News and analysis

-

Off-season engagement highlights shifting views on ESG

Companies ponder how to keep talking about sustainability We’re coming to the end of ‘off season’ – when many companies go out on the road to engage with key institutional investors ahead of their annual shareholder meeting. According to a recent IR Magazine survey, around two thirds of IR teams say they have a program […]

-

The evolution of the IRO role: staying informed and strategic with Quartr Pro

Staying informed isn’t just a valuable skill for IROs – it’s a complete necessity for the job The fast pace of the market, rapid news cycles and intricate details hidden within earnings calls or filings make it challenging for IROs to cut through the noise and uncover key information quickly. But the role of IROs […]

-

The CFO: Heads of IR should understand their company better than management, says Alamos Gold finance chief

To mark the first of the year’s CFO interviews, we headed to Toronto to talk IR with Greg Fisher, finance chief at Alamos Gold – a company that has been repeatedly recognized for its efforts in investor relations

-

People moves: Kambi Group bets on Mattias Frithiof as head of IR and sustainability

Other people moves come at Inditex, GE Aerospace, Xcel Energy, Eastern Bank and Mercury Systems Kambi Group, the sports betting company, has named Mattias Frithiof as its new senior vice president of IR and sustainability. Frithiof joins from Storytel, the audiobooks company, where he served as head of IR. In total, he has more than […]

-

Net zero targets don’t affect corporate strategy – so let’s get rid of them

At the core of most corporate ESG strategies, we are used to seeing a number.

-

How modern IR teams can use CRMs to stay ahead

A proper system to keep track of customers is essential when juggling hundreds of engagements a year

-

Maximizing shareholder value by combining IR with corporate communications – and reporting directly to the CEO

The case for IR to report to the chief executive, even as increasing numbers report to the CFO

-

Maximizing the potential of and mitigating risks in IR using AI

Majority of IROs have not embedded AI into their processes but are interested in learning more, research shows Just under two thirds (64 percent) of IR professionals indicated they have not embedded AI into their processes, but are interested in understanding its potential, according to findings from Nasdaq’s 5th annual IR Issuer Pulse survey. AI integration could […]

-

Clear Street launches healthcare equity research, to debut at JP Morgan Healthcare conference

Financial technology and capital markets firm launched its healthcare and biotechnology equity research last month

-

The times they are a-changin’: the new era of institutionalized shareholder activism

The trends in activism, which are shifting in form and focus, are heralding the start of a new, more institutionalized era.

-

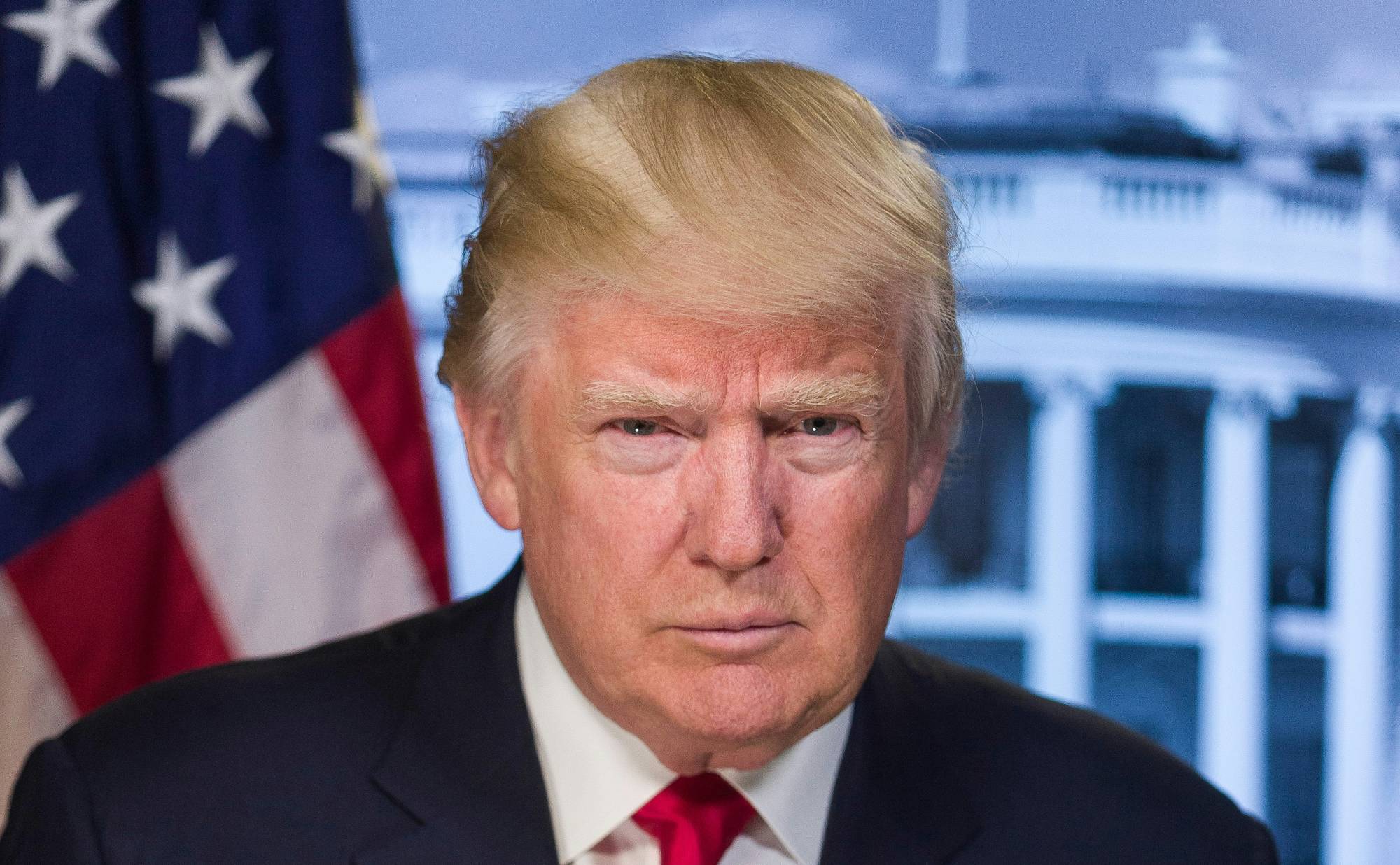

Why the return of Trump heralds a year of change for IR teams

As we kick off 2025, there is one topic that is front of mind for just about every IR team: what impact will the new US administration have on my company, sector and IR activities? At the current time, there are many, many questions – and essentially no clear answers. We can start, however, to […]

-

Trillium Asset Management: Shareholder proposals shouldn’t be seen as an extreme form of escalation

Interview taken from the Governance Intelligence Playbook: Your AGM, your investors, your engagement As chief advocacy officer with Trillium Asset Management, Jonas Kron leads the firm’s advocacy program to engage with companies on their environmental and social performance. He spoke to IR Magazine sister site Governance Intelligence about aspects of that work in the run-up to and during […]

-

People moves: new year, new IROs at Innoviz Technologies, Couer Mining and Sandoz

Several IROs have found new roles at the beginning of the new year, with new team members in place at Innoviz Technologies, Coeur Mining and Sandoz.

-

How liquidity can enhance the impact of your wider IR strategy

IR serves as a bridge between companies and their investors, promoting transparency, trust and market awareness.

-

Why I turned down tickets to the opening of the Paris Olympics: the importance of saying ‘no’ in IR

A polite ‘no’ lets you focus on what only the IR team can do – and frees up much-needed time – argues Thomas Kudsk Larsen Last year, I turned down tickets to the opening ceremony of the Paris Olympics. While many might think I was crazy to pass up such an opportunity (I definitely wasn’t, […]

-

Governance, adaptation, flexibility and variety: four key topics from the IR Magazine Forum – Greater China 2024

Even in adverse market conditions, good IR can always make the difference for listed companies. This was the focus for the nearly 200 IR professionals from across the Greater China region – Hong Kong, Taiwan and mainland China – who came together for the IR Magazine Forum – Greater China 2024. Here, IROs and capital […]

-

What you read in 2024: The problems with ESG and what Trump means for IR

A look at the articles our readers enjoyed most in the last 12 months

-

‘We’re seeing unusual complexities’: Webinar explores the changing nature of market valuation

Stock markets hit record highs in 2024, powered by falling interest rates and, more recently, expectations for business-friendly polices under US president-elect Donald Trump. The macroeconomic environment, however, feels highly uncertain, with talk of trade wars back on the agenda and geopolitical tensions simmering across the globe. Amid this complex environment, it’s becoming harder to […]

-

Storytelling, reinvention and quizzing your analysts: Four things we learned at the IR Magazine Forum – South East Asia 2024

Though it was chilly back in IR Magazine’s London home, at the end of November myself and our events team made the painful decision to fly to warmer climes in Singapore, where we would stage the IR Magazine Forum – South East Asia 2024. We were joined there by senior IR professionals from across Indonesia, […]

-

Five areas for IROs to focus corporate sustainability in 2025

What investors will want to see in ESG disclosures will evolve again next year As we approach 2025, corporate sustainability continues to evolve into a standard component of any business. In this article, we suggest five things that business leaders and sustainability teams should look for in 2025. The annual cycle of materiality-strategy-reporting will become […]

-

People moves: New head of IR at Boohoo ahead of Mike Ashley boardroom clash

Plus former head of IR takes over as CFO at Swedish digital bank Northmill

-

Personality and pandemics: What we learned from a year of talking IR with CFOs

As the year draws to a close, we look back on 12 months of The CFO column. What started with Kurt Barton of Tractor Supply Company expanded to conversations about all things IR with finance chiefs from Brazil’s NuBank to Hong Kong’s Sa Sa International, Canada’s Cineplex to Campbell’s Soup Company in the US – and many more. We discussed the benefits that good IR can deliver, about what they look for in their heads of IR, about what works in corporate access and what they liked most – and least – about their involvement in the IR program.

-

Why IROs need to get smart about the hidden health risk of air pollution

New consultation asks IR teams to share details about corporate contributions to toxic air Air pollution has major impacts on human health, the environment and the economy. As a growing business risk, it’s an issue that IROs cannot afford to ignore. Some 99 percent of people breathe air that exceeds World Health Organisation (WHO) limits and one […]

-

The CFO: ‘Our ultimate mission is the protection of lives’, says finance chief of Japan’s Weathernews Inc

Masanori Yoshitake talks weather, climate and society, ramping up IR and taking investors from a financial return to an emotional one

-

Small caps don’t plan to change strategy despite Trump’s election win, finds poll

While Donald Trump’s reelection as US President is often viewed as positive for small-cap companies, most do not see the result as an opportunity to rethink their strategy, according to a poll carried out during a recent IR Magazine webinar, held in partnership with One 44 Advisory and Consulting. The event, titled ‘Navigating today’s capital […]

-

Why Brian Thompson’s killing has prompted companies to think about executive safety and corporate purpose

‘Executive security used to be something of a hard sell,’ says Iylia Lavatelli, a former close-protection security provider, now working at operational resilience firm Restrata, talking about budget as well as executive willingness playing their parts in what any security manager can achieve. That, of course, changed with the shooting of Brian Thompson, UnitedHealthcare CEO, in New York last week. The news today is of companies scrambling to organize their security and senior profiles being removed from corporate websites – health insurance firms in particular

-

December is a time for celebration, both for IROs and our staff

The end of the year is a time for reflection, of course, but this year it feels like there are a few more reasons to celebrate.

Spotlight Content

Off-season engagement highlights shifting views on ESG

Companies ponder how to keep talking about sustainability We’re coming to the end of ‘off season’ – when many companies go out on the road to engage with key institutional investors ahead of their annual shareholder meeting. According to a recent IR Magazine survey, around two thirds of IR teams say they have a program…

quick Guides to key ir issues

New to IR?

Looking for career advice?

Don’t know where to start with AI or ESG?

Get a curated briefing in these key areas and more with our starter guides!