IR Impact Forum – AI & Technology

Empowering IROs with thought-leading AI and tech insights

Convene 101 Park Avenue, New York

About the event

As more investors and corporate communication teams embrace AI, machine learning and emerging technologies to inform their decision making, investor relations professionals are facing a pivotal moment: adapt and lead, or risk falling behind.

At this fast-moving stage of adoption, IR teams are asking important questions regarding implementation, accuracy, data security and how to ensure these tools truly add value. This is where the IR Impact Forum – AI & Technology comes in.

More than 150 attendees joined us on Wednesday, November 12, for a focused and practical event designed to help IR professionals understand and harness the power of AI. Through real-world case studies and insights from leading IROs, tech innovators and companies already using AI in their IR programs, this forum offered a clear roadmap for integrating technology responsibly and effectively.

WHEN

WHERE

Convene 101 Park Avenue, New York

NIRI IRC® CREDENTIAL

Holders of the NIRI IRC® credential can earn up to four professional development unit (PDUs) per day. IRC-credentialed speakers may also earn PDUs. For more information about the Investor Relations Charter (IRC)®, please visit www.niri.org/certification.

Agenda: 2025

If you are interested in being a panelist at a future forum, please contact Andrew Gibbons on [email protected].

Times are shown in ET (Eastern Time).

Timings are subject to change.

8.15 am

Registration, refreshments and networking

8.55 am

Welcome to the forum

Steve Wade, head of content, IR Impact

9.00 am

Navigating the AI frontier: A comprehensive update on industry developments

As AI continues to evolve at an unrelenting pace, IROs must constantly educate themselves on how the industry is changing and understand the impact that failing to stay ahead of the curve will have on their role. Remaining informed is no longer optional, it’s a strategic necessity.

In this panel, leading IROs will explore the most impactful AI advancements, the platforms and tools gaining greatest traction and the emerging trends that are redefining the IR function.

- Examine the AI and technological needs of today’s IROs and assess whether recent shifts in the vendor landscape are effectively meeting those demands

- Discover the latest advancements in AI and technology and explore how they can enhance targeting strategies, refine earnings call preparation and strengthen competitive positioning

- Discuss if there is a ‘one-stop shop’ and examine how different platforms and tools are being successfully used in unison for a variety of IR functions

- Consider the crucial role AI is playing in managing and reporting sustainability metrics, ensuring compliance with new regulations like the evolving SEC disclosure requirements

- Gather strategic insights into what the next steps in the AI and technology evolution will be.

Moderator: Steve Wade, head of content, IR Impact

Deborah Belevan, vice president of investor relations, Duolingo

Ryan Wallace, vice president of investor relations, PayPal

9.30 am

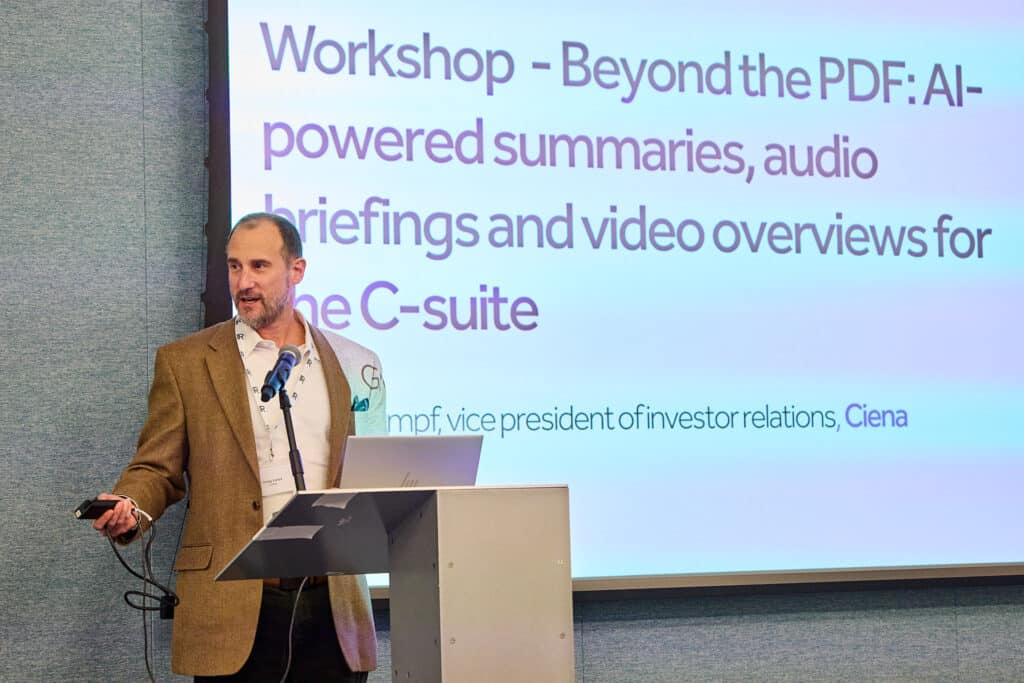

Workshop – Beyond the PDF: AI-powered summaries, audio briefings and video overviews for the C-Suite

Building on last year’s well-received workshop, where Gregg Lampf demonstrated how the free version of Google NotebookLM could be applied to ESG-focused competitive analysis, this year’s session takes the use cases further.

Gregg will show how the paid version of NotebookLM enables IR teams to efficiently digest sell-side reports and post-earnings commentary and transform them into executive-ready briefing documents, podcast-style audio overviews, and narrative slide video recaps – giving you flexible, multimodal outputs that match the diverse consumption preferences of your leadership team.

Attendees will leave with a clear, practical roadmap for using AI to streamline workflows and strengthen IR’s impact at the executive level.

Gregg Lampf, vice president of investor relations, Ciena

10.05 am

An effective roadmap for AI adoption and use: How to efficiently collaborate with your Legal, IT and dedicated AI resources

As AI technologies rapidly evolve, organizations face increasing pressure to integrate intelligent systems responsibly and efficiently. However, successful AI adoption is not just a technical challenge, but requires seamless collaboration across departments and AI resources particularly within legal and IT.

This panel will explore the strategies and tactics IROs can use to ensure successful AI adoption, implementation and usage, while balancing innovation with compliance, security and operational integrity.

- Understand the specific challenges your legal, IT and AI teams face when evaluating the implementation of AI and emerging technologies

- Learn how to foresee and address IT risks and regulatory concerns

- Best practices for engaging legal teams early to navigate regulatory and ethical considerations

- Strategies for partnering with IT and dedicated AI experts to ensure scalable, secure and unbiased AI systems

- Identify the internal infrastructure and workforce required for the effective adoption

- Assess the importance of cross-departmental AI committees to ensure alignment of AI adoption strategies with compliance and technical feasibility

- Insights into overcoming a lack of resources in terms of money, people and infrastructure to enhance company-wide acceptance.

Moderator: Laurie Havelock, editor, IR Impact

Carolynne Borders, chief investor relations officer, GE Healthcare

Lucy Fato, executive vice president, general counsel and corporate secretary, Seaport Entertainment Group

10.35 am

Networking break

11.05 am

Workshop – AI for SEC disclosure: Helping IR and Legal speak the same language

Use AI to bridge messaging, compliance and market awareness without adding workflow friction.

Greenshoe is an AI-native platform that streamlines how public companies craft and review SEC disclosures. While built for legal and compliance teams, it also delivers real-time intelligence for IR professionals shaping narrative, managing investor messaging and monitoring peer communication trends.

In this session, we’ll explore how IR teams can use Greenshoe to stay ahead of disclosure trends, align faster with Legal and sharpen market storytelling.

- Instantly benchmark how peers communicate risk, outlook, and performance.

- Use AI to explore recent 10-Ks, 8-Ks, and comment letters tied to your sector or messaging themes.

- Draft Reg FD-safe messaging using real examples from EDGAR and issuer websites.

- Spot early shifts in regulatory focus or peer tone, before they impact investor sentiment.

This workshop is ideal for IR professionals looking to stay ahead of disclosure trends, coordinate more effectively with legal and bring real-time intelligence into the messaging process.

Payton McCoy, co-founder and CEO, Greenshoe

11.40 am

Measuring the unmeasurable and immeasurable: Demonstrating the value of AI investment

Many IROs struggle to justify AI investments, expecting to demonstrate clear, measurable benefits when AI remains a complex and often misunderstood technology among key stakeholders.

This session brings clarity by providing a roadmap for measuring the ROI of AI, enabling IROs to quantify the success of the technology, track its tangible impact and measure the results effectively, proving that the effort, money and time invested in AI are worthwhile.

- Discuss what ROI actually looks like and consider the challenges around defining it

- Understand how to showcase successful AI and technology use cases and their impact on business metrics

- Debate the relevance of ‘hard’ and ‘soft’ benefits and examine which are most important to you, such as cost and time saving vs employee satisfaction and retention

- Learn how your peers are monetizing the use of AI.

Moderator: Steve Wade, head of content, IR Impact

Bryan Kloster, investor relations manager, AutoNation

Gregg Lampf, vice president of investor relations, Ciena

12.15 pm

Case study. AI tactics and workflows – What’s now and next for AI in IR

The AI revolution isn’t coming to investor relations, it is already here, fundamentally reshaping how IROs engage stakeholders, craft narratives and optimize their digital presence. While many professionals remain focused on basic automation, the real competitive advantage lies in mastering advanced AI workflows and tactical implementations that are transforming the industry today and increasing IRO productivity. This session cuts through the hype to deliver actionable insights on the AI tools and strategies that forward-thinking IR teams are deploying now:

- Decode AI Agents and their practical applications: Understand what AI Agents actually are, how they function behind the scenes and witness an example of autonomous systems

- Master ‘vibe coding’ for stakeholder intelligence: Explore how AI platforms like Lovable and Blink can enable IROs to build custom tools without technical expertise that can support existing reporting and other foundational tasks

- Leverage visual AI for compelling storytelling: Discover how tools like Gamma 3.0 and Google’s Gemini can transform presentations and be a sounding board for evolving your outdated investor decks

- Implement AI Engine Optimization (AEO) strategies: Move beyond SEO to AEO with unique techniques to help ensure your content is at the top generative search engines results to ensure your company narrative is being represented more accurately

Bryan Kloster, investor relations manager, AutoNation

12.50 pm

Lunch

1.50 pm

How will Agentic AI change IR workflows and what are the associated risks and opportunities?

IROs are beginning to explore Agentic AI to enhance efficiency and engagement in financial communications. Unlike traditional AI, agentic AI can autonomously analyze data, generate insights and even interact with stakeholders without the need for constant human intervention.

This session will explore the evolution of Agentic AI, strategizing ways to enhance its opportunities while addressing the associated risks and challenges.

- Gain insights into how your peers are utilizing Agentic AI to enhance risk assessment, engage stakeholders, automate reporting and collect market intelligence

- Create a strategy for developing and scaling Agentic AI ecosystems that are efficient, well-governed and future-proof

- Recognize the new risks that Agentic AI poses to data security, trust and transparency and identify the steps necessary to mitigate these risks

- Consider the regulatory uncertainties surrounding Agentic AI implementation and usage along with strategies to ensure compliance

- Discuss the efficiency gains associated with Agentic AI and evaluate methods for quantifying operational cost reductions.

Moderator: Laurie Havelock, editor, IR Impact

Jared Wasserman, associate vice president corporate platforms, Nasdaq

2.25 pm

Workshop – From earnings call to investor action: How Agentic AI drives smarter follow-up

The next frontier in IR is here. Transform how you manage post-earnings follow-up with AI Agents that can think, act and collaborate autonomously.

Your earnings call concluded recently. Now, maximize its impact. Using Q, the industry’s first ‘IRO Agent’, you’ll transform earnings insights into strategic investor engagement through hands-on experience with AI Agents.

Turn your post-earnings period from reactive scramble into strategic advantage with autonomous AI systems that deliver personalized engagement at scale.

- Analyze your IR landscape and plan your post-earnings week with AI

- Master investor sentiment analysis and institutional engagement prioritization

- Create personalized outreach based on call questions and stakeholder priorities

- Build monitoring dashboards to track engagement effectiveness

- Integrate Q with your existing data to streamline activity planning.

Darrell Heaps, chairman and chief strategy officer, Q4

3.00 pm

Turning conversations into action: Conquering the fear of embracing AI and innovative technology

The integration of AI and innovative technology into IR workflows is inevitable, yet many IROs face resistance due to regulatory concerns, security risks and operational disruptions. In this session we will explore how IR teams can embrace AI confidently, address fears from internal stakeholders and leverage AI for data-driven investor engagement.

- Assess how clear communication, continual training and early stakeholder alignment can streamline AI acceptance

- Consider what guard rails you can implement to ensure data privacy and protection against cyber threats and data breaches

- Explore the ethical frameworks for integrating AI, while prioritizing human impact and addressing employee concerns relating to AI-driven job displacement (You won’t lose your job to AI, but you may lose your job to someone who is using AI).

Moderator: Steve Wade, head of content, IR Impact

Lori Chaitman, global head of investor relations, Kyndryl

Amit Kaura, head of Irwin engineering, FactSet

Heather Livingston, manager, investor relations, ONEOK

Ronen Tamir, vice president investor relations, Pfizer

3.30 pm

Networking break

4.00 pm

Workshop – The new buy-side persona, AI language processing: Understanding how investors are measuring language and how to optimize your communications

Buy-side investors have long utilized technology to measure and analyze the language being used by public companies. In today’s environment, AI is further accelerating this approach for both the complexity of analysis and the proliferation across investment community.

In this workshop, understand how many investors are using this technology and how you can adjust your language to account for it. Get hands on experience with tools that can analyze your language, both in secure private settings as well as more complex analysis of public documents.

Chris Blake, executive director of product innovation within issuer solutions, S&P Global Market Intelligence

4.30 pm

How are the buy-side harnessing AI to optimize decision making and why does generative engine optimization matter

As buy-side firms rapidly adopt AI to enhance investment analysis, decision making and portfolio management, it is essential for IR professionals to evolve in parallel.

This panel offers a behind-the-scenes look at how investors are using AI and how IR teams can leverage similar tools to anticipate investor behavior, tailor engagement and sharpen their strategic communications.

- Discuss how you can adapt your IR strategy and messaging to AI-driven capital markets

- Tactical guidance for optimizing web communications for generative AI discovery, a deep dive into the emergence of generative engine optimization

- Debate whether AI-driven algorithmic trading is emerging as the driving force behind buy-side strategies and how to overcome the associated challenges

- Strategic insights into how AI is being used for predictive analytics, sentiment analysis and alternative data integration

- Consider the role of machine learning in portfolio optimization and trade execution

- Learn effective strategies to enhance investor access to IR information through streamlined self-service formats

- Learn how to integrate AI into your IR website efficiently.

Moderator: Laurie Havelock, editor, IR Impact

David Grunfeld, founder and CEO, aiiro AI

Stephen Pettibone, partner, FGS Global

Thaddeus Pollock, executive vice president, head of equities, Mutual of America Capital Management

5.00 pm

Demo – Prompt engineering for a successful earnings call

- GE HealthCare’s journey leveraging Generative AI to deliver insights that support Investor Relations in preparing earnings call deliverables

- How prompt engineering helps shape the right tone, structure and language for earnings call communications

- The use of prompts throughout the earnings cycle to generate actionable insights, from initial messaging to editing and final review

Michelle Montemarano, strategic planning and investor relations, GE HealthCare

5.15 pm

Summary and closing remarks

5.30 pm

Drinks reception

6.30 pm

End of drinks reception

Speakers: 2025

Who attends our events

Our attendees are leading IR practitioners with an established track record and strategic IR role within their company.

Below is a sample list of attendees who have joined our events in the past:

| JOB TITLE | COMPANY |

|---|---|

| CFO | Envela Corporation |

| Director, IR | General Electric |

| Director, IR | Kyndryl |

| Director, IR | Roko |

| Director, IR | Fresenius |

| Head of IR | Fiserv |

| Head of IR | Esperion |

| Senior director, IR | Cognizant |

| Senior vice president, director of IR | Chubb |

| Senior vice president, IR | Walmart |

| JOB TITLE | COMPANY |

|---|---|

| Senior vice president, IR | Voya Financial |

| Senior vice president, IR | eHealth |

| Senior vice president, IR | Solventum |

| Vice president, IR | Braze |

| Vice president, IR | Cognizant |

| Vice president, IR | PG&E |

| Vice president, IR | Reynolds Consumer Ptoducts |

| Vice president, IR and financial reporting | Sonic Automotive |

| Vice president, strategy marketing and IR | Advanced Energy |

| Vice president, IR | Campbell |

| Vice president, IR | WW International |

What our attendees say

Thinking of becoming an event partner?

Our events provide a unique opportunity to get in front of some of the most influential people in the IR community. As a partner, you will gain an extensive amount of exposure through a wide range of print and digital marketing materials, both pre and post event, as well as on the day itself. Additionally, you can use the event to align yourself with IR excellence and network with key decision makers from across the region – the ones pushing the profession forward through innovation.

Coalition for the Homeless

IR Impact is a long-term supporter of the Coalition for the Homeless. The Coalition is doing all in its power to ensure that homeless New Yorkers get the help and protection they need.

For further information about their work, please visit coalitionforthehomeless.org.

Register your interest for 2026

Gallery

Key insights into the latest trends and best practices

How the buy side uses AI to pick stocks and the truth inside SEC filings – IR Voice

How the buy side is using AI to help with investment decisions and we speak to an SEC filings expert

Investor targeting and AI: Where are we now – and what are the possibilities?

AI is already being applied to targeting, but accuracy could be improved further with higher-quality data

How Udemy’s Dennis Walsh won an IR Magazine Award for his use of social media and video

Innovative video series featuring customer and creator panels proves a hit with investors

Contact us

Upcoming events

-

Forum – AI & Technology Europe

About the event Stay ahead. Harness AI. Transform IR. In today’s rapidly evolving financial landscape, AI is transforming how IROs engage with investors, analyze market sentiment and deliver insights. Yet, many IR teams face challenges in understanding and employing these tools effectively. WHEN WHERE America Square Conference Centre, London The…

-

Briefing – The story behind the story: how IR teams prepare for volatile periods

In partnership with WHEN 8.00 am PT / 11.00 am ET / 3.00 pm GMT / 4.00 pm CET DURATION 45 minutes About the event After a tumultuous 12 months in the markets, 2026 appears poised to be dominated by the same macroeconomic factors that defined 2025. The ongoing impacts…

-

Think Tank – West Coast

Our unique format – Exclusively for in-house IRO’s The IR Impact Think Tank – West Coast will take place on Thursday, March 19, 2026 in Palo Alto and is an invitation-only event exclusively for senior IR officers. Our think tanks are free to attend and our unique format enables participants to network extensively, and discuss, debate and dissect…

IR benchmarking tool

Instant comparison data at your fingertips. This advanced tool provides real-time analytics comparing your IR program to peers in your region, sector, and cap size. Evaluate your program’s strengths and uncover opportunities for growth with key IR metrics covering:

- IR budgets

- Team size

- Reporting lines

- Sell-side analyst coverage

- Investor meetings

Fast, intuitive and packed with tailored insights, it’s the ultimate resource for building a smarter, data-driven IR strategy.