News and analysis

-

As Rachel Reeves urges bankers to be less ‘negative’ on selling shares, is the UK due a retail boom?

As the UK’s Labour party deals with its fair share of crises this summer, the chancellor Rachel Reeves has outlined her intention to promote long-term equity investing for retail investors.

-

Muted mics, loud protests: how the rise of AGM protests is forcing companies to rethink shareholder meetings

Are we witnessing a rise in AGM protests? While often a forum for disagreements with shareholders, this year’s AGM season was characterized by a marked rise in public campaigns targeting annual meetings – particularly in the UK – each of which gained significant press attention.

-

People moves: Fredrik Erlandsson steps down from NIBE Industrier as David Galison joins Stella-Jones

Fredrik Erlandsson has announced he will leave his role as head of corporate communications and IR at Swedish heating technology company NIBE Industrier at the end of the year.

-

Inside the room at the IR Impact Think Tank – Europe 2025: Rethinking investor day strategy in uncertain times

This June, I had the privilege of joining a panel at the IR Impact Think Tank – Europe 2025 to discuss how companies can evolve their investor day strategy in the face of growing market uncertainty. The conversation brought together leaders from YouGov, Bank of America and Lumi Global, with a shared focus on transparency, engagement and navigating disruption with confidence.

-

DIRK conference 2025: How German IROs are navigating ‘permavolatility’

IR professionals are facing an ever-growing set of challenges: geopolitical uncertainties, the rapid rise of artificial intelligence, cybersecurity threats and an increasingly complex regulatory landscape, to name but a few. These developments are reshaping the IR profession. Against this backdrop, the 28th annual DIRK Conference took place under the highly relevant theme: IR in a time of ‘permavolatility’.

-

Corporate art: The annual report as an object of design

Annual reports serve a legal purpose – to report on a company’s accounts and operations. But it has also become a graphic object that describes the company’s narrative in both words and design. The report is a central part of ‘telling the company story’, its business and sometimes the investment case, while also satisfying the needs of governance hawks. Using Sthlm Kom, we take a closer look at what graphic and design trends we can see in this ‘dry corporate document’ over the last 20 years.

-

From IR to finance chief: Sinclair Names Narinder Sahai as CFO

Media firm Sinclair – which owns, operates or provides services to 185 television stations in 85 markets – has announced former IR professional Narinder Sahai as its new executive vice president and CFO. Sahai joins from Arcis, a leading leisure and hospitality operator, where he led financial planning, accounting, tax, treasury and debt investor relations as the company’s CFO. He was also previously CFO at powersports platform RumbleOn, a role that saw him work on transformative acquisitions. Before working at RumbleOn, Sahai was at Amazon Web Services, where he serves as head of worldwide go-to-market finance for compute and AI/machine…

-

From tools to teammates: Getting started with agentic AI in IR

Investor relations is at the heart of corporate strategy, yet many IROs feel trapped in operational quicksand. The role demands sophisticated market insight, nimble decision-making and executive influence, but too often, the day gets consumed by mountains of admin tasks. Between managing earnings prep, tracking sentiment across fragmented channels and crafting compelling stories from complex financial data, the strategic work gets squeezed out. Agentic AI can flip that balance, clearing space for the work that actually moves the needle. By automating routine tasks and providing real-time intelligence, agentic AI liberates IROs from administrative burden and transforms them into strategic architects.…

-

Activist nominees, ESG Trojan horses and tangible investor days: five things we learned at the IR Impact Think Tank – Europe 2025

Europe’s top IR leaders gathered in London to debate, discuss and learn in a series of panels, sessions and roundtables ahead of the IR Impact Awards – Europe 2025 What did more than 170 IR professionals head to London to talk about at the IR Impact Think Tank – Europe 2025? Everything from volatility and uncertainty (of course) to what makes an award-winning IR team and how to untangle yourself from the spilled alphabet soup of ESG and making the most of AI for IR. Panels were mixed with live polls, roundtable discussions, collaborative sessions and networking. We’ve picked five…

-

‘European investors are better prepared than US ones’: Inside the one-woman IR show at Central Garden & Pet

How did Friederike Edelmann end up where she is today? The West Coast-based IR lead for Central Garden & Pet has two decades of global IR experience under her belt – working on everything from IPO preparation to pandemic IR and micro-cap to mega-cap companies – but it all started back in Germany ‘way back when’. She speaks to IR Impact about juggling IR with other responsibilities (she manages ESG and external communications for Central), managing in-person engagements when your operations are remote and what she would have been doing if she hadn’t gone into corporate finance. You can also…

-

‘Prevention is better than remedy’: majority of investors say governance gaps attract activists, research shows

The majority of institutional investors credit poor governance practices as the biggest driver of shareholder activism, a new study from shareholder advisory firm SquareWell Partners has found. Some 84 percent of investors polled, who hail from North America, Europe (including the UK) and Asia, said that poor governance was the main driver of activist investor attention. The findings of SquareWell’s report, titled The Long and the Short of It: Institutional Investors’ Views on Activism, center around three key themes, views on activism, evaluation criteria and engagement dynamics. This finding means that the quality of a company’s governance framework is paramount and…

-

‘She significantly shaped IR in Germany’: in memory of Magdalena Moll

Magdalena Moll, or Maggie as many called her, recently passed away. She remains at the top of the IR Impact Awards league tables, having dominated the most prestigious positions in the Europe Awards year after year as the lead for German chemicals giant BASF. Some years there were humorous groans as she stepped up to claim yet another trophy. Once, when this writer asked for her views (yet again), she said quite seriously that she had nothing left to say, having been tapped for her thoughts on IR best practice too many times. Laurie Havelock, IR Impact editor, recalls Moll…

-

People moves: new IROs join teams at Pennon, Cellnex and Austriacard

Spanish wireless telecommunications infrastructure and services firm Cellnex has brought in Maria Carrapato as its new group investor relations director. In her new role at the Madrid-listed company, she will lead the IR team and report to Raimon Trias, Cellnex’s CFO. She previously served as head of IR and sustainability at Portuguese telecoms company NOS, where she worked since 2007.

-

Teddy bears, school reports and rising stars: what you said about the IR Impact Awards – Europe 2025

Now the confetti has been picked up and the hangovers are starting to clear, it’s a great time to reflect on last week’s celebrations at the IR Impact Awards – Europe 2025. More than 300 of Europe’s leading IROs joined us for a night of food, drink and connections at the swanky Peninsula London hotel, where eDreams ODIGEO, Iberdrola and Infineon Technology emerged as the big winners with three awards apiece.

-

All wrapped up: how Deutsche EuroShop sparked conversation with AI action figures

What did it take to turn Patrick Kiss, IR Impact Award-winning investor relations lead at Deutsche EuroShop, into a fully boxed action figure? Well, it needs a spark of creativity, a ChatGPT Pro account plus a lot of patience. ‘To give you an idea of the work involved, the final optimized prompt for my own action figure had 304 words in 66 lines with more than 2,200 characters,’ says Kiss. This is something of a side step from the usual conversations around AI for IR, where the focus is on saving time for IROs paddling against the current of increasing…

-

Three trophies apiece for eDreams ODIGEO, Iberdrola and Infineon Technology at the IR Impact Awards – Europe 2025

German semiconductor firm Infineon Technologies won three trophies at the IR Impact Awards – Europe 2025, with two Spanish firms – Iberdrola and eDreams ODIGEO – also matching the tally.

-

People moves: Standard Lithium charges up IR with new hire

US lithium producer Standard Lithium has announced two new names to its executive team, including a new investor relations lead. David Rosen joins the Arkansas and Texas-focused firm as its new vice president of strategy and investor relations, with the company also naming Tim Sobel as vice president of health, safety, social and environment (HSSE). Rosen joins Standard Lithium from a director of integration role at Rio Tinto, a position that saw him play a ‘key role in the post-acquisition integration of Arcadium Lithium’ into the mining company, according to a press statement. In that capacity, Rosen led ‘cross-functional initiatives…

-

How IR teams can master analyst consensus

Analyst consensus – the aggregated estimates from analysts on a company’s upcoming results – is a critical part of the financial communication landscape and an essential tool for IR teams. Yet for many investor relations professionals, working with analyst consensus is time-consuming, difficult to analyze and too often based on incomplete data.

-

Geopolitical volatility has made the IRO presence more important than ever

IROs are at the frontline for communication and engagement with shareholders. The role is as complex as it is satisfying while navigating the constant turbulence. At any given time, new regulatory requirements, shareholder tendencies or political factors demand a response.

-

The CFO: ‘Don’t wait too long to make changes,’ says Central Garden & Pet finance chief

Visit the executive page of Central Garden & Pet, the Walnut Creek, California-headquartered company, and you get an immediate sense of just how much the C-suite is tied to the company: instead of the typical suit-in-a-boardroom shot, it’s a case of bring-your-pet-to-work day. Brad Smith, who was promoted from his role as finance chief for the firm’s pet segment to group CFO eight months ago, brought in his French bulldog. Elsewhere there are labradors, maybe a couple of poodle mixes and a cat, though Smith points out that dogs are definitely the more cooperative choice. Smith talks to IR Impact…

-

Five reasons why public companies should conduct post-shareholder meeting engagement

The annual shareholder meeting marks a major milestone for public companies – but it is not the finish line. Instead, it offers a starting point for deeper, more meaningful shareholder engagement throughout the rest of the year.

-

How Canada’s IROs are preparing for a storm on the horizon

CIRI’s annual conference brings together hundreds of IROs from across the ‘true north’, from Toronto-based multinationals through to tiny mining companies based in the wilds.

-

People moves: Autodoc names new IR lead as $2.8 bn IPO looms

Stefanie Steiner has taken up the IR reins at Autodoc as it prepares an IPO expected to value it at $2.8 bn. Writing on LinkedIn this week, she says: ‘I am excited to share that I will embark with #AUTODOC on the next stage of my journey. About a week ago, I joined the new team and had a very warm welcome. In such a technology-driven company I have to familiarize myself not only with business model, strategy, financials and the large market that has enormous potential in the years to come, but also with many new programs and tools.…

-

Investor relations in Europe: uniting a fractured landscape

Across Europe, the landscape of IR societies is diverse and highly decentralized, with most countries having their own independent associations. While these national IR societies effectively support local professionals, there is no singular pan-European body that unifies these efforts. In most European markets, you can find well-established societies like Germany’s DIRK or France’s CLIFF.

-

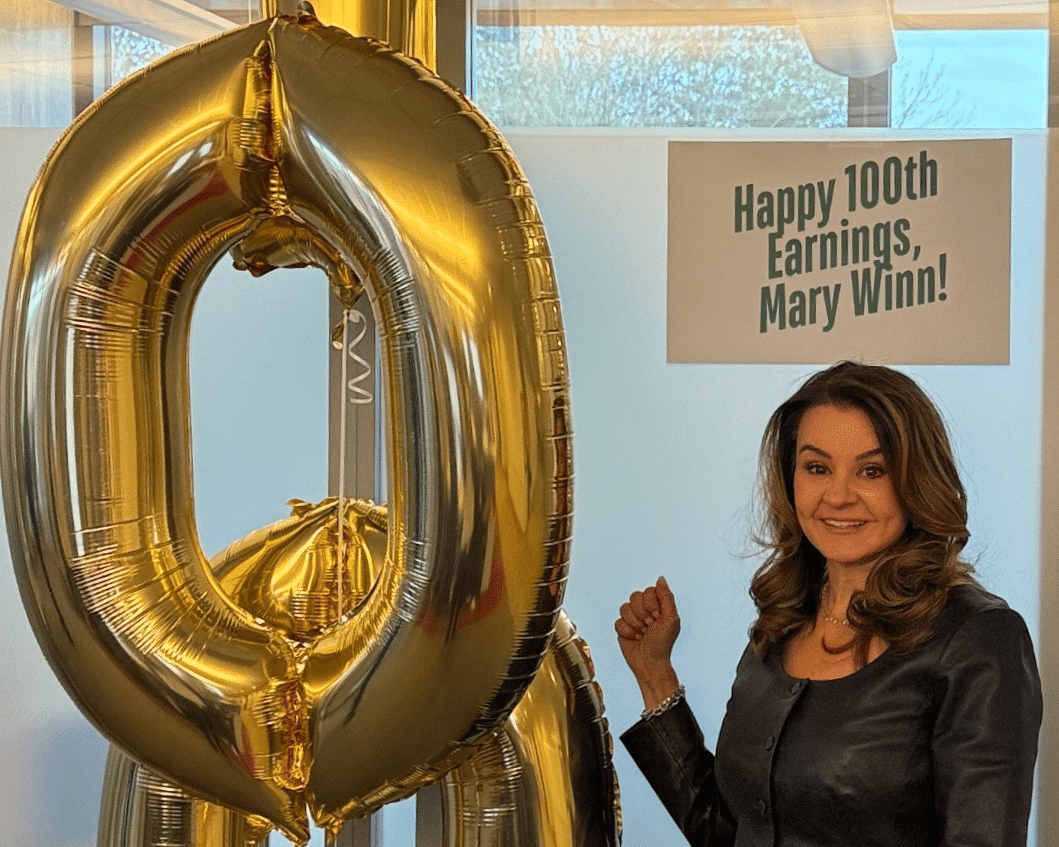

‘Earnings are our Super Bowl halftime show’: Tales from 100 quarterly updates with Mary Winn Pilkington

Earlier this year, Tractor Supply Company (TSC)’s Mary Winn Pilkington celebrated her 100th earnings call – with balloons, cake and the typical quarterly stress to match. ‘In IR you touch on everything – that’s probably part of the reason I have stayed in investor relations for 25 years,’ she says. ‘Every day is different and you get to work with the smartest people inside the company. ‘You’re working with people that are on the board or the management team, you’re working with high potential individuals that have been given strategic projects to work on,’ she adds. ‘Then, outside of the…

-

People moves: William Houston steps down from BAT as Jordyn Eskijian joins Metronet

William Houston, formerly head of investor sustainability at British American Tobacco (BAT), has stepped down from his role after five years at the company.

-

‘People aren’t robots’: How can companies support mothers in their IR teams?

How do you keep a mother in investor relations? How do you support her in a way that keeps diversity of knowledge and experience climbing the corporate ladder? This is a very difficult act to balance, with our recent article on the topic hearing from high-functioning, street facing women who hold senior positions while also raising children. And as Debbie Nathan of Debbie Nathan Associates explained, the issue of childcare is not one that men ever raise in the recruitment process: this is predominantly a female issue. So what should companies be doing to make sure that women feel they…

-

Forecasting discipline: The cornerstone of IPO readiness for IR teams

An IPO isn’t the finish line; it’s the start of a new playbook where credibility and execution become critical drivers of long-term value. Among the many pillars of IPO readiness is a sound and disciplined forecasting methodology. Companies that thrive after going public are the ones that start practicing disciplined forecasting early and consistently hit the targets they set, long before the S-1 is even filed.

-

IR time management: the holy grail for today’s investor relations professionals

It’s no secret that the IR workload has been expanding – even as resources fail to match pace. At the same time, market uncertainty has made the day-to-day less predictable. The result is that the modern IRO is busier than ever. This was something Erik Carlson, chief operating officer at Notified pointed to early in a recent webinar titled: Strategic time management for today’s IRO. ’If look at the challenges in the market, the rise in distrust of the media, the proliferation of content – it’s becoming harder and harder to cut through the noise, to synthesize information and do…

Spotlight Content

Off-season engagement highlights shifting views on ESG

Companies ponder how to keep talking about sustainability We’re coming to the end of ‘off season’ – when many companies go out on the road to engage with key institutional investors ahead of their annual shareholder meeting. According to a recent IR Magazine survey, around two thirds of IR teams say they have a program…

quick Guides to key ir issues

New to IR?

Looking for career advice?

Don’t know where to start with AI or ESG?

Get a curated briefing in these key areas and more with our starter guides!