IR Impact Think Tank – West Coast

Exclusively for in-house IROs

el Prado Hotel, Palo Alto

Our unique format – Exclusively for in-house IRO’s

The IR Impact Think Tank – West Coast will take place on Thursday, March 19, 2026 in Palo Alto and is an invitation-only event exclusively for senior IR officers. Our think tanks are free to attend and our unique format enables participants to network extensively, and discuss, debate and dissect topical issues affecting today’s IROs.

WHEN

WHERE

el Prado Hotel, Palo Alto, CA

What makes our format so unique?

Our think tanks are far removed from the traditional conference set-up as the event consists of a series of panel sessions followed by roundtable discussions on select IR issues. These interactive sessions are an opportunity to share experiences with and learn from other top-rated IROs. All table discussions are confidential, and none of the participants’ comments is attributed. This allows attendees to talk freely and have frank, open discussions.

How do our roundtable discussions work?

Industry experts, top-rated IROs and members of the investment community set the agenda on a panel discussion by sharing their thoughts on session topics.

Small roundtables of IROs discuss these issues face to face.

Each table gives feedback from its discussion and shares ideas with the group as a whole.

NIRI IRC® CREDENTIAL

Holders of the NIRI IRC® credential can earn up to four professional development unit (PDUs) per day. IRC-credentialed speakers may also earn PDUs. For more information about the Investor Relations Charter (IRC)®, please visit www.niri.org/certification.

Agenda: 2026

If you are interested in being a panellist, please contact Gevitha Anbarasu

[email protected]

Click below to view the 2026 agenda as a PDF.

Times are shown in PT (Pacific Time).

Timings are subject to change.

8.00 am

Registration, breakfast and networking

8.45 am

Welcome to the IR Think Tank

9.00 am

Leading IR through the unknown

2025 has brought faster market reactions, rapidly changing information and heightened macro-uncertainty shaping investor behavior. IR teams are tasked with communicating revenue and performance signals with precision while maintaining disclosure guidelines. IROs must balance speed and accuracy in how information is delivered, as emerging developments such as the tokenization of securities introduce further uncertainty around future market impact.

This session explores how leading IR teams are adapting their approach to maintain credibility, manage market volatility effectively and support valuation in an environment where clarity and timing matter more than ever.

- Navigating faster market reactions: explore how IR teams are responding to real-time investor and broker reactions to revenue and performance signals

- Balancing speed with disclosure discipline: discover practical approaches to communicating critical information accurately and in an orderly manner

- Reducing volatility through clarity: understand how consistency, timing and tailored messaging can help stabilize market reaction

- Preparing for the unknown: explore what IR teams should consider today when assessing uncertainty, including the potential impact of 24-hour trading and the tokenization of securities

9.30 am

Navigating AI in IR: bridging the gap between the buy-side and issuers

AI is reshaping IR, yet adoption and understanding remain fragmented. While these tools are changing how company information is created and discovered, gaps persist between how IR teams deploy AI and how investors actually use it.

This session brings together buy-side and IR perspectives to examine how AI can be applied more effectively across earnings and answer engine optimization (AEO), with a focus on improving credibility, transparency and trust in IR communication.

The discussion will focus on:

- Aligning IR and buy-side expectations: discover how investors are using AI to process company information and how IR practices can better mirror this

- AI in earnings: explore practical use cases that support preparation, clarity and consistency in earnings materials

- Understanding content visibility: understand how IR content is discovered through answer engines and what teams can do to improve AEO performance

10.00 am

Workshop: lessons learned from AI: prompts, tools and case studies

A peer-led, hands-on discussion that surfaces real-world lessons on IR related prompt design. Discover how to use AI in a way that drives impact for IROs while remaining safe and secure.

10.30 am

Networking break

11.00 am

Stewardship, governance and proxy voting: what IR needs to know

As proxy advisors’ policies are becoming more bespoke and diverse, through updates to voting guidelines and changes in how governance factors are evaluated and voting expectations continue to evolve, IR leaders are under increased pressure to anticipate outcomes while communicating governance decisions that influence investor confidence and voting results.

With heightened scrutiny around director elections and shareholder rights, IR teams need practical ways to stay ahead of proxy season engagement.

This session focuses on how IR leaders can proactively work with governance colleagues, engage more effectively with investor stewardship teams and translate governance decisions into a clear, investor-aligned narrative that supports long-term valuation and voting outcomes.

The discussion will focus on:

- Anticipating proxy outcomes: learn how to monitor and respond to a more diverse proxy-advisor policy landscape

- Strengthening engagement: explore practical approaches to engage stewardship teams amid shifting priorities and limited access

- From compliance to clarity: discover how to turn governance decisions into messaging that your investors understand and support

11.30 am

Roundtable: navigating governance risk narratives

Discuss with fellow IR leaders how to effectively prepare for proxy season, shareholder proposal concerns and engagement with governance teams

12.00 pm

How is SB 253 reshaping sustainability disclosure and IR strategy?

How are California climate laws, such as the California Climate Corporate Data Accountability Act (SB 253), changing the way you approach sustainability reporting?

With the reporting window now in effect for SB 253, scope 1 and 2 data is an imminent disclosure challenge for most public companies furthermore companies need to prepare for audit-ready emissions data across scopes 1,2 and 3. Peer comparisons and potential penalties are increasing investor scrutiny, while the absence of a federal SEC rule is forcing IR leaders to reassess ESG expectations and adapt sustainability strategy, data readiness and investor communication.

Senior IR leaders will discuss how evolving regulations are reshaping sustainability strategies and disclosures for investors and key stakeholders.

12.30 pm

Roundtable: communicating sustainability in a changing ESG landscape

As investor attention to ESG becomes more selective, IR teams face a growing risk: over-emphasizing ESG can dilute the broader narrative and increase exposure to greenwashing concerns, while being overly cautious or under-communicating ESG can lead to greenhushing, raising questions around credibility, transparency, and compliance.

This session provides IR leaders with practical guidance on how to navigate ESG messaging, best practices for sustainability to improve financial performance and disclosure requirements without overwhelming investors. Attendees will leave with clearer frameworks for communicating ESG in a way that supports valuation, credibility and long-term investor confidence

The discussion will focus on:

- Prioritizing ESG messages: explore how to decide which ESG topics matter most to investors today

- Linking ESG to value: discover how to frame ESG as a driver of strategy, resilience and returns rather than a standalone narrative

- Managing ESG fatigue: learn to reduce repetition and complexity while maintaining transparency

- Balancing narrative and disclosure: Understand meeting regulatory requirements without distracting from the equity story

12.45 pm

Lunch

1.45 pm

Executing a high impact investor day

Investor days present a rare opportunity to reset valuation, strengthen credibility and showcase leadership depth. When done right, with a clear strategy and concrete long-term guidance, an investor day can transform how the market perceives a company’s future. In this session, IR leaders will hear directly from seasoned IR professionals on their experience hosting Investor Days and gain insight from a leading research analyst on what makes for a successful event.

The discussion will focus on:

- Rationale for hosting an Investor Day: what key milestones or strategic updates warrant an Investor Day deep-dive

- Optimal timing and frequency: key considerations to evaluate when scheduling your event

- Long-term guidance disclosure: weighing the appropriate timeframe and valuation implications

- Beyond the deck: bringing your investment narrative to life

- Measuring success: how will analysts and investors assess your Investor Day

2.15 pm

Targeting active investors in an increasingly passive environment

As passive ownership rises and the access to decision-makers becomes a fight for attention, IR teams must adapt their strategies for outreach. Effective targeting today depends less on volume and more on understanding influence, investor priorities and market perception.

This session will explore how IR professionals can use perception data, stakeholder analysis to fine-tune their engagement strategies, sharpen messaging and make better use of limited C-suite access.

Some key discussion points from this session may include:

- Understanding your investors’ influence: understand where influence sits in a passive-dominated investor ownership base

- Effective communication: learn how to adapt messaging to increase impact when engagement windows are limited

- The power of retail investors: explore how to adapt key messaging to engage with retail investors

- Leadership engagement: understand how to make the most of your C-suite leaders’ time with your audience

2.45 pm

Roundtable: prioritizing investor engagement when access is limited

This session will enable IR leaders to share practical examples of how they manage relationships, messaging and access to management when management are reluctant to dedicate time to. Participants can exchange learnings on how they identify influential stakeholders, tailor messaging and allocate leadership time more strategically.

3.15 pm

Networking break

3.45 pm

Climbing the C-suite ladder: an open Q&A with IROs that made the jump to the C-suite

More IROs are moving into the CFO role, bridging their market insight, communication skills and investor perspective into broader financial leadership.

This session explores how IR professionals are making the leap, what skills translate, what gaps to close and how to prepare for the transition. Hear from former IROs who now lead finance teams and understand what it takes to move from IR to the C-suite.

- Better game plan, better outcome: learn how capital markets insight, investor messaging and interacting with leadership directly can support your IR strategy

- Understanding the C-suite effectively: gain practical guidance on how to manage relationships with the C-suite, including how to position objectives and goals to meet evolving expectations

- Interactive fishbowl Q&A: attendees will be invited to submit and pool their questions in a fishbowl in advance and on the day, enabling a candid, peer-led discussion focused on how IROs can work in tandem with their leadership teams

4.15 pm

Roundtable: cutting through the noise – the role of IR in an information-heavy market

When the time comes around for investors to speak to companies, or join their earnings call, they already have a pre-conceived idea based on market commentary, alternative data, trading data and sell-side research. Yet, IR faces a critical challenge to ensure that the information the buy side access to look into companies is consistent, reliable and accurate.

This roundtable brings senior IR leaders together to share how they are refining their communication approach to stand out, reduce reliance on external noise and strengthen trust, without increasing the volume of information needed

This roundtable will feature the following key themes:

- Establishing a trusted IR voice: discover effective ways to position IR as the consistent reference point for investors

- Cutting through the noise: understand how to stand out through concise and quality communications

- Reinforcing trust: explore how the role of IR is essential in preventing misperceptions of the company

4.45 pm

Summary of discussions and end of conference

5.00 pm

Happy hour drinks reception

Speakers: 2025

What our attendees say

Who attends our events

Our attendees are leading IR practitioners with an established track record and strategic IR role within their company.

Below is a sample list of our past attendees:

| JOB TITLE | COMPANY |

|---|---|

| Chief financial officer | Medexus Pharma |

| Director | Airbnb |

| Director IR, FP&A | lithia |

| Director, IR | Atlassian |

| Director, IR | Del Monte |

| Director, IR | Electronic Arts |

| Director, IR | Splunk Technology |

| Director, IR | United States Steel Corporation |

| Head of IR | EleAffirm |

| Head of IR | AOL |

| Head of IR | Joby Aviation |

| Head of IR | Longboard Pharmaceuticals |

| Senior director, IR | Equinix |

| JOB TITLE | COMPANY |

|---|---|

| Senior vice president | Genasys |

| SVP, IR | FIGS |

| SVP, IR | Okta |

| SVP, IR, corporate development | Workiva |

| VP, IR | Allbirds |

| VP, IR | Bill.com |

| VP, IR | BlackBerry |

| VP, IR | Central & Garden & Pet |

| VP, IR | Farmers’ Business Network |

| VP, IR | J.M. Smucker |

| VP, IR | The Honest Company |

| VP, IR | Rover Group |

| VP, IR | Intuitive Surgical |

Venue information

Accommodation

We have arranged preferential rates for attendees at nearby hotels. View the hotels and rates by clicking here.

Thinking of becoming an event partner?

Our events provide a unique opportunity to get in front of some of the most influential people in the IR community. As a partner, you will gain an extensive amount of exposure through a wide range of print and digital marketing materials, both pre and post event, as well as on the day itself. Additionally, you can use the event to align yourself with IR excellence and network with key decision makers from across the region – the ones pushing the profession forward through innovation.

Registration

This event is exclusively for senior corporate, in-house IR professionals. To register for this event, please fill in the form below.

If you have any questions please contact Thomas Williams at [email protected] or call on +44 208 090 2156.

FREE

This event is free to attend for senior IROs only

Gallery

Key insights into the latest trends and best practices

‘If I wasn’t in IR, I’d love to teach students about finance’: Matthew Ross on leading Block’s IR team and working with Jack Dorsey

Payments companies are increasingly those which keep the world spinning. Just ask Block’s new head of IR, Matthew Ross, who joined the company in 2024 and took over running the IR team earlier this year. The NYSE-listed company – which operates point-of-sale system Square, digital wallet Cash App, buy now, pay later service Afterpay and music streaming business Tidal – has grown from strength to strength in recent years, leading to its ascension to the S&P 500 index in July 2025, replacing Hess Corporation.

‘I love when investors start a meeting by showing me their streak’: Duolingo’s Debbie Belevan on life after an IPO

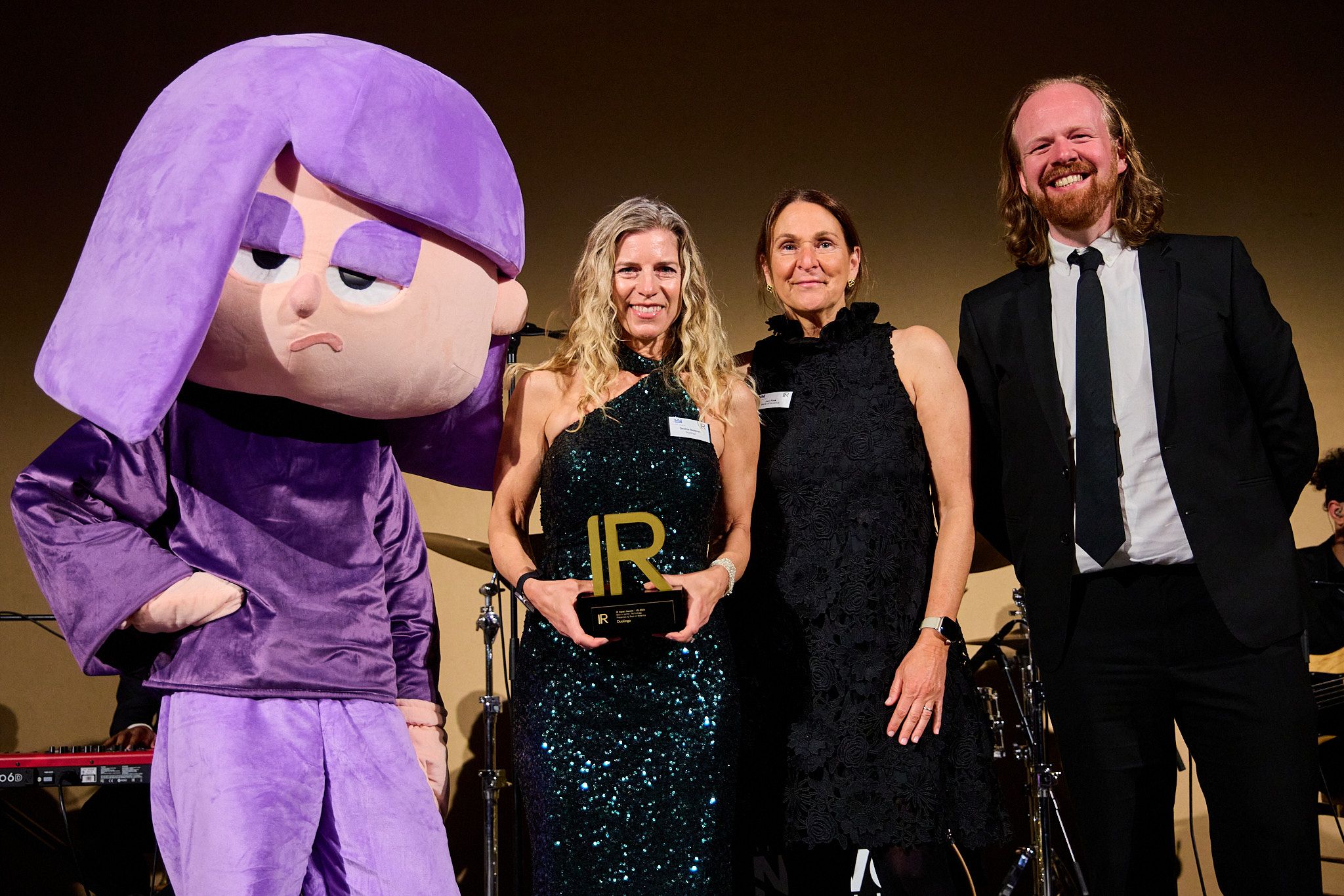

At this year’s IR Impact Awards – US 2025, Duolingo’s head of IR Debbie Belevan swept the board, picking up trophies for best overall IR – mid cap, best IRO – mid cap and best in sector – technology. All of this came just a few years after Belevan joined the language learning app in 2021 as its VP, IR two weeks before the company’s IPO. Since then, Duolingo has seen exponential growth in both its share price and subscriber base. Debbie has become an active member of the IR community, serving as a board member for NIRI.

‘A chatbot can’t capture the CEO’s voice’: The real role of AI in earnings prep

The technology can streamline the earnings process, experts agreed on a recent IR Impact briefing How can AI best be employed in your earnings preparation? According to leading IR experts, it’s best not to make a facsimile of your CEO, but the technology can certainly help save time and leave you to concentrate on more […]

Contact us

IR benchmarking tool

Instant comparison data at your fingertips. This advanced tool provides real-time analytics comparing your IR program to peers in your region, sector, and cap size. Evaluate your program’s strengths and uncover opportunities for growth with key IR metrics covering:

- IR budgets

- Team size

- Reporting lines

- Sell-side analyst coverage

- Investor meetings

Fast, intuitive and packed with tailored insights, it’s the ultimate resource for building a smarter, data-driven IR strategy.

Upcoming events

-

Forum – AI & Technology Europe

About the event Stay ahead. Harness AI. Transform IR. In today’s rapidly evolving financial landscape, AI is transforming how IROs engage with investors, analyze market sentiment and deliver insights. Yet, many IR teams face challenges in understanding and employing these tools effectively. WHEN WHERE America Square Conference Centre, London The…

-

Awards – US

About the event The IR Impact Awards – US will take place on Wednesday, March 25, 2026 in New York. This very special event honors excellence in the investor relations profession across the US. WHEN WHERE Cipriani 25 Broadway, New York Celebrating IR excellence Since the annual event first launched…

-

Think Tank – East Coast

Our unique format – Exclusively for in-house IRO’s The IR Think Tank, brought to you by BofA Securities & IR Impact will take place on Wednesday, March 25 in New York and is an invitation-only event exclusively for senior IR officers. A combination of BofA’s Investor Relations Insights Conference and IR Impact’s IR…