News and analysis

-

People moves: Karen Blomquist joins Albany International as GoldMining appoints Martin Dumont

Karen Blomquist has joined NYSE-listed materials science developer Albany International as its new director of investor relations. Formerly an investor relations consultant for BD Emerson, Blomquist joins Albany after two years as vice president of investor relations at P3 Health Partners.

-

Use of the word ‘diversity’ in corporate disclosures drops sharply in 2025, research shows

New disclosure data shows how quickly corporate language can shift as boards respond to legal, regulatory and investor pressure Only 36 percent of the top 100 US companies mentioned the word ‘diversity’ in human capital management disclosures – compared to 96 percent who did so in 2024 – according to a new report which demonstrates […]

-

A material focus: BlackRock refocuses its 2026 voting stance in a tumultuous proxy landscape

BlackRock’s updates its stewardship expectations for 2026 following criticism of its decarbonization plans in New York BlackRock will renew its focus on long-term financial performance and take a more pragmatic approach to environmental policies at investee companies in 2026, according to its updated US Stewardship guidelines for 2026, as proxy advisers and companies continue to […]

-

Proxy season 2026: What to expect from rule 14a-8 changes

Governance experts share their predictions for the upcoming proxy season following the SEC’s pullback around shareholder proposals Among the tumult of 2025 was a November announcement from the SEC stating that it would reduce oversight of shareholder proposal disputes. Blaming ‘current resource and timing considerations following the lengthy government shutdown,’ the regulator said that it would end ‘substantial’ reviews of no-action requests under rule 14a-8, with the change applying to the proxy season running from October 2025 to September 2026 – as well as anything it hadn’t got to before the decision was made. You can read more about the…

-

Inside IR at Advanced Energy: ‘IR can talk to the world, but we can’t disclose everything,’ says Edwin Mok

Investor relations draws people who are attracted to the art of weaving complex sets of facts into coherent narratives. They are finance people, they are storytellers and, because IR may be the most personal area of business, they often find their way to the profession from distant parts of the corporate universe. Edwin Mok is senior vice president, strategic marketing and investor relations at Advanced Energy. The company is a global leader in engineered, precision power conversion, measurement and control solutions.

-

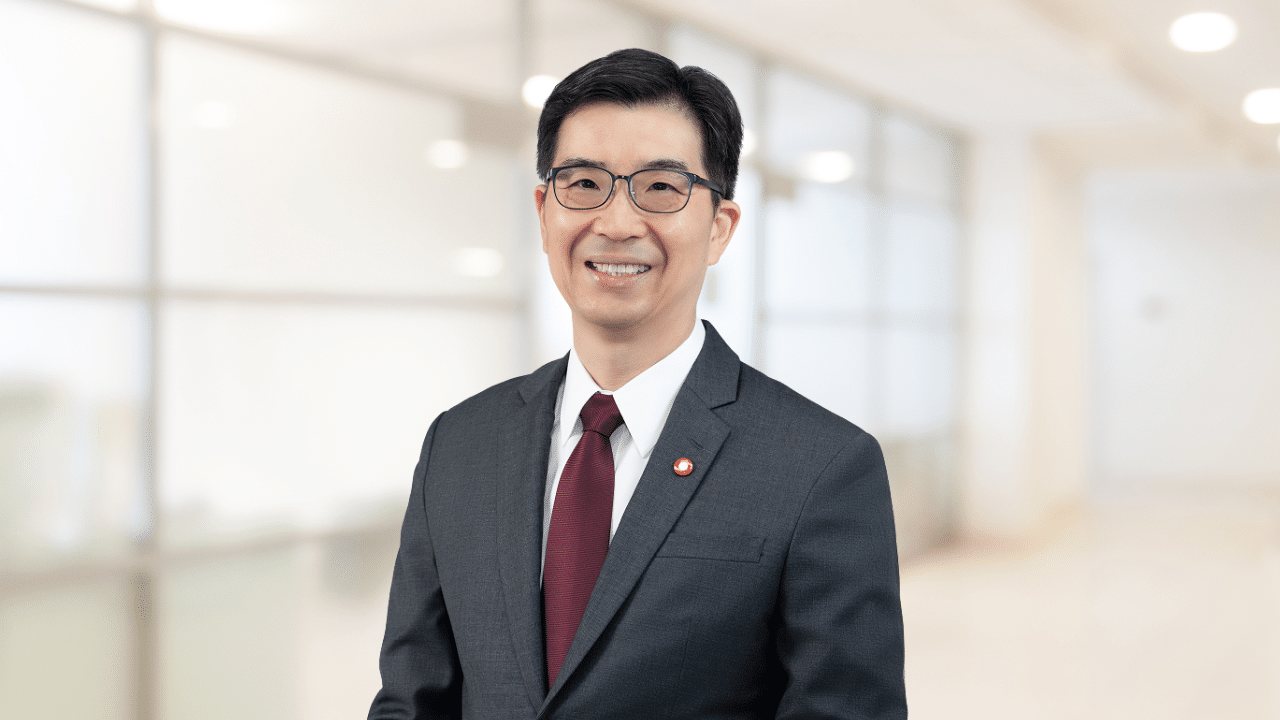

People moves: Former head of IR takes over as CFO at Bank of Singapore

Bank of Singapore has appointed Collins Chin, formerly the head of IR of its parent company Oversea-Chinese Banking Corporation (OCBC), as its new CFO. Chin joined OCBC in July 2009 as the head of group financial and management reporting, assuming the position of head of investor relations in May 2013. There, he led the Singapore Stock Exchange-listed bank’s engagement with the investment community and oversaw shareholder communications around capital raising and M&A initiatives.

-

Beyond the quarter: Rethinking corporate reporting in the US

Amid a growing debate over the future of quarterly reporting, experts are weighing what a slower cadence of disclosure could mean As policymakers and corporate leaders debate the future of quarterly financial reporting in the US, a significant shift looms over how public companies communicate with investors and how they are held accountable. Beginning in […]

-

From shareholder to managerial capitalism: how proxy firm regulation and 14a-8 reform will define IR in 2026

In October 2025, Tesla CEO Elon Musk deployed provocative language characterizing proxy advisors as ‘corporate terrorists’ following ISS’s recommendation that shareholders reject his proposed $1 trn compensation package. Musk argued that ISS and Glass Lewis ‘have no actual ownership themselves’ yet effectively control corporate governance outcomes through their recommendations to investors. This identifies a genuine agency problem: proxy advisors bear no economic consequences from their recommendations.

-

One battle after another: Why the 2026 proxy season might be marked by activist ‘do-overs’ and M&A proposals

In the current critically-acclaimed film One battle after another, circumstances compel the lead character, played by Leonardo DiCaprio, to revisit old conflicts and confront former adversaries. A similar narrative could prove to be one of the major themes in the shareholder activism world this year, as old battles flare up again and activists continue to push for improved corporate performance. My view is largely based on the momentum generated by last year’s high volume of activist campaigns, coupled with the fact that a large percentage of those contests were resolved via negotiated settlements between the activists and the target companies’…

-

People moves: Joris Silon takes over as head of IR at AstraZeneca as Dollar Tree brings in Daniel Delrosario

London-listed biopharmaceutical company AstraZeneca has brought in Joris Silon as its new head of IR, in a move effective from 1 March. Silon, who previously served as the firm’s country president for AstraZeneca US, will replace Andy Barnett, who is taking up another internal position.

-

Managing expectations in 2026: Why valuation stability depends on perception, not just performance

As companies move through 2026, one lesson stands out clearly: delivering strong results is no longer sufficient to protect valuation. Across markets in 2025, share-price volatility was driven less by execution and more by misalignment between investor expectations and management’s forward-looking narrative. In this environment, the IR function has become a strategic discipline. Beyond communicating performance, IR teams are increasingly responsible for aligning market perception with a company’s long-term value creation path. When that alignment breaks down, even earnings beats can result in sharp corrections, elevated volatility and weakened investor confidence.

-

The six hats shaping the IRO role in 2026

Investor relations has never been a static function, but the pace and breadth of change now shaping the role today underscore a redefinition of how IR contributes to enterprise leadership. What once felt like incremental role expansion is becoming a structural rewrite of the job itself.

-

‘I want us to have influence on the big issues IROs are facing,’ says Investor Relations Society’s new CEO

Having taken the society’s CEO reins from Laura Hayter in October last year, Matt Hall spent his first months in listening mode, keen to hear what the UK’s IR professionals need from the body that represents them, learning about the big issues that are changing investor relations and thinking about how he can shape a society that delivers ‘value and insight’ at every touchpoint. Prior to taking on his new role, Hall held senior roles at various other representative membership organizations within financial and professional services, including UK Finance, the Chartered Insurance Institute and TheCityUK. Here, he tells IR Impact…

-

IR in the age of AI: How answer engine optimization will transform content visibility

Content visibility and engagement are always key priorities for IR professionals. As AI and large language models (LLMs) become a primary source of information for buy-side and sell-side analysts, content visibility and narrative control are constantly shifting, creating new challenges in how audiences discover and engage with IR corporate content.

-

People moves: Amit Bhalla swaps IR for global strategy at Schneider Electric as Sarah Fakih joins Evotec

Amit Bhalla, the long-serving head of IR at Schneider Electric, has moved into a new role in the energy management solution company’s global strategy team.

-

Janet Craig: Ten things I am doing to up my IR game in 2026

Predictably, as I moved into the New Year, I thought about what I wanted to accomplish over the coming 12 months. There are many opportunities for professional development, but my focus is on areas where I can hone my craft, build relationships and pay it forward. Here are 10 IR things I want to do in 2026:

-

What makes an equity narrative compelling? An investor survey offers clear perspective

In today’s competitive capital markets, crafting a compelling equity narrative is more than a communications exercise; it is a strategic imperative. But what distinguishes the enduring from the generic? BNY’s Market Insights and Initiatives team, in partnership with S&P Global, surveyed 40 institutional investors across six continents, representing $2 trillion in equity assets under management, to answer this question.

-

Responsible AI adoption in IR: from intimidation to impact

AI is everywhere in investor relations today. Yet for many IR teams, the journey from curiosity to confidence is anything but straightforward. The ’empty prompt window’ syndrome and uncertainty around where to start and how to trust the technology remain real.

-

Looking back at a year of ‘The CFO’: How finance chiefs measure IR success

We’re rounding up another year of IR Impact’s flagship interview series The CFO, where we talk investor relations with finance chiefs from around the world. January 2026 will mark two years of speaking to finance leaders about all things IR. Kurt Barton from Tractor Supply Company was first in The CFO seat two years ago and Dominique Barker, CFO and head of sustainability at Canada’s Lithium Royalties Corp, closed 2025. We always ask CFOs a question about how they measure the success of their IR program, as the nature of the profession makes it notoriously difficult to assess. But proving…

-

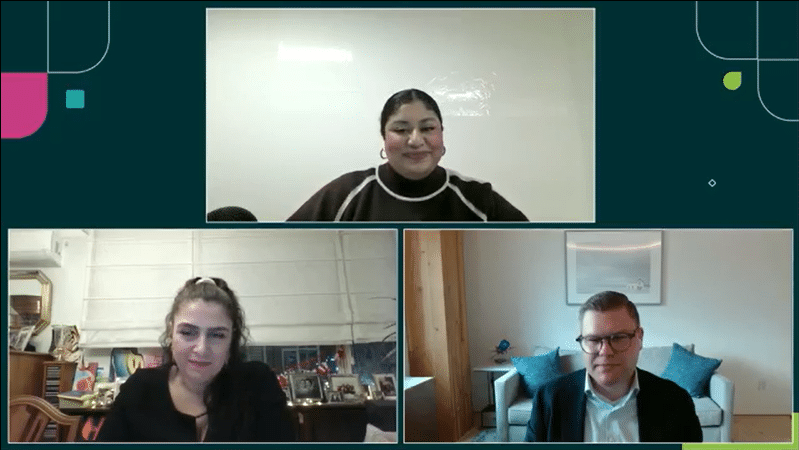

‘Market volatility necessitates a more thoughtful approach’: Four things we learned at the IR Impact Forum – Greater China 2025

The Hong Kong event brought together IR professionals and capital market experts to explore how the IR function should adapt When volatility and concentration risk become part of the backdrop for Chinese IROs targeting investors globally, new challenges emerge. From tailored engagement strategies to navigating unfamiliar capital market expertise, securing long-term investors requires consistency, long-term engagement and market insight. The IR Impact Forum – […]

-

IR for video games, AI for engagement and the Big Three’s voting policies: What you read in 2025

As 2025 draws to a close, it feels like we are wrapping up a particularly momentous year in the capital markets. In the past 12 months, we’ve seen the global markets grapple with seismic macroeconomic shifts – including Donald Trump’s return to the White House, ongoing instability in Europe and the Middle East, plus the ever-evolving role of AI – as well as more localized changes to the day-to-day of IROs.

-

The CFO: ‘Too much material can be a detractor to investment,’ says Lithium Royalty Corp finance chief

When she took the top finance role at Toronto-headquartered Lithium Royalty Corp, Dominique Barker brought her experience on the buy side, the sell side and in ESG advisory – all of which feeds into her approach to investor relations and sustainability. In the closing interview of our 2025 series of The CFO, Barker talks to IR Impact about finding a host of women in charge at a high-altitude brine, bridging the gap between mining and the energy transition, and the supper club she’s part of with multi-award winning IR Impact Awards judge Janet Craig.

-

‘The tolerance for inconsistency is zero’: Four things we learned at the IR Impact Forum – South East Asia 2025

The Singapore event brought together 100 senior IR experts to examine how the IR function is evolving The IR Impact Forum – South East Asia 2025 brought around 100 IR professionals to the Singapore Stock Exchange (SGX) on December 2 to discuss how the IR function is evolving in the region. A series of panel […]

-

The IR Benchmarking Report 2026 Global & Europe available now

A new year, a new name. In recognition of our flagship IR Benchmarking Tool, launched in early 2025, our long-running Global Practice Report has become the IR Benchmarking Report Bringing you research from several hundred IR professionals, it offers insights into everything from budgets and IR team analysis to sell-side coverage across markets caps and […]

-

The IR Benchmarking Report 2026 Global & North America available now

This year we bring you a brand new, revamped IR Benchmarking Report that couples our survey research with interview and data from our flagship IR Benchmarking Tool. Alongside the data – covering everything from budgets to gender breakdowns, from analyst numbers to senior management attendance at virtual and in-person meetings – this report offers a […]

-

People moves: CBIZ brings in Christopher Sikora as Reinsurance Group of America appoints Ryan Krueger

Professional services company CBIZ has brought in Christopher Sikora as its new vice president, investor relations and corporate finance. The NYSE-listed firm describes Sikora as ‘an accomplished investor relations professional with extensive experience in finance, strategy and corporate development’ in a press release announcing the move.

-

‘If you’ve worked in politics, the stock market doesn’t scare you’: Håkan Tribell on swapping writing a prime minister’s speeches for managing IR at AAC Clyde Space

Most people’s route into IR follows one of two predictable paths: either a start on the sell-side, where they gain an aptitude for understanding financial research, or via an internal route that may take in financial planning, treasury or accountancy roles. For Håkan Tribell, it was a career writing speeches for the Swedish prime minister Ulf Kristersson that set him up perfectly to join satellite technology and services company AAC Clyde Space as its head of communications for investor relations and public affairs earlier this year. In July, that role expanded to take on ‘the full spectrum of marketing and…

-

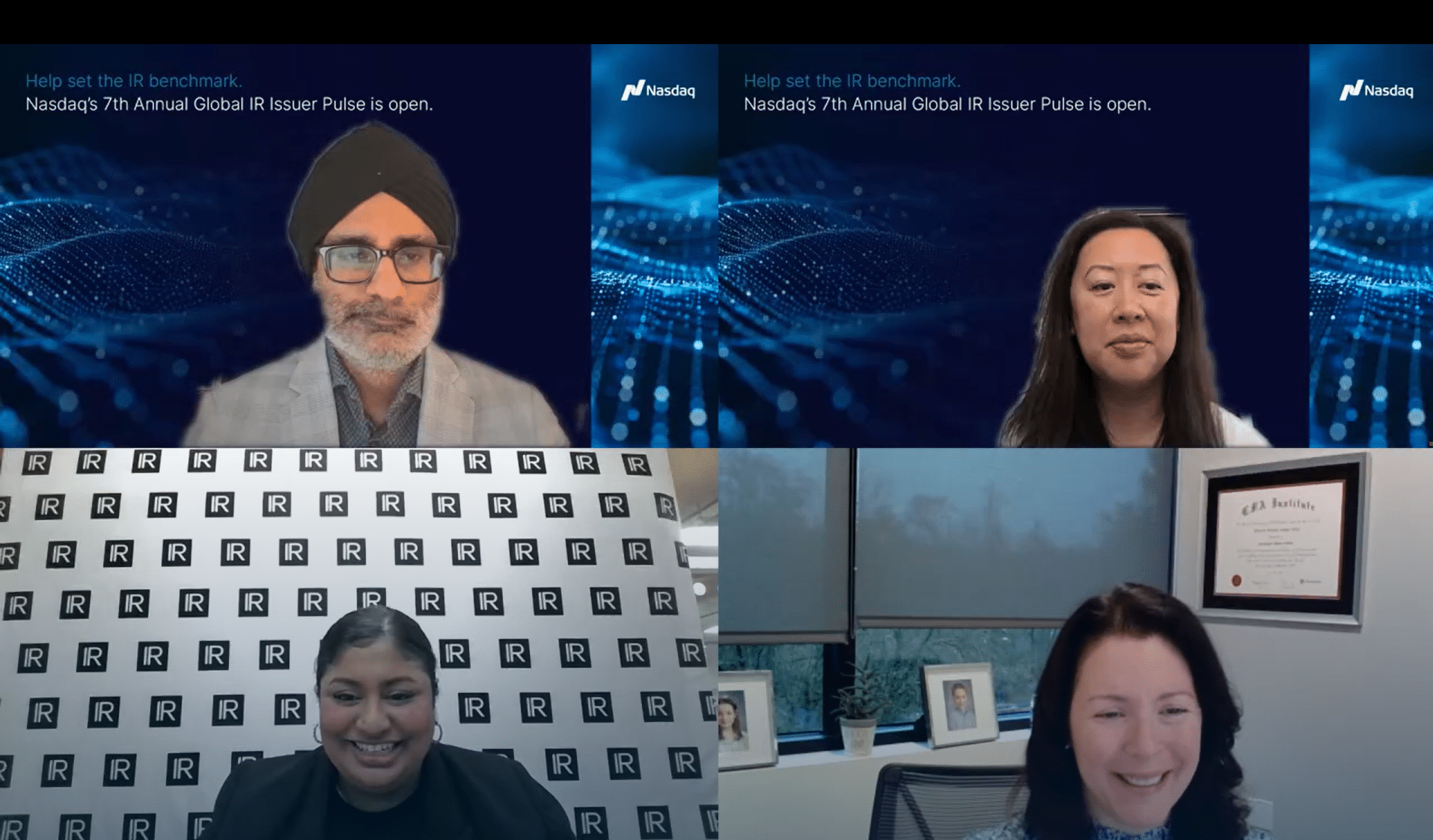

Passive investors driving active opportunities: how fund flows are shaping how IR teams direct their time

Recent IR Impact briefing, held alongside Nasdaq, explores the implications of the ongoing passive shift As passive ownership continues to grow, how companies interpret trading activity and allocate their investor engagement efforts is shifting in parallel. A recent IR Impact briefing, in association with Nasdaq, brought together Jacquelynn Bohlen (head of IR, Columbia Banking System), Stephanie Bui (co-head, investor engagement, Americas, Nasdaq) and Prabhdeep Sagoo (senior director, market and shareholder […]

-

As Trump signs executive order targeting ISS and Glass Lewis, experts say change is already happening

‘Unbeknownst to many Americans, two foreign-owned proxy advisors, ISS and Glass Lewis, play a significant role in shaping the policies and priorities of America’s largest companies through the shareholder voting process,’ wrote US President Donald Trump on Thursday as – after weeks of rumor – he signed an executive order targeting the two firms. In it, Trump advises everyone from the SEC to the Federal Trade Commission, the Attorney General, the Secretary of Labor to put a regulatory spotlight on the big two. The rhetoric leading up to the signing was fierce: SEC chairman Paul Atkins talked about the ‘weaponization…

Spotlight Content

Off-season engagement highlights shifting views on ESG

Companies ponder how to keep talking about sustainability We’re coming to the end of ‘off season’ – when many companies go out on the road to engage with key institutional investors ahead of their annual shareholder meeting. According to a recent IR Magazine survey, around two thirds of IR teams say they have a program…

quick Guides to key ir issues

New to IR?

Looking for career advice?

Don’t know where to start with AI or ESG?

Get a curated briefing in these key areas and more with our starter guides!