News

-

Where were the directors? Why investors want to know how boards act in a corporate scandal

When a corporate scandal breaks, the first question investors ask is Where were the directors? This phrase was coined by Peter Dey in 1994 when he led a report on how to improve corporate governance practices at Canadian listed companies. Corporate scandals have always existed and many stem from weak corporate governance, often caused by a lack of communication, insufficient internal controls or a very lax attitude towards potential problems. In 2024, the US administration criticized Boeing’s board for failing to adequately supervise the safety procedures of its aircraft, following several accidents involving its 737 Max model that resulted in…

-

Despite any advantages, ditching quarterly reporting will ultimately place more burden on IR teams

After DE&I policies, sensible foreign trade policy and the SEC’s ability to enforce regulations, what’s the next thing in Donald Trump’s sights? Why, of course, it’s that scourge of the capital markets, quarterly reporting.

-

People moves: Jeannie Ong joins Temasek and Tom Waldron moves to Springer Nature

Jeannie Ong, the multiple IR Impact Award winner and South East Asia Awards judging regular, has announced her new position at Temasek, which manages a Singaporean government fund with a portfolio worth S$434 bn ($339 bn). In her new role as operating partner, investor relations, Ong tells IR Impact that she ‘leads initiatives to build capabilities and drive alignment across Temasek’s portfolio companies in the area of investor relations.’ She adds: ‘Super excited to be doing what I love again to raise the bar for IR in Singapore!’ Ong brings more than 25 years of experience in the telecommunications, media…

-

How small and large IR teams can manage investor meetings differently

In a new report on IR meetings in the first half of 2025, Modular Finance analyzed over 11,000 investor meetings and 330,000 transactions from more than 250 IR teams across Europe.

-

Ten ways IROs can benefit from trend following

By now you’ll know that institutional investors and their decision-making processes have evolved to become more data-driven and systematic, using strict mathematical rules for portfolio construction. Discretionary stock and bond picking is increasingly an investment style of past, being rapidly replaced by quants, big-data sets and algorithms that can better select stocks and bonds compared to humans.

-

People moves: Nathalie Richert joins The Platform Group as Aaron Bertinetti swaps JP Morgan for Computershare

JP Morgan Chase’s IR Magazine award-winning head of IR Aaron Bertinetti has left the bank to head up Computershare’s newly-launched investor engagement business.

-

Executive pay: Say-on-pay support stays steady and other lessons from the 2025 proxy season

With the 2025 North American proxy season now officially closed, emerging trends in executive compensation are offering valuable insights and shaping important considerations for boards going forward. Here, we explore some of these issues and ways boards and management teams can start to incorporate these into planning for next year’s shareholder meeting.

-

The long view: how to unlock strategic value with scenario planning

Next time you meet with a top-tier investor, how much would it improve your interaction if you could confidently present a long-term view of how supply chain disruptions, interest rate shifts or geopolitical tensions could shape your company’s future? Picture equipping your analysts with data-driven insights that help your board navigate uncertainty with clarity and control. This is the power of modern scenario planning: a dynamic framework that enables IR teams to model multiple strategic themes across five, 10 or even 15-year horizons – and pivot quickly when the landscape changes.

-

From intuition to impact: How ROI thinking can transform investor relations

Across boardrooms, investment decisions are increasingly driven by rigorous financial analysis and measurable outcomes. While marketing debates attribution models and sales scrutinizes conversion funnels, the IR function, though central to connecting companies and capital markets, often relies on intuition and anecdotal evidence when justifying budgets and strategic initiatives. IR now has the opportunity to adopt the ROI mindset that drives decision-making across the enterprise.

-

The summer’s over, it’s back to school time – even for IROs

Welcome back, everybody, to the world of work! Yes, it’s that time of year – for our US readers, Labor Day is over and, for our European friends, the summer holidays are officially done. That can only mean one thing: the pitter-patter of tiny feet as they scamper energetically back to educational establishments heralding the ‘back to school’ season. It’s a good time of year to reflect on your own professional development – as well as making sure your workwear is up to scratch.

-

People moves: NIRI New York’s Laura Kiernan takes up in-house role at Clear Channel Outdoor

Laura Kiernan, the former president of NIRI’s New York chapter, has taken up a new role as an in-house IRO at San Antonio, Texas-based advertising company Clear Channel Outdoor.

-

Innovation and capital raising: the engine for UK long-term sustainable growth

To develop an innovative idea and scale into a competitive business, entrepreneurs need capital; investors seek a vision, a way to market, credible execution, defined deliverables and risk-adjusted returns, all of which underpin long-term growth. When innovators succeed, they create growth and catalyse a broader market expansion, as seen in the US in recent years.

-

Yes, Taylor Swift’s engagement is making ripples in the stock market – here’s what it means for you

In a decade already defined by wide-ranging macroeconomic shocks, IR teams may be forgiven for ignoring the news that pop princess Taylor Swift has announced her engagement to Kansas City Chiefs tight end Travis Kelce. After all, this sort of thing usually doesn’t have much more impact than the celebrity sections of news sites and the social media ecosystem. However, this is Taylor Swift we’re talking about: arch-capitalist, savvy marketeer and industry-defining brand, whose net worth is estimated to be $1.6 bn (that’s enough to make her a small-cap company, in market terms). So naturally, when she makes such a…

-

People moves: Centuri Holdings recruits former Equitrans Midstream IRO Nate Tetlow

US utility infrastructure services company Centuri Holdings has appointed Nate Tetlow as its new vice president of investor relations. Tetlow will take responsibility for the NYSE-listed firm’s IR program, ‘further strengthening relationships with analysts and institutional investors as the company’s primary liaison to the investment community,’ according to a press release announcing the move.

-

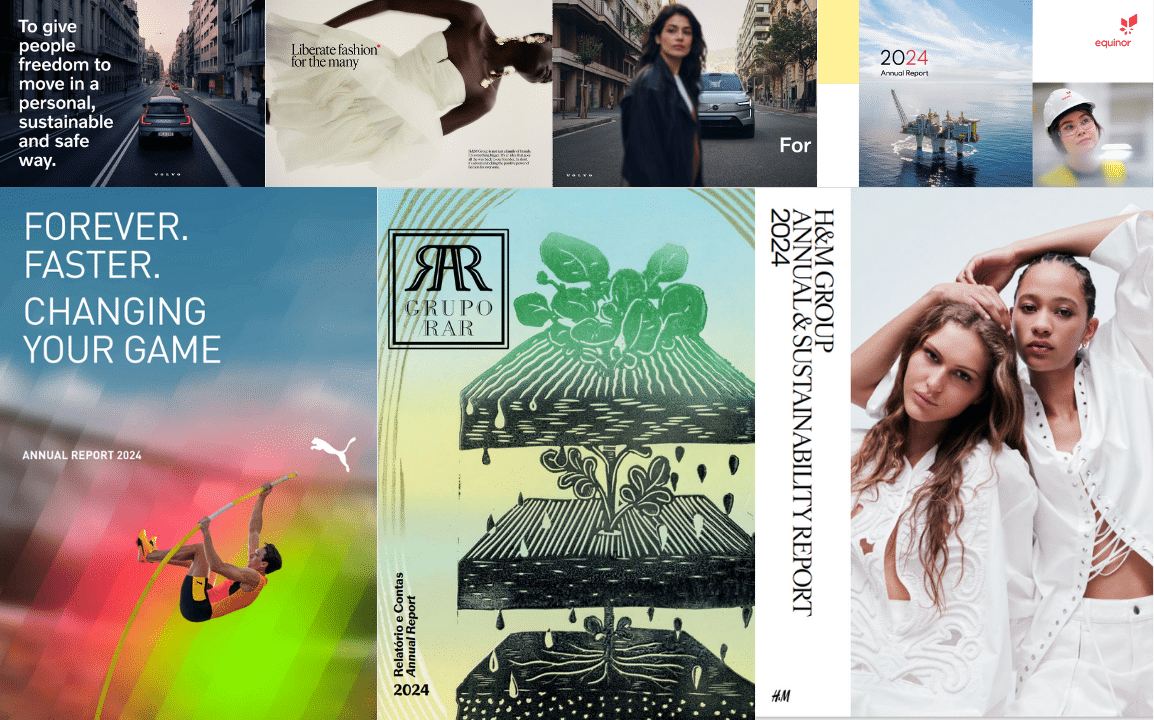

People moves: Manuel Bösing makes IR comeback at Puma as Hippo brings in new head of IR

Manuel Bösing has returned to the IR team at Puma after several years working for fellow German companies tonies and Henkel. Formerly a portfolio manager for HSBC Global Asset Management in Germany, Bösing first worked in Puma’s IR team between November 2018 and December 2020.

-

How AI and technology are modernizing the earnings call

For a long time, the quarterly earnings call has been a highly orchestrated affair. Production companies have been brought in to handle webcasts, teleconferencing and Q&A sessions, resulting in a presentation that serves its purpose, but that is expensive, time-consuming and inflexible.

-

What can IR teams do when Donald Trump makes demands of your CEO?

Not every company has had to field a complaint in a public forum from one of the leaders of the free world. That is until Donald Trump started his second term.

-

‘A chatbot can’t capture the CEO’s voice’: The real role of AI in earnings prep

The technology can streamline the earnings process, experts agreed on a recent IR Impact briefing How can AI best be employed in your earnings preparation? According to leading IR experts, it’s best not to make a facsimile of your CEO, but the technology can certainly help save time and leave you to concentrate on more […]

-

The art of engagement: how to build lasting shareholder relationships

Political pressure and regulatory change pose a challenge to IR and governance teams Shareholder engagement remains a top priority for companies navigating today’s complex capital markets. Proactively engaging key shareholders allows companies to communicate their long-term strategies, explain operational decisions and develop and strengthen relationships with this key stakeholder group. This need for engagement has […]

-

As Glencore retains its London listing, is this the end of the LSE exodus?

Despite what recent headlines might have suggested, not every London-listed firm wants to jump across the pond. That’s at least the message that has been sent after mining giant Glencore announced that it would not shift its listing from London to New York, a move that has often been called for by its shareholders.

-

Looking to deliver a capital market day that impresses? Read our new playbook top tips

Analysts, investors and IR professionals share their thoughts on what makes a compelling investor day in this new IR Impact Playbook, with Lumi Global

-

How the SEC’s ‘pendulum swing’ has realigned rules with market realities this proxy season

DE&I, ESG proposals trends and regulatory changes take center stage at Governance Intelligence briefing How is the proxy season evolving? During a recent Governance Intelligence briefing on Lessons from the 2025 Proxy Season – held in partnership with BetaNXT – Amanda Thrash, senior counsel and assistant corporate secretary at The Williams Companies, said that DE&I issues were still of […]

-

Inside the room at the IR Impact Think Tank – Europe 2025: Rethinking investor day strategy in uncertain times

This June, I had the privilege of joining a panel at the IR Impact Think Tank – Europe 2025 to discuss how companies can evolve their investor day strategy in the face of growing market uncertainty. The conversation brought together leaders from YouGov, Bank of America and Lumi Global, with a shared focus on transparency, engagement and navigating disruption with confidence.

-

Corporate art: The annual report as an object of design

Annual reports serve a legal purpose – to report on a company’s accounts and operations. But it has also become a graphic object that describes the company’s narrative in both words and design. The report is a central part of ‘telling the company story’, its business and sometimes the investment case, while also satisfying the needs of governance hawks. Using Sthlm Kom, we take a closer look at what graphic and design trends we can see in this ‘dry corporate document’ over the last 20 years.

-

From IR to finance chief: Sinclair Names Narinder Sahai as CFO

Media firm Sinclair – which owns, operates or provides services to 185 television stations in 85 markets – has announced former IR professional Narinder Sahai as its new executive vice president and CFO. Sahai joins from Arcis, a leading leisure and hospitality operator, where he led financial planning, accounting, tax, treasury and debt investor relations as the company’s CFO. He was also previously CFO at powersports platform RumbleOn, a role that saw him work on transformative acquisitions. Before working at RumbleOn, Sahai was at Amazon Web Services, where he serves as head of worldwide go-to-market finance for compute and AI/machine…

-

Activist nominees, ESG Trojan horses and tangible investor days: five things we learned at the IR Impact Think Tank – Europe 2025

Europe’s top IR leaders gathered in London to debate, discuss and learn in a series of panels, sessions and roundtables ahead of the IR Impact Awards – Europe 2025 What did more than 170 IR professionals head to London to talk about at the IR Impact Think Tank – Europe 2025? Everything from volatility and uncertainty (of course) to what makes an award-winning IR team and how to untangle yourself from the spilled alphabet soup of ESG and making the most of AI for IR. Panels were mixed with live polls, roundtable discussions, collaborative sessions and networking. We’ve picked five…

-

‘Prevention is better than remedy’: majority of investors say governance gaps attract activists, research shows

The majority of institutional investors credit poor governance practices as the biggest driver of shareholder activism, a new study from shareholder advisory firm SquareWell Partners has found. Some 84 percent of investors polled, who hail from North America, Europe (including the UK) and Asia, said that poor governance was the main driver of activist investor attention. The findings of SquareWell’s report, titled The Long and the Short of It: Institutional Investors’ Views on Activism, center around three key themes, views on activism, evaluation criteria and engagement dynamics. This finding means that the quality of a company’s governance framework is paramount and…

-

‘She significantly shaped IR in Germany’: in memory of Magdalena Moll

Magdalena Moll, or Maggie as many called her, recently passed away. She remains at the top of the IR Impact Awards league tables, having dominated the most prestigious positions in the Europe Awards year after year as the lead for German chemicals giant BASF. Some years there were humorous groans as she stepped up to claim yet another trophy. Once, when this writer asked for her views (yet again), she said quite seriously that she had nothing left to say, having been tapped for her thoughts on IR best practice too many times. Laurie Havelock, IR Impact editor, recalls Moll…

-

All wrapped up: how Deutsche EuroShop sparked conversation with AI action figures

What did it take to turn Patrick Kiss, IR Impact Award-winning investor relations lead at Deutsche EuroShop, into a fully boxed action figure? Well, it needs a spark of creativity, a ChatGPT Pro account plus a lot of patience. ‘To give you an idea of the work involved, the final optimized prompt for my own action figure had 304 words in 66 lines with more than 2,200 characters,’ says Kiss. This is something of a side step from the usual conversations around AI for IR, where the focus is on saving time for IROs paddling against the current of increasing…