneider, the firm’s finance chief, told IR Impact about the 30 conferences and 20 roadshows the company has held this year. It has also been a year of huge success for the IR team, which took home some of the most prestigious IR Impact trophies at the Europe Awards in June, winning the best overall investor relations (large cap) category as well as the gong for best in sector, technology. The same night also saw…

-

‘Sometimes I have to play some Witcher or Cyberpunk during my work day’: CD Projekt’s Karolina Gnas on heading IR at a video game developer

The Polish company appeared on two IR Impact Award shortlists at this year’s Europe awards Many IR professionals may have found themselves working at companies they have a deep personal interest in. For Karolina Gnas, head of IR at the Polish video game developer CD Projekt, this means that she gets to enjoy the studio’s […]

-

Why listed companies should engage with hedge funds

I have been working as an IR professional for almost 15 years. To my continued surprise, I still meet peers who remain negative around hedge funds. In fact, they actively seek to minimize interaction. And if they do allow such meetings, they squeeze hedge fund managers into large group meetings, normally led by IR rather than management. To me, this approach is counterproductive. The role of the IR department is to safeguard a fair valuation of the share by communicating correctly to all relevant corners of the financial markets. I strongly believe that open doors and strong relationships improve liquidity…

-

‘The word ‘Texas’ means friend, and all are welcome!’ Barrow Hanley on its long-term value focus

Patricia Barron and Mark Giambrone talk about Texas, when IR-only meetings work and how often the investment management firm likes to meet before it buys in As companies eye Texas – and Dallas in particular – as a roadshow destination, the Lone Star State has been pushing forward its business-friendly appeal with the new Texas Stock Exchange poised to begin trading next year, listings already in place on NYSE Texas and new legislation. Patricia Barron, executive director, chief operating officer and head of risk at Barrow Hanley, and Mark Giambrone, the investment management firm’s executive director, head of US equities…

-

The sell side talks IR – part two: those crucial coverage numbers

In a series of anonymous conversations – with identifies protected in order to get frank responses – IR Impact talked to sell-side analysts about their relationships with IR professionals. In part one, we looked at the value of research – from both the IR viewpoint and from the sell side, including advice from analysts on how they felt IR could improve data sharing, face time, responsiveness and more – all the elements that go into a good IR-sell-side relationship.

-

The CFO: ‘We’ve done 30 conferences and 20 roadshows this year,’ says Infineon’s Dr Sven Schneider

Semiconductors and chips might be synonymous with Taiwan. But Germany’s Infineon Technologies is not only growing its own market share in key industries but is helping to drive forward the EU’s goals on chip manufacturing – captured in the European Chips Act, which aims to double the bloc’s share of global chip production to 20 percent by 2030. Infineon also happens to excel at investor relations, taking home some of the most prestigious awards at this year’s IR Impact Awards – Europe. The firm won the gong for best overall investor relations (large cap); best investor relations officer (large cap)…

-

‘If I wasn’t in IR, I’d love to teach students about finance’: Matthew Ross on leading Block’s IR team and working with Jack Dorsey

Payments companies are increasingly those which keep the world spinning. Just ask Block’s new head of IR, Matthew Ross, who joined the company in 2024 and took over running the IR team earlier this year. The NYSE-listed company – which operates point-of-sale system Square, digital wallet Cash App, buy now, pay later service Afterpay and music streaming business Tidal – has grown from strength to strength in recent years, leading to its ascension to the S&P 500 index in July 2025, replacing Hess Corporation.

-

‘IR is fun in good times but more important in bad’: Inaugural winner of the Best IR Impact award on managing a crisis

This is a story that is perhaps best started at the end, after Irina Zhurba of Mister Spex had won the inaugural trophy for Best IR Impact at the IR Impact Awards – Europe 2025. She took that gong in recognition of everything that makes IR so hard to measure, from rebuilding trust with dissatisfied shareholders – even taking calls at 5.00 am before climbing Machu Pichu – to supporting C-suite through leadership transitions, to managing a difficult activist situation. When that activist announced via press release its intent to sell a 7.6 percent stake in the German eyewear company,…

-

The sell side talks IR – part one: the value of research

Sell-side analysts occupy a pivotal position in financial markets. Through their in-depth research and recommendations, they exert influence on stock valuations, market liquidity and overall market dynamics. Their buy, hold or sell ratings can cause stock prices to rise or fall, impacting investor decisions. Upgrades often lead to price surges, while downgrades may result in declines.

-

The Texas takeover: Dallas rising the roadshow ranks as ‘Y’all Street’ grows its appeal

‘Texas is the new financial services capital of America,’ declared Governor Greg Abbott last week as he announced moves by yet another major bank into the state. Scotiabank is set to create a major regional office out of Dallas, in a move that will open up over 1,000 jobs and more than $60 mn in investment. It joins other financial services bigwigs from Goldman Sachs to Nasdaq and NYSE making moves to mark their Texas territory.

-

Cutting red tape: Texas legislature passes pro-business reforms

Texas is positioning itself as a serious challenger to Delaware for corporate incorporations with two landmark corporate law reforms. Effective September 1, 2025, Senate Bills SB 29 and SB 1057 introduce sweeping changes aimed at enhancing legal predictability, reducing litigation risks, and curbing shareholder activism. These changes are set to make Texas a more attractive, management-friendly jurisdiction for companies.

-

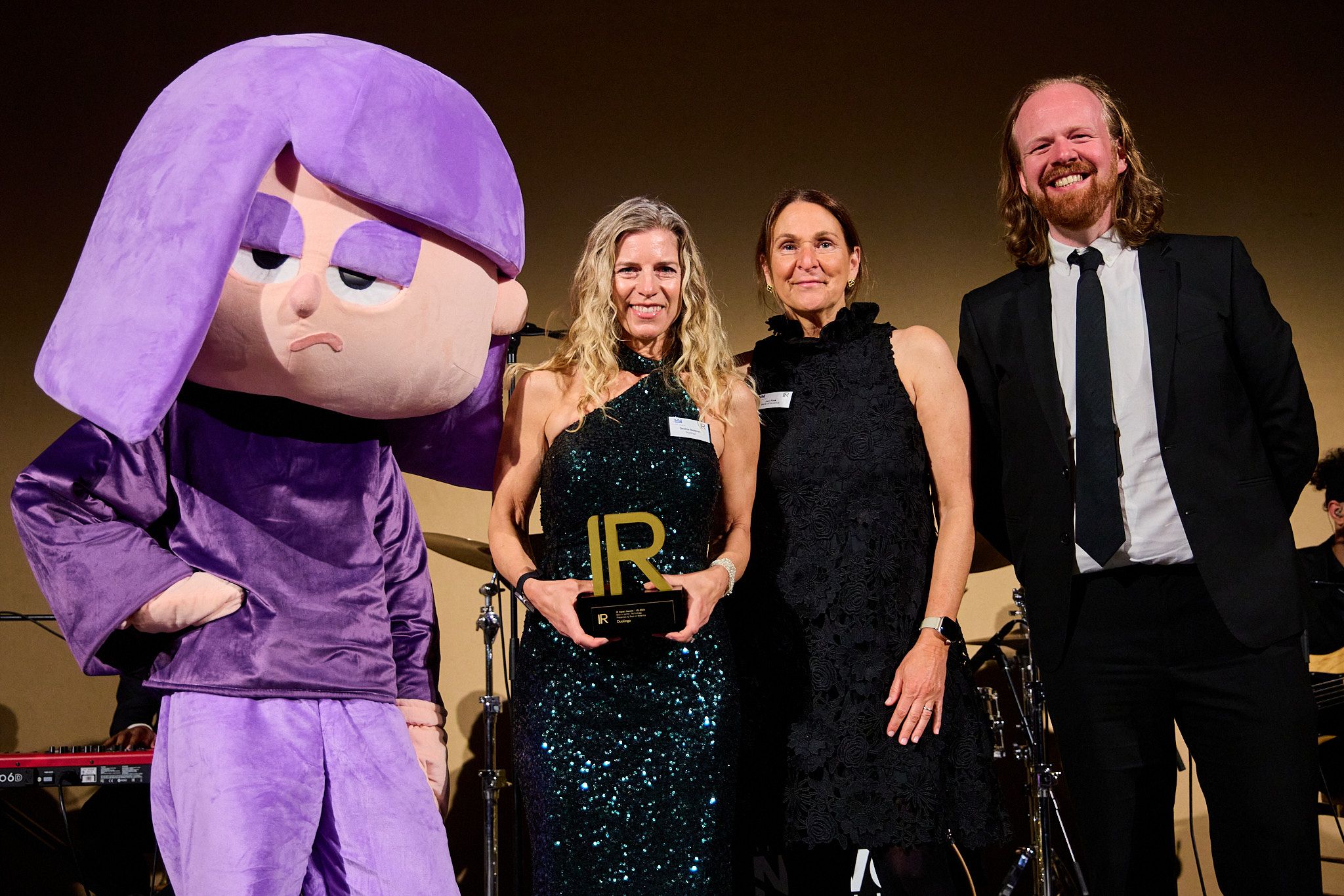

‘I love when investors start a meeting by showing me their streak’: Duolingo’s Debbie Belevan on life after an IPO

At this year’s IR Impact Awards – US 2025, Duolingo’s head of IR Debbie Belevan swept the board, picking up trophies for best overall IR – mid cap, best IRO – mid cap and best in sector – technology. All of this came just a few years after Belevan joined the language learning app in 2021 as its VP, IR two weeks before the company’s IPO. Since then, Duolingo has seen exponential growth in both its share price and subscriber base. Debbie has become an active member of the IR community, serving as a board member for NIRI.

-

The CFO: ‘You have to explain why your flavor of lollipop is the best’: Rainbow Rare Earth’s finance chief on making a complicated story simple

Most people probably don’t understand the full extent of the use of rare earth elements in their daily lives. For Pete Gardner, CFO at Rainbow Rare Earths, the London-listed mining company, explaining just how extensive their applications are is a daily conversation with shareholders and analysts.

-

Is it too late to relight the London listings fire? What IROs can learn from the LSE

Imagine an IPO timeline measured in weeks, not months, where your IR team crafts and delivers a compelling equity story from initial analyst briefing to the opening bell, before investor sentiment moves and the IPO window closes.

-

AI for IR: How creating your own LLM could help you think and act like your investors

Recently Blackstone announced its plans to invest $500 bn in Europe over the next years. Did you see this coming and will some this capital flow into your company? Imagine if your IR department could predict with some certainty what your investors are going to think, say and do with respect to your company.

-

Despite political noise, the stats clearly show the anti-DEI movement does not have shareholder support

The movement fell flat in 2025’s proxy season with most proposals receiving less than 2 percent investor backing Shareholders sent companies a clear message this proxy season: anti-DEI proposals do not have their backing. At 30 of the largest US companies, together worth over $13 trn, every anti-DEI proposal was rejected, with most receiving less than […]

-

The CFO: ‘When there’s profit, we’ll be ready’ – Norcod’s finance chief on being a pre-profit company in uncharted waters

Nordcod, listed on Euronext Growth and the Oslo Stock Exchange, is seeking to do with cod what the seafood industry has already done with salmon: turn it into a year-round, accessible food source. There are challenges, ranging from the biology of the Atlantic cod to the growing media scrutiny that surrounds seafood and fishing. Still, Stian Vollan-Hansen, the Norwegian firm’s CFO, believes that Norcod can make cod farming work – for the company and its investors, for the customer and, crucially, for the fish and their surrounding environment.

-

Muted mics, loud protests: how the rise of AGM protests is forcing companies to rethink shareholder meetings

Are we witnessing a rise in AGM protests? While often a forum for disagreements with shareholders, this year’s AGM season was characterized by a marked rise in public campaigns targeting annual meetings – particularly in the UK – each of which gained significant press attention.

-

‘European investors are better prepared than US ones’: Inside the one-woman IR show at Central Garden & Pet

How did Friederike Edelmann end up where she is today? The West Coast-based IR lead for Central Garden & Pet has two decades of global IR experience under her belt – working on everything from IPO preparation to pandemic IR and micro-cap to mega-cap companies – but it all started back in Germany ‘way back when’. She speaks to IR Impact about juggling IR with other responsibilities (she manages ESG and external communications for Central), managing in-person engagements when your operations are remote and what she would have been doing if she hadn’t gone into corporate finance. You can also…

-

The CFO: ‘Don’t wait too long to make changes,’ says Central Garden & Pet finance chief

Visit the executive page of Central Garden & Pet, the Walnut Creek, California-headquartered company, and you get an immediate sense of just how much the C-suite is tied to the company: instead of the typical suit-in-a-boardroom shot, it’s a case of bring-your-pet-to-work day. Brad Smith, who was promoted from his role as finance chief for the firm’s pet segment to group CFO eight months ago, brought in his French bulldog. Elsewhere there are labradors, maybe a couple of poodle mixes and a cat, though Smith points out that dogs are definitely the more cooperative choice. Smith talks to IR Impact…

-

‘Earnings are our Super Bowl halftime show’: Tales from 100 quarterly updates with Mary Winn Pilkington

Earlier this year, Tractor Supply Company (TSC)’s Mary Winn Pilkington celebrated her 100th earnings call – with balloons, cake and the typical quarterly stress to match. ‘In IR you touch on everything – that’s probably part of the reason I have stayed in investor relations for 25 years,’ she says. ‘Every day is different and you get to work with the smartest people inside the company. ‘You’re working with people that are on the board or the management team, you’re working with high potential individuals that have been given strategic projects to work on,’ she adds. ‘Then, outside of the…

-

‘People aren’t robots’: How can companies support mothers in their IR teams?

How do you keep a mother in investor relations? How do you support her in a way that keeps diversity of knowledge and experience climbing the corporate ladder? This is a very difficult act to balance, with our recent article on the topic hearing from high-functioning, street facing women who hold senior positions while also raising children. And as Debbie Nathan of Debbie Nathan Associates explained, the issue of childcare is not one that men ever raise in the recruitment process: this is predominantly a female issue. So what should companies be doing to make sure that women feel they…

-

The sustainability Taliban, the eco right and why we need a new language for ESG: down the rabbit hole with Robert Eccles

When Robert Eccles wrote a piece called Grift capitalism: The GOP’s brilliant strategy for ripping off ordinary Americans, it received the usual dose of online hate mail. It also led to a challenge: if you can find a conservative that thinks sustainability is good for capital markets, will you stop ‘writing nasty stuff’ about Republicans? That led him to the position he speaks from today: a liberal ex-hippy who has found common ground with the so-called ‘eco right’. Eccles, a well-known author and lecturer who has been writing about non-financial metrics since the early 1970s, had already become frustrated with…

-

Mothers of IR: From babies at conferences to the metaphorical ‘sticky floors’ beneath the glass ceiling

If you were at an investor event in May 2022 alongside alternative defense firm Axon, you might have spotted a rather unusual attendee: the softest of blonde hair, pacifier in place and no socks on their feet. This was Andrea James’ third child getting a fast-track induction to IR so that James could continue breastfeeding as she worked a high-profile, Street-facing job. Today, James is finance lead at Oncocyte. But she isn’t just a CFO, nor just an IR Impact Award-winning former head of IR either. On her CV she proudly lists the position of ‘co-founder at Family Inc’. Check…