-

‘If you’re good at IR it’s going to make a big difference to your share price’: Gervais Williams from Premier Miton Investors on making the most of volatility

In a global equity market still defined by volatility and political uncertainty, how can IR teams make the most of the opportunities available to them? According to Gervais Williams, head of equities at Premier Miton Investors, good IR professionals can make a world of difference to their organizations by communicating clearly. With so much capital moving around, it could also make a significant difference to a company’s share price he adds.

-

‘We have radically rethought how to look at sustainability’: Christian Granquist on AP7’s new outlook

Christian Granquist joined AP7, one of Sweden’s national public pension funds – into which some 6 mn Swedes pay – in August 2025. Working alongside Jessica Eskilsson Frank, Granquist is senior portfolio manager, impact investments, climate transition at the globally invested fund that has total assets of around $150 bn. Before joining AP7, Granquist – who has a master’s in economics from Uppsala University – had a 10-year stint at Lancelot and worked at Handelsbanken for 13 years in a number of roles including chief investment strategist and co-head, equities. He talks to IR Impact about how the fund is…

-

The 2025 state of AI for business and finance

2025, the teams seeing the biggest gains aren’t chasing shiny tools, they are quietly transforming how work gets done. Organizations adopting workflow-integrated, expert-driven AI are seeing measurable gains in efficiency and insight generation. This new report from AlphaSense sets out the findings based on a survey conducted in May 2025, into the perspectives of 300 professionals in the United States, across areas like consulting, corporate strategy, competitive intelligence, asset management and investment banking.

-

Nuance over polish: Leveraging the conference calendar and other top tips for your 2026 meeting schedule

What do investors want when it comes to capital markets days (CMDs)? Or other Street-facing events for that matter? It was with that investor view in mind that Sylvie Harton, chief business strategy officer at Lumi Global – partner on the IR Impact Briefing: Making your 2026 investor meetings count – kicked off the conversation.

-

Enhancing valuation: optimizing your equity story for the right investors

In Asia’s dynamic capital markets, the challenge for listed companies is clear: how to enhance valuation and ensure the right story resonates with the right investors. High ownership concentration, regional shareholder dominance and fragmented analyst coverage mean that earning the attention – and conviction – of global investors requires more than traditional broker-driven outreach or routine disclosures. What’s needed is an integrated approach built around three collar pillars: independent investor feedback, rigorous investor targeting and high-impact capital markets events.

-

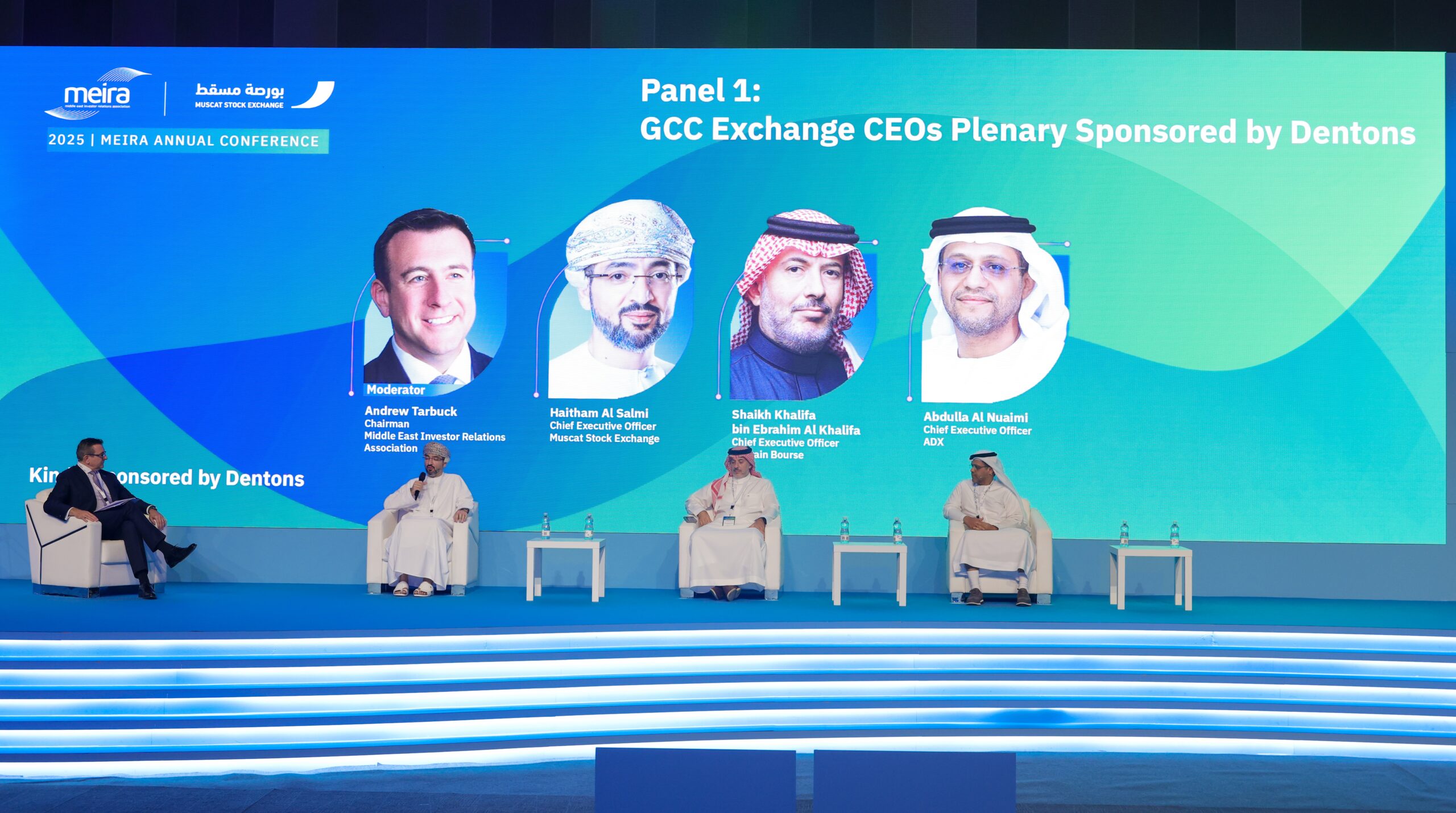

Meira Muscat 2025: From the role of the exchange to SWFs and debt IR

Over the past few years, the IR platform in the Middle East has been evolving quickly. Exchanges are maturing, listings are more regular and IR is moving beyond ‘results day’ toward a steadier focus on access, liquidity and clear communication. We’re seeing more structured targeting, more emphasis on guidance and capital allocation and better use of data that investors can actually work with. Sovereign funds are engaging in more targeted ways and many issuers are doing a better job of aligning the equity and debt stories. This came through clearly in Muscat. With more than 1,200 attendees in town, the…

-

Earnings tracker

Download this comprehensive, data-driven review of recent earnings calls across leading companies. It covers emerging trends across sectors and industries, uncovering how top companies are navigating the current economic landscape.

-

Valuation drivers in utilities: insights from the sector for GCC-listed companies

Study points to an opportunity to align equity narratives more closely with international valuation expectations The utilities sector globally remains a cornerstone of defensive investing, valued for its stable cash flows and predictable returns. As Gulf Cooperation Council (GCC) markets mature and attract a broader investor base, understanding the valuation drivers that influence market perceptions […]

-

The sell side talks IR – part three: when and how analysts want to be engaged

There is no denying the ways in which Covid-19 and the rapid shift to virtual changed investor relations – most notably engagement. Driving home just how dramatic that change has been, one of our anonymous analyst interviewees – anonymous in order to encourage openness – says this: ‘Before 2020, I think I’d done probably two video calls in 20 years. This call is the third one of the day. So that’s changed dramatically.’ In the third part of our series on the sell-side-IR-relationship, we look at how IR teams interact with their analysts, how often analysts want to hear from…

-

Navigating volatile stock price movements: a playbook for public company executives and boards

Corporate executives often wake up to unsettling stock price swings with no clear catalyst, news, filings or obvious events. In today’s markets, volatile price movements frequently extend well beyond the fundamentals. Algorithmic trading, macro-overlay strategies and ETF flows often drive disconnects, making market reactions appear irrational.

-

Finding out what the sell side really thinks about IR

Would you like to know exactly what your analysts are thinking? No, I’m not here to tell you about some new sell-side telepathy service – though I’m sure many of our readers would jump at the option and maybe that’s one for Elon Musk’s Neuralink to figure out – but rather some new research that exposes just how analysts think about IR.

-

Why listed companies should engage with hedge funds

I have been working as an IR professional for almost 15 years. To my continued surprise, I still meet peers who remain negative around hedge funds. In fact, they actively seek to minimize interaction. And if they do allow such meetings, they squeeze hedge fund managers into large group meetings, normally led by IR rather than management. To me, this approach is counterproductive. The role of the IR department is to safeguard a fair valuation of the share by communicating correctly to all relevant corners of the financial markets. I strongly believe that open doors and strong relationships improve liquidity…

-

‘The word ‘Texas’ means friend, and all are welcome!’ Barrow Hanley on its long-term value focus

Patricia Barron and Mark Giambrone talk about Texas, when IR-only meetings work and how often the investment management firm likes to meet before it buys in As companies eye Texas – and Dallas in particular – as a roadshow destination, the Lone Star State has been pushing forward its business-friendly appeal with the new Texas Stock Exchange poised to begin trading next year, listings already in place on NYSE Texas and new legislation. Patricia Barron, executive director, chief operating officer and head of risk at Barrow Hanley, and Mark Giambrone, the investment management firm’s executive director, head of US equities…

-

The sell side talks IR – part two: those crucial coverage numbers

In a series of anonymous conversations – with identifies protected in order to get frank responses – IR Impact talked to sell-side analysts about their relationships with IR professionals. In part one, we looked at the value of research – from both the IR viewpoint and from the sell side, including advice from analysts on how they felt IR could improve data sharing, face time, responsiveness and more – all the elements that go into a good IR-sell-side relationship.

-

‘Nothing short of an investor relations telenovela’: How 2025 has treated IROs so far

If somebody could have plotted out the broad strokes of the past 12 months – ongoing international crises, political unrest, economic uncertainty to name but a few – I don’t think many of us would have believed what was in store. But, as it is, the capital markets have experienced quite the rough ride in 2025 so far. For IR professionals, that’s meant an even higher burden when it comes to keeping their investors, analysts and other stakeholders informed.

-

The sell side talks IR – part one: the value of research

Sell-side analysts occupy a pivotal position in financial markets. Through their in-depth research and recommendations, they exert influence on stock valuations, market liquidity and overall market dynamics. Their buy, hold or sell ratings can cause stock prices to rise or fall, impacting investor decisions. Upgrades often lead to price surges, while downgrades may result in declines.

-

How small and large IR teams can manage investor meetings differently

In a new report on IR meetings in the first half of 2025, Modular Finance analyzed over 11,000 investor meetings and 330,000 transactions from more than 250 IR teams across Europe.

-

Innovation and capital raising: the engine for UK long-term sustainable growth

To develop an innovative idea and scale into a competitive business, entrepreneurs need capital; investors seek a vision, a way to market, credible execution, defined deliverables and risk-adjusted returns, all of which underpin long-term growth. When innovators succeed, they create growth and catalyse a broader market expansion, as seen in the US in recent years.

-

Yes, Taylor Swift’s engagement is making ripples in the stock market – here’s what it means for you

In a decade already defined by wide-ranging macroeconomic shocks, IR teams may be forgiven for ignoring the news that pop princess Taylor Swift has announced her engagement to Kansas City Chiefs tight end Travis Kelce. After all, this sort of thing usually doesn’t have much more impact than the celebrity sections of news sites and the social media ecosystem. However, this is Taylor Swift we’re talking about: arch-capitalist, savvy marketeer and industry-defining brand, whose net worth is estimated to be $1.6 bn (that’s enough to make her a small-cap company, in market terms). So naturally, when she makes such a…

-

What can IR teams do when Donald Trump makes demands of your CEO?

Not every company has had to field a complaint in a public forum from one of the leaders of the free world. That is until Donald Trump started his second term.

-

A deep dive into deep research tools

This report gives a key briefing on OpenAI, Google, Perplexity, Microsoft and more – pros and cons, trustworthiness and other factors to be aware of. Find out how you – or financial analysts covering your stock – can start using these tools by reading this briefing today!

-

Looking to deliver a capital market day that impresses? Read our new playbook top tips

Analysts, investors and IR professionals share their thoughts on what makes a compelling investor day in this new IR Impact Playbook, with Lumi Global

-

Playbook: How to deliver capital market days that impress investors & analysts

This playbook contains tips and desires shared by investors and analysts – many of them on our IR Impact Award judging panels – on what they want from investor days as well as what turns them off.

-

The quiet power of the Big Three: a new era of corporate governance

We are witnessing a quiet but seismic shift in corporate governance. Behind the headlines of stock prices and board reshuffles, a powerful trio of asset management giants – BlackRock, Vanguard and State Street Global Advisors (SSGA) – has quietly become the most influential force in the corporate world.

-

As Rachel Reeves urges bankers to be less ‘negative’ on selling shares, is the UK due a retail boom?

As the UK’s Labour party deals with its fair share of crises this summer, the chancellor Rachel Reeves has outlined her intention to promote long-term equity investing for retail investors.

-

Inside the room at the IR Impact Think Tank – Europe 2025: Rethinking investor day strategy in uncertain times

This June, I had the privilege of joining a panel at the IR Impact Think Tank – Europe 2025 to discuss how companies can evolve their investor day strategy in the face of growing market uncertainty. The conversation brought together leaders from YouGov, Bank of America and Lumi Global, with a shared focus on transparency, engagement and navigating disruption with confidence.

-

Optimizing earnings analysis opportunities with AI-driven intelligence

In this new report from AlphaSense, you’ll learn about new solutions to streamline and enhance earnings analysis. It includes insights from asset managers from the UK, EU and APAC.

-

Activist nominees, ESG Trojan horses and tangible investor days: five things we learned at the IR Impact Think Tank – Europe 2025

Europe’s top IR leaders gathered in London to debate, discuss and learn in a series of panels, sessions and roundtables ahead of the IR Impact Awards – Europe 2025 What did more than 170 IR professionals head to London to talk about at the IR Impact Think Tank – Europe 2025? Everything from volatility and uncertainty (of course) to what makes an award-winning IR team and how to untangle yourself from the spilled alphabet soup of ESG and making the most of AI for IR. Panels were mixed with live polls, roundtable discussions, collaborative sessions and networking. We’ve picked five…

ALPHASENSE

The 2025 state of AI for business and finance

2025, the teams seeing the biggest gains aren’t chasing shiny tools, they are quietly transforming how work gets done. Organizations adopting workflow-integrated, expert-driven AI are seeing measurable gains in efficiency and insight generation. This new report from AlphaSense sets out the findings based on a survey conducted in May 2025, into the perspectives of 300…

Sponsored white paper

From our sponsor

AlphaSense empowers investor relations professionals with generative AI-driven insights to stay ahead of market trends, competitors and industry shifts. Our platform provides a comprehensive view of relevant financial data, transcripts, filings, news and research, all in one place. This enables investor relations teams to streamline their workflow, improve productivity and make data-driven decisions.

Discover the power of AlphaSense. Sign up here >>