New SEC FILING RULES REPRESENT A BIG SHIFT

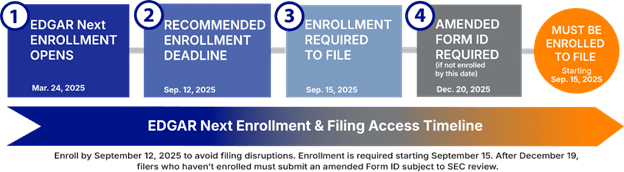

EDGAR Next represents the most significant shift in SEC filing access in over two decades. Beginning September 15, 2025, public companies must transition to a more secure, role-based access system that replaces shared credentials with individual login.gov accounts. Failure to comply may result in loss of filing access and missed disclosure deadlines.

To avoid disruptions in filing access, enrollment should be completed between March 24 and September 12, 2025. Although the enrollment window remains open until December 19, filings cannot be submitted until the process is finalized, potentially delaying time-sensitive disclosures.

Filers who do not complete enrollment by December 19 must submit an amended Form ID, which requires additional documentation and SEC review. Early enrollment helps avoid this step and ensures continued access.

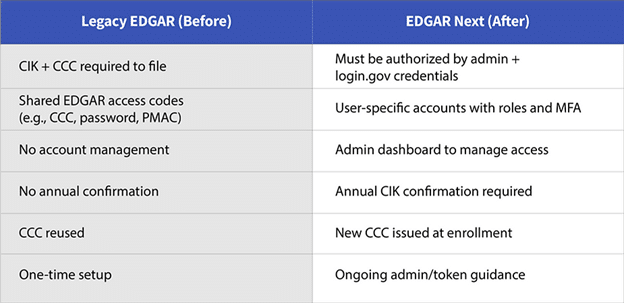

EDGAR Next eliminates shared credentials and introduces a centralized dashboard for managing user access, assigning account administrators and completing annual confirmations.

Missing the compliance deadline may lead to filing disruptions and increased regulatory risk, particularly during peak periods.

The following sections outline the key changes, required actions, and timelines to help issuers prepare for a smooth transition to the new system.

Key features of EDGAR Next

EDGAR Next introduces several key changes to how filers access and manage their EDGAR accounts.

- Secure Access: Replaces shared credentials (like CCC and PMAC) with login.gov and multi-factor authentication (MFA).

- Admin Oversight: Each filer must designate at least two account administrators who manage access and confirm details annually.

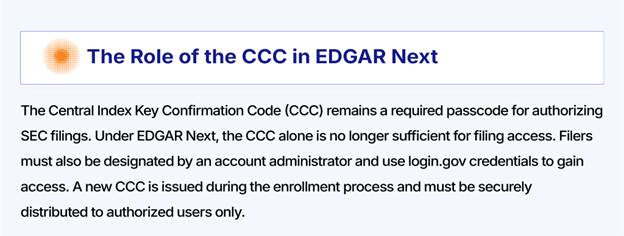

- New CCC Issuance: Filers will receive a new CCC upon enrollment. This code remains required for filings but must be securely shared only with authorized users.

- Enrollment Requirement: All CIKs must be enrolled by September 15, 2025, or face the risk of filing delays.

- Optional API Access: For organizations with automated systems, machine-to-machine filing through APIs will be available.

Here’s how EDGAR Next compares to the legacy EDGAR system across key areas of access and management.

Preparing for EDGAR Next: key steps and requirements

The following steps outline core requirements and best practices to support a smooth transition to EDGAR Next ahead of the September 15, 2025 compliance deadline.

Step 1: Prepare

- Create login.gov credentials: each individual who will access the EDGAR system must create a secure login.gov account. This replaces the legacy model of shared access and is required for multi-factor authentication.

- Assign Account Administrators : each CIK must have a minimum of two account administrators. These individuals will be responsible for managing user permissions, confirming account information annually, and overseeing overall access. Organizations may assign up to 20 admins per account, and these roles can be updated after enrollment as needed. Larger teams may find it helpful to establish internal protocols to determine which personnel should serve as admins and how access will be managed internally.

Step 2: Enroll

- Enroll via the EDGAR filer management dashboard: enrollment is a one-time action per CIK. Once completed, filers will receive a new CCC and updated access structure under the EDGAR Next framework. To help filers familiarize themselves with the updated interface, the SEC has released an EDGAR Next Beta dashboard. This allows users to preview the experience before formally enrolling.

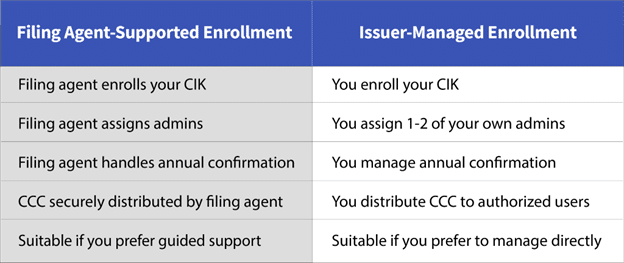

- Enrollment approaches and considerations: public companies are generally choosing one of two enrollment paths: managing the process internally or working with a regulatory filing agent to oversee enrollment, CCC distribution and ongoing compliance requirements. Regardless of the approach, it’s critical to coordinate internally and externally. Only one enrollment is permitted per CIK. Duplicate submissions can cause conflicts, so issuers should ensure the correct party initiates the process.

An important consideration during enrollment is the continued role of the Central Index Key Confirmation Code (CCC).

The case for early enrollment

While enrollment remains open until December 19, filers who wait until the final weeks may encounter SEC processing delays, particularly during peak reporting periods. A surge in enrollments is expected in late summer, which could create administrative bottlenecks. Those who miss the September 15 compliance date will temporarily lose filing access until enrollment is completed.

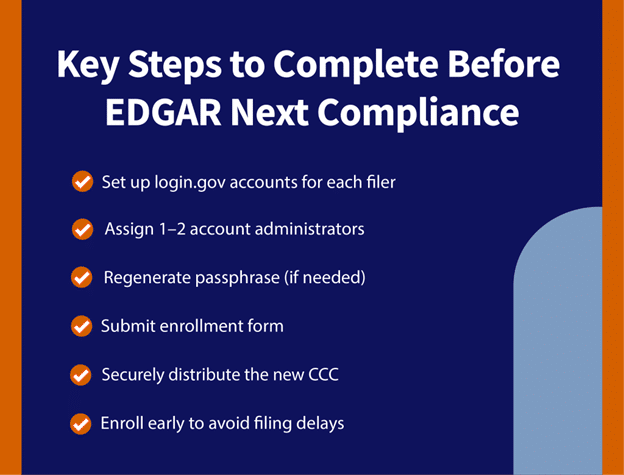

Additional time may also be needed to regenerate a passphrase (if one is not on file), assign account administrators, and securely distribute the new CCC — especially for teams managing multiple users or complex access structures.

Early enrollment helps reduce administrative risk, ensure continuity of disclosure obligations, and avoid stress during busy filing windows. To maintain uninterrupted filing access, enroll by September 12, 2025, ahead of the September 15 compliance date.

The following checklist outlines key actions filers should complete ahead of the EDGAR Next compliance deadline.

Step 3: stay compliant

- Annual confirmation: to maintain EDGAR filing access, the SEC requires an annual confirmation of account details by a designated administrator. Missing this step results in a temporary loss of filing rights. Issuers should track this deadline carefully or delegate responsibility to a trusted filing partner to help ensure continuity.

The SEC’s EDGAR Next page provides official updates and resources for ongoing compliance.

As the transition approaches, public companies and their advisors should take proactive steps to prepare.

And of course, TMX Newsfile can support enrollment, CCC management, and compliance tracking for those seeking filing agent assistance during the transition.

For ongoing updates and official SEC resources, visit the EDGAR Next webpage.

Melissa Strle is a marketing specialist at TMX Newsfile