Best Practice IR

-

IR Impact Masterclass: How to manage crucial IR skills – both personally and within your team

Welcome to IR Impact’s Masterclass video series, where leaders and experts from across the capital markets share their insights, strategies and experiences to provide you with in-depth knowledge and practical skills to excel in your IR journey.

-

Inside IR at Itron: ‘Part of IR’s DNA is being immune to being surprised,’ says Paul Vincent

How do IROs leverage their expertise within their companies? For Paul Vincent, VP of IR at Itron, the core of IR lies not only in conveying the company’s message but doing so in a way particular to each investor and analyst. Itron supplies innovative technologies that help utilities and cities manage energy and water. Vincent believes IR should help management shape strategy based on its own best judgment, not by deferring to investors’ views. IR’s job, he says, is to understand every individual investor and analyst so thoroughly as to communicate management’s thinking in the way each is prepared to…

-

‘It makes you realize how impactful the IR profession is’: Purcari Wineries’ Victoria Moldovan on being named Europe’s 2025 rising star

One of the best parts of our awards, wherever they may be, is giving IROs the chance to catch up with their peers, many of whom they may not see throughout the rest of the year. This is particularly true for the next generation of IR professionals, many of whom we recognize with our award for the rising star of the year, which picks out early-career IROs who are ones to watch for the future.

-

‘We’ve tried to make the accessibility of our IR story much improved’: Victoria Buxton on innovating BAT’s communications

Keeping your communications with the financial markets fresh can be a challenge for even the most established brands. For a company like British American Tabacco (BAT), which is repositioning itself as an enabler of a post-smoking society, it has formed a cornerstone of its IR team’s ongoing evolution.

-

‘If you’re good at IR it’s going to make a big difference to your share price’: Gervais Williams from Premier Miton Investors on making the most of volatility

In a global equity market still defined by volatility and political uncertainty, how can IR teams make the most of the opportunities available to them? According to Gervais Williams, head of equities at Premier Miton Investors, good IR professionals can make a world of difference to their organizations by communicating clearly. With so much capital moving around, it could also make a significant difference to a company’s share price he adds.

-

‘We’re listed in the US but still haven’t had the chance to go to’: China’s ATRenew on engaging US investors when you can’t meet face-to-face

As a company that facilitates the buying, selling and recycling of pre-owned consumer electronics in China, ATRenew is counter-cyclical, with a model that stands to benefit when consumers look to save on that ‘new’ phone or tablet. Here, Xiaoyi (Jessie) Jin, financial communications and IR at ATRenew, talks to IR Impact about engaging local and international investors, ramping up analyst coverage and planning a trip to meet US-based shareholders – more than four years after listing on the NYSE. ATRenew is nominated in two categories at the IR Impact Awards – Greater China 2025: best buy-side management, best investor event…

-

How pre-IPO investor relations shapes long-term market success

The IPO journey doesn’t start on listing day. Companies that treat investor relations as an afterthought until the opening bell often find themselves scrambling to build credibility when it matters most. The statistics tell a sobering story: approximately only one third of newly listed companies outperform their already-listed peers over the long term. Poor financial communication sits at the heart of this underperformance. Building relationships before you need them Establishing an effective IR function well before your IPO creates something money can’t buy on demand: trust. When analysts and investors already know your story, understand your business model and have…

-

‘Show me the before-and-after, not just the highlight reel’: Jeannie Ong on what she looks for as an IR Impact Awards judge

Multi-award winner shares her thoughts on the Greater China and South East Asia judging Jeannie Ong, managing director, operating partner, investor relations at Temasek, is a seasoned IR Impact Award judge – this year taking on the mammoth task of both the Greater China and the South East Asia entries. She talks to IR Impact about how her own experience in investor relations helps her find the winners, the categories that are harder to judge and how IR across the region is evolving.

-

Tesla: How do you get support for a $1 trn pay package? Give shareholders a slice of the pie

ISS is recommending against Tesla CEO Elon Musk’s $1 tn compensation package. Glass Lewis too. CalPERS and NBIM, manager of the world’s most valuable sovereign wealth fund, have each come out publicly against. But with the Tesla AGM happening today online and at Tesla’s Gigafactory Texas, one small, family-run proxy advisory firm – whose ESG-skeptic voting guidelines are offered by ISS, and which boasted the $57 bn Texas Permanent School Fund as the first state fund to sign up – is backing Musk’s compensation. ‘We’re strongly focused on the alignment of incentives,’ says Jerry Bowyer, CEO of Bowyer Research, who…

-

‘It’s not necessarily about coming up with a brand-new thing’: Janet Craig on what she looks for as an IR Impact Awards judge

As we gear up for the IR Impact Awards in both South East Asia and Greater China, our teams of expert judges have been sifting through the many entries from companies talking about everything from how they have implemented AI into their programs to the memorable investor events they’ve put on for analysts. IR Impact catches up with Janet Craig – herself a multiple IR Impact Award winner and now a judge for our events – to find out what marks an entry out as special.

-

Philosophy and numbers: IR Impact briefing explores how AI is – and isn’t – changing earnings

‘Investors, analysts – everyone in financial markets – is consulting a vast amount of increasing data sources to inform their investment decisions,’ said Laurie Havelock, IR Impact editor, kicking off the recent briefing that brought together Jesse Rose, head of IR at Reddit, Dave Bezanson, vice president of IR and pensions at EMERA and Christopher Napolitano, account executive at AlphaSense, the event partner. While data opens up a world of insights, Havelock pointed to the added pressure it brings when IROs must distil everything that is out there into something they can deliver to the board. This, said Napolitano, is…

-

Meira Muscat 2025: From the role of the exchange to SWFs and debt IR

Over the past few years, the IR platform in the Middle East has been evolving quickly. Exchanges are maturing, listings are more regular and IR is moving beyond ‘results day’ toward a steadier focus on access, liquidity and clear communication. We’re seeing more structured targeting, more emphasis on guidance and capital allocation and better use of data that investors can actually work with. Sovereign funds are engaging in more targeted ways and many issuers are doing a better job of aligning the equity and debt stories. This came through clearly in Muscat. With more than 1,200 attendees in town, the…

-

The sell side talks IR – part three: when and how analysts want to be engaged

There is no denying the ways in which Covid-19 and the rapid shift to virtual changed investor relations – most notably engagement. Driving home just how dramatic that change has been, one of our anonymous analyst interviewees – anonymous in order to encourage openness – says this: ‘Before 2020, I think I’d done probably two video calls in 20 years. This call is the third one of the day. So that’s changed dramatically.’ In the third part of our series on the sell-side-IR-relationship, we look at how IR teams interact with their analysts, how often analysts want to hear from…

-

‘I felt a mix of respect and fear’ going into IR, says Infineon’s multiple award-winning IR lead

German semiconductor firm Infineon Technologies has had a busy year. To start with, as revealed in the latest instalment of The CFO column, Dr Sven Schneider, the firm’s finance chief, told IR Impact about the 30 conferences and 20 roadshows the company has held this year. It has also been a year of huge success for the IR team, which took home some of the most prestigious IR Impact trophies at the Europe Awards in June, winning the best overall investor relations (large cap) category as well as the gong for best in sector, technology. The same night also saw…

-

Why listed companies should engage with hedge funds

I have been working as an IR professional for almost 15 years. To my continued surprise, I still meet peers who remain negative around hedge funds. In fact, they actively seek to minimize interaction. And if they do allow such meetings, they squeeze hedge fund managers into large group meetings, normally led by IR rather than management. To me, this approach is counterproductive. The role of the IR department is to safeguard a fair valuation of the share by communicating correctly to all relevant corners of the financial markets. I strongly believe that open doors and strong relationships improve liquidity…

-

The sell side talks IR – part two: those crucial coverage numbers

In a series of anonymous conversations – with identifies protected in order to get frank responses – IR Impact talked to sell-side analysts about their relationships with IR professionals. In part one, we looked at the value of research – from both the IR viewpoint and from the sell side, including advice from analysts on how they felt IR could improve data sharing, face time, responsiveness and more – all the elements that go into a good IR-sell-side relationship.

-

The CFO: ‘We’ve done 30 conferences and 20 roadshows this year,’ says Infineon’s Dr Sven Schneider

Semiconductors and chips might be synonymous with Taiwan. But Germany’s Infineon Technologies is not only growing its own market share in key industries but is helping to drive forward the EU’s goals on chip manufacturing – captured in the European Chips Act, which aims to double the bloc’s share of global chip production to 20 percent by 2030. Infineon also happens to excel at investor relations, taking home some of the most prestigious awards at this year’s IR Impact Awards – Europe. The firm won the gong for best overall investor relations (large cap); best investor relations officer (large cap)…

-

‘IR is fun in good times but more important in bad’: Inaugural winner of the Best IR Impact award on managing a crisis

This is a story that is perhaps best started at the end, after Irina Zhurba of Mister Spex had won the inaugural trophy for Best IR Impact at the IR Impact Awards – Europe 2025. She took that gong in recognition of everything that makes IR so hard to measure, from rebuilding trust with dissatisfied shareholders – even taking calls at 5.00 am before climbing Machu Pichu – to supporting C-suite through leadership transitions, to managing a difficult activist situation. When that activist announced via press release its intent to sell a 7.6 percent stake in the German eyewear company,…

-

Despite any advantages, ditching quarterly reporting will ultimately place more burden on IR teams

After DE&I policies, sensible foreign trade policy and the SEC’s ability to enforce regulations, what’s the next thing in Donald Trump’s sights? Why, of course, it’s that scourge of the capital markets, quarterly reporting.

-

People moves: Jeannie Ong joins Temasek and Tom Waldron moves to Springer Nature

Jeannie Ong, the multiple IR Impact Award winner and South East Asia Awards judging regular, has announced her new position at Temasek, which manages a Singaporean government fund with a portfolio worth S$434 bn ($339 bn). In her new role as operating partner, investor relations, Ong tells IR Impact that she ‘leads initiatives to build capabilities and drive alignment across Temasek’s portfolio companies in the area of investor relations.’ She adds: ‘Super excited to be doing what I love again to raise the bar for IR in Singapore!’ Ong brings more than 25 years of experience in the telecommunications, media…

-

The sell side talks IR – part one: the value of research

Sell-side analysts occupy a pivotal position in financial markets. Through their in-depth research and recommendations, they exert influence on stock valuations, market liquidity and overall market dynamics. Their buy, hold or sell ratings can cause stock prices to rise or fall, impacting investor decisions. Upgrades often lead to price surges, while downgrades may result in declines.

-

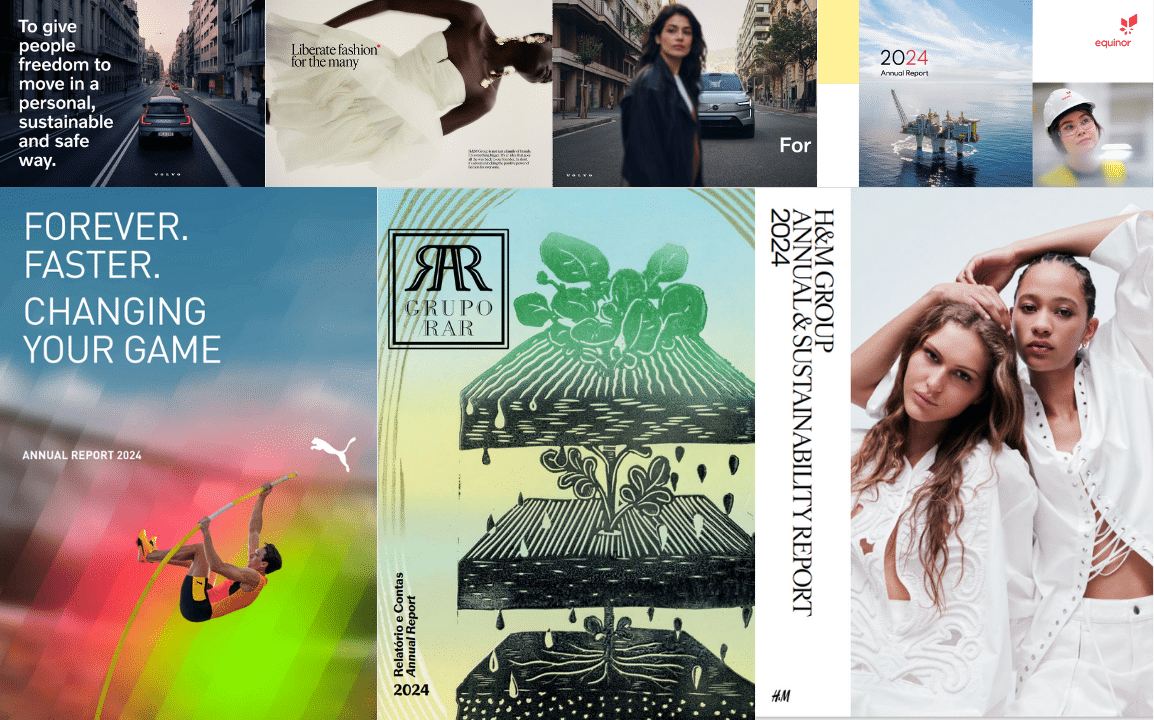

Corporate art: The annual report as an object of design

Annual reports serve a legal purpose – to report on a company’s accounts and operations. But it has also become a graphic object that describes the company’s narrative in both words and design. The report is a central part of ‘telling the company story’, its business and sometimes the investment case, while also satisfying the needs of governance hawks. Using Sthlm Kom, we take a closer look at what graphic and design trends we can see in this ‘dry corporate document’ over the last 20 years.

-

From tools to teammates: Getting started with agentic AI in IR

Investor relations is at the heart of corporate strategy, yet many IROs feel trapped in operational quicksand. The role demands sophisticated market insight, nimble decision-making and executive influence, but too often, the day gets consumed by mountains of admin tasks. Between managing earnings prep, tracking sentiment across fragmented channels and crafting compelling stories from complex financial data, the strategic work gets squeezed out. Agentic AI can flip that balance, clearing space for the work that actually moves the needle. By automating routine tasks and providing real-time intelligence, agentic AI liberates IROs from administrative burden and transforms them into strategic architects.…

-

Activist nominees, ESG Trojan horses and tangible investor days: five things we learned at the IR Impact Think Tank – Europe 2025

Europe’s top IR leaders gathered in London to debate, discuss and learn in a series of panels, sessions and roundtables ahead of the IR Impact Awards – Europe 2025 What did more than 170 IR professionals head to London to talk about at the IR Impact Think Tank – Europe 2025? Everything from volatility and uncertainty (of course) to what makes an award-winning IR team and how to untangle yourself from the spilled alphabet soup of ESG and making the most of AI for IR. Panels were mixed with live polls, roundtable discussions, collaborative sessions and networking. We’ve picked five…

-

‘European investors are better prepared than US ones’: Inside the one-woman IR show at Central Garden & Pet

How did Friederike Edelmann end up where she is today? The West Coast-based IR lead for Central Garden & Pet has two decades of global IR experience under her belt – working on everything from IPO preparation to pandemic IR and micro-cap to mega-cap companies – but it all started back in Germany ‘way back when’. She speaks to IR Impact about juggling IR with other responsibilities (she manages ESG and external communications for Central), managing in-person engagements when your operations are remote and what she would have been doing if she hadn’t gone into corporate finance. You can also…

-

‘Prevention is better than remedy’: majority of investors say governance gaps attract activists, research shows

The majority of institutional investors credit poor governance practices as the biggest driver of shareholder activism, a new study from shareholder advisory firm SquareWell Partners has found. Some 84 percent of investors polled, who hail from North America, Europe (including the UK) and Asia, said that poor governance was the main driver of activist investor attention. The findings of SquareWell’s report, titled The Long and the Short of It: Institutional Investors’ Views on Activism, center around three key themes, views on activism, evaluation criteria and engagement dynamics. This finding means that the quality of a company’s governance framework is paramount and…

-

IR Impact Masterclass: How to use AI to power your research tactics and competitive analysis

Welcome to IR Impact’s Masterclass video series, where leaders and experts from across the capital markets share their insights, strategies and experiences to provide you with in-depth knowledge and practical skills to excel in your IR journey. Each IR Impact Masterclass will delve into critical topics, offering valuable perspectives and actionable advice. Whether you are looking to enhance your expertise, stay ahead of industry trends or gain a competitive edge, these long-form videos are your gateway to achieving these goals.