IR Impact Think Tank – Europe

Exclusively for in-house IROs

About the event

The IR Impact Think Tank – Europe took place on Thursday, June 26, 2025 in London and was an invitation-only event exclusively for senior IR officers. Our think tanks are free to attend and our unique format enabled participants to network extensively, discuss, debate and dissect topical issues affecting today’s IROs.

WHEN

WHERE

Bank of America, London

What makes our format so unique?

Our think tanks are far removed from the traditional conference set-up as the event consisted of a series of panel sessions followed by roundtable discussions on select IR issues. These interactive sessions were an opportunity to share experiences with and learn from other top-rated IROs. All table discussions are confidential, and none of the participants’ comments was attributed. This allowed attendees to talk freely and have frank, open discussions.

How do our roundtable discussions work?

Industry experts, top-rated IROs and members of the investment community set the agenda on a panel discussion by sharing their thoughts on session topics.

Small roundtables of IROs discuss these issues face to face.

Each table gives feedback from its discussion and shares ideas with the group as a whole.

Agenda: 2025

If you are interested in being a panelist at a future think tank, please contact Lauren Wilson on [email protected].

Times are shown in BST (British Summer Time).

8.10 am

Registration, breakfast and morning networking

8.45 am

Opening remarks: Welcome to the think tank

Laurie Havelock, editor, IR Impact

Mark Troman, deputy head of EMEA equity research, Bank of America

9.00 am

State of the markets: Communicating with impact amid global uncertainty

As macro, political, and investor dynamics shift, IR teams must cut through the noise. This session explores what’s driving sentiment in 2025 and how to communicate effectively in a volatile, passive-led world.

- Gain expert insight into the shifting macro, political and regulatory landscape

- Identify the key forces shaping the 2025 outlook

- Assess the risks and catalysts for UK and European equities

- Strengthen messaging in a deglobalising, passive-heavy market

Moderator: Steven Wade, head of content, IR Impact

Chiara Angeloni, senior Europe economist and director, BofA Global Research

9.30 am

Strategic investor targeting: Finding the right mix in today’s capital markets

In today’s fragmented capital markets, precise investor targeting is crucial. This panel will explore how companies can refine their outreach strategies, from institutional investors to retail and family offices, and adapt to shifting trends for growth.

- Tailoring your targeting mix by size, region, and goals

- Key metrics for prioritizing and segmenting investor targets

- New approaches to corporate access, format, and engagement

- Engaging retail, family offices, and different fund types

- Strategies for expanding into markets like the US

Moderator: Laurie Havelock, editor, IR Impact

Daniel Györy, senior director of investor relations, Infineon

Richard Manning, head of investor relations, International Workplace Group

Lauren Wu Leng, head of investor relations, Burberry

10.00 am

What is driving your stock and a new wave of shareholder activism in the region?

From rising activism to shifting trading patterns, this session explores what’s really driving market activity around your stock. Hear from experts on the forces at play – and how to communicate effectively across your business.

- Unpack the new wave of shareholder activism in the UK and Europe

- Learn about the different factors affecting trading activity in the current climate

- Understand what’s behind trading volatility and clarify internal messaging around it

- Navigate opaque registers and identify beneficial owners

Moderator: Steven Wade, head of content, IR Impact

Kate Cooper, partner, Freshfields

Adam Riches, senior managing director, Alliance Advisors

Irina Zhurba, director of investor relations and sustainability, Mister Spex

10.30 am

Roundtables – Communicating with impact in a volatile market

In today’s volatile and fragmented markets, IR teams must adapt how they communicate. This roundtable explores how IROs are refining messaging, targeting and disclosure to meet rising expectations. Share what’s working – and what’s not – as you navigate activism, global alignment and investor shifts.

11.00 am

Morning networking break

11.30 am

New reality: Rethinking your ESG strategy, reporting and investor expectations

As ESG faces increased scrutiny and shifting global standards, IR teams must navigate new regulations, investor demands, and political pressures. This session explores whether companies should adjust their ESG strategy and how to communicate effectively in this evolving landscape.

- How new rules like CSRD and CSDDD will change sustainability reporting

- Aligning ESG with global frameworks for impact, risk, and opportunity

- Metrics and disclosures investors still value vs those losing relevance

- Managing diverging EU/US ESG expectations

- Integrated annual reports vs standalone disclosures: What works?

- Addressing greenhushing, political backlash, and D&I criticism

- When to adapt, pause, or strengthen your ESG strategy

Moderator: Laurie Havelock, editor, IR Impact

Menka Bajaj, global sustainability strategist, Bank of America

Dr. Michelle de Jongh, managing director of ESG services, Inspired

12.00 pm

Delivering robust investor days during uncertainty: Planning and performance

Investor days are critical when it comes to meeting the rising expectations for transparency, engagement and seamless delivery. This panel explores how companies are rethinking event strategy – from smarter planning and stakeholder targeting to hybrid formats that drive confidence and deliver impact.

- Building an effective agenda that balances strategy, storytelling and access

- Pre-event preparation: aligning messaging, materials and spokespeople

- Tactics to boost engagement across in-person and virtual audiences

- How to use AI and tech to enhance interactivity, track participation and gather feedback

- Analysis of and lessons learned from recent investor days – what worked, what didn’t

Moderator: Laurie Havelock, editor, IR Impact

Hannah Jethwani, head of corporate strategy and investor relations, YouGov

Ben Riley, UK sales director, Lumi Global

Matthew Yates, managing director, Bank of America

12.30 pm

Roundtables – Maximizing your return on time: How IROs can focus on what matters

With growing demands and limited resources, IR teams are under pressure to do more with less. This roundtable explores how IROs are spending their time, what’s driving the most impact, and how smarter processes and tech can free up hours for high-value work. Join us to share ideas on what to prioritize, how to cut admin, and where others are gaining real efficiencies.

1.00 pm

Lunch

1.00 pm

Optional lunchtime roundtable discussion: Lessons, tools and tough calls

Grab a plate and pull up a chair – this informal roundtable invites candid, experience-led discussion around three high-impact areas for IROs.

- How to manage profit warnings: Practical strategies, real examples on how to rebuild trust after tough announcements

- What specific AI tools are you using – and would you recommend them? Share what’s working (and what’s not)

- What lessons would you pass on from your experience when it comes to your career? The advice you’d give your younger self

1.55 pm

Valuation resilience: introducing the Valuation Eight framework

In a fast-moving macro environment, resilience isn’t just operational – it’s about sustaining and growing enterprise value. In this session, we’ll introduce the idea of ‘valuation resilience’ and how elements of the Valuation Eight can help shape investor communications and strategic narratives. We’ll explore:

- What’s changed in the capital markets narrative – and what investors now expect

- How one or two core principles of the Valuation Eight can improve your capital markets day or earnings story

- A quick look at how leading companies use these tools to build market confidence in uncertain times

Moderator: Steven Wade, head of content, IR Impact

Mark Hayes, partner and head, Breakwater Capital Markets

2.15 pm

Intelligent IR best practices: How modern IR teams use AI and automation

AI is moving from buzzword to boardroom. This session explores how IR teams use AI to boost efficiency, gain insights and improve investor engagement. Hear practical examples, tool recommendations and advice on balancing innovation with human judgment.

- Real-world AI use cases in IR across company sizes

- How AI drives efficiency and new insights in IR

- Tools and data sets that deliver real results (and what to avoid)

- What AI-literate investors expect and how to stay ahead

- Evaluating AI solutions for your team’s needs

- Overcoming barriers to AI adoption in IR

- Future trends: sentiment analysis, predictive insights, and investment analysis

Moderator: Steven Wade, head of content, IR Impact

Souheil Salah, investor relations operations director, GSK

Maria Siano, general manager – corporate governance data and insights, Broadridge Financial Solutions

Isabel Vilela, head of investor relations and corporate communications, GoviEx Uranium

2.45 pm

From good to great: Secrets of award-winning IR teams to get a seat at the table

What makes an IR team exceptional, and how can you stay ahead as the role evolves? Join award-winning IROs to discuss what sets top teams apart, how to manage priorities, and how to build influence within your company. Leave with practical tips on time management, team development, and securing a seat at the strategic table.

- Key traits of exceptional IR professionals

- Prioritizing time and resources in a fast-paced environment

- Gaining internal influence and driving strategic value

- Career progression in IR – where to go next?

- The future of IR in evolving markets

Moderator: Adam Christensen, chief marketing officer, Notified

Jane Henderson, investor relations manager, BAT

Graham Phillips, IR director, Schneider Electric

3.15 pm

The IR situation room

A carefully structured, collaborative session that gives attendees an opportunity to work together to solve each other’s real-life IR challenges in a consultation-style setting

- Get real solutions from IR peers on a particular challenge you are facing

- Understand the challenges that other IR professionals are dealing with

- Benefit from the collective discussions that result

Moderator: Steven Wade, head of content, IR Impact

3.45 pm

Closing remarks and summary of key takeaways

4.00 pm

End of Think Tank

Event Speakers

Who attends our events

Our attendees are leading IR practitioners with an established track record and strategic IR roles within their company.

Below is a sample list of attendees who have joined our events in the past:

| JOB TITLE | COMPANY |

|---|---|

| Associate director | BioNTech |

| Associate director, IR | Lloyds Banking Group |

| Chief of staff to CFO, head of IR | Ignitis Group |

| Director IR, sustainability | IRES REIT |

| Director, ESG | Vedanta Resources |

| Director, head of distribution | Gravis |

| Director, IR | Alcon |

| Director, IR | BT Group |

| Director, IR | Burberry |

| Director, IR | Fever-Tree |

| Director, IR | GSK |

| Director, IR | Metro Bank |

| Director, IR | Shurgard |

| JOB TITLE | COMPANY |

|---|---|

| Director, IR | Teck Resources |

| Director, IR | YouGov |

| IR director | Ermenegildo Zegna |

| IR director | Reach |

| Senior director | Willis Towers Watson |

| Senior director, IR | Infineon Technologies |

| Senior director, IR, comms | Verona Pharma |

| SVP, head of IR, communication | Swedish Orphan Biovitrum |

| SVP, IR, corporate development | Agilyx |

| VP treasury, IR | SUSE |

| VP, IR | PMI |

| VP, IR | Technip Energies |

| VP, IR, corporate communications | ADC Therapeutics |

What our attendees say

Thinking of becoming an event partner?

Our events provide a unique opportunity to get in front of some of the most influential people in the IR community. As a partner, you will gain an extensive amount of exposure through a wide range of print and digital marketing materials, both pre and post event, as well as on the day itself. Additionally, you can use the event to align yourself with IR excellence and network with key decision makers from across the region – the ones pushing the profession forward through innovation.

Register your interest for 2026

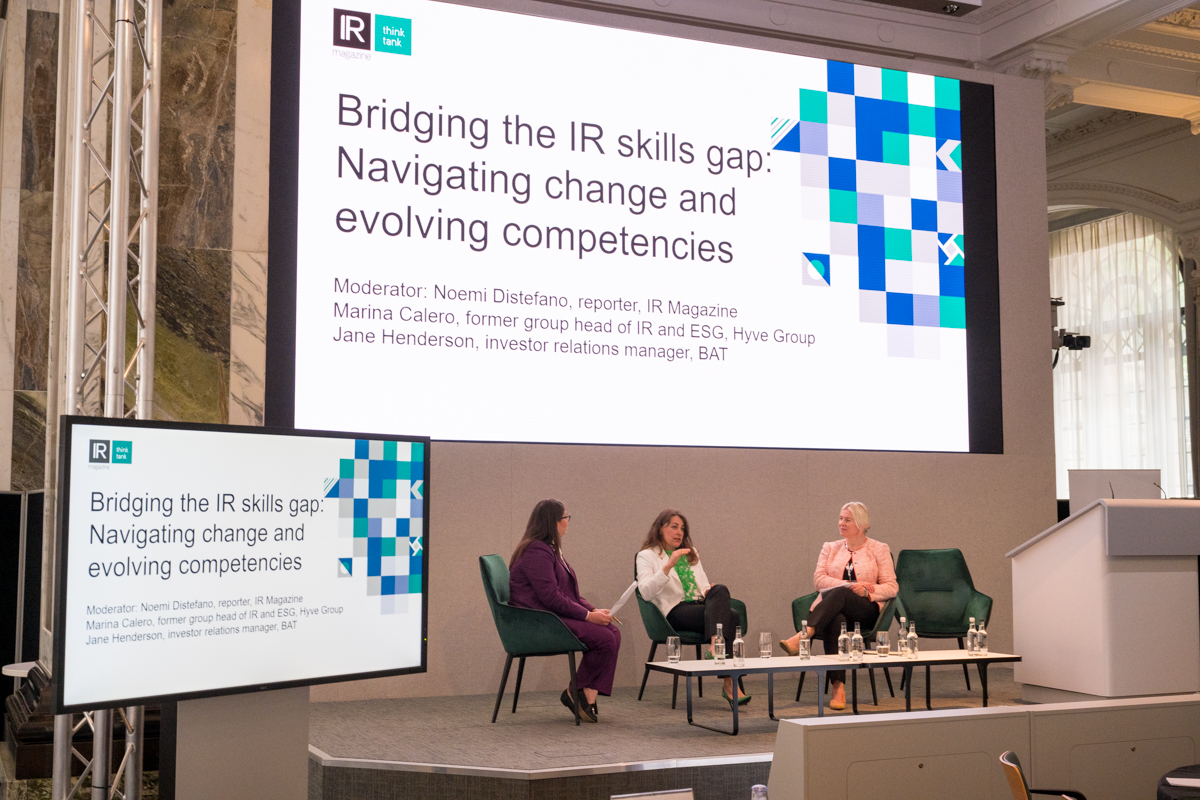

Gallery: 2024

Key insights

Unwritten rules, budget squeezes and trust issues: Inside post-event investor feedback

Four experienced IROs explain the challenges of capturing investor sentiment – and how to overcome them

A candidate’s primer for landing the perfect IR job: How AI is transforming recruitment

IR salaries are rising as investor relations takes on new responsibilities

First-of-its-kind IR benchmarking tool puts analysis at your fingertips

New IR Impact website allows investor relations teams to measure activity against peers – for free

Contact us

Upcoming events

Briefing – Lessons from the 2025 Proxy Season

In partnership with WHEN 8.00 am PT / 11.00 am ET / 4.00 pm BST / 5.00 pm CET DURATION 45 minutes About the event The 2025 proxy season was influenced by several key issues, including changes announced in Staff Legal Bulletin 14M regarding the interpretation of Rule 14a-8, and…

Briefing – Effective earnings preparation amid macro volatility

In partnership with WHEN 8.00 am PT / 11.00 am ET / 4.00 pm BST / 5.00 pm CET DURATION 45 minutes About the event Amid constant tariff news, geopolitical upheaval and other developments stemming from the new US administration, IR teams have their work cut out as they prepare…