Buy side

-

‘We went public into a bear market’: Lithium Royalty Corp’s head of IR on the buy-side-into-IR learning curve

Lithium Royalty Corp’s IR lead didn’t come to the profession through the more typical paths of corporate finance or a transition from the sell side. As Jonida Zaganjori tells IR Impact, she took on her first IR role fresh from working at a Toronto money manager, an experience that has guided her approach to relationship building on the other side of the table. You can read more from Zaganjori in the IR Impact Global Roadshow Report 2026, where she shares her views on divvying up the CFO and the CEO’s time as well as her favorite city to visit. We…

-

Why capital allocation is the new equity story in the AI era

A familiar pattern is dominating the current earnings season: companies deliver clean beats on revenue and earnings – then see their shares wobble or sell off as management outlines higher-than-expected capex and a longer-dated investment phase. Alphabet and Amazon are prominent examples, but the takeaway for CFOs and IROs is broader: capital allocation has become the equity story. In an AI-driven market, the debate is no longer simply about growth. It’s about how that growth is funded, how long elevated investment will persist and what returns the capex is expected to generate. Investors aren’t punishing ambition; they’re repricing capital intensity,…

-

The Polish miracle: How IR is finally catching up in the ‘second Japan’ predicted to outstrip the UK’s GDP

A new wave of Polish tech firms are bringing IR into the spotlight – shown by record attendance at the Polish IR Association conference at the end of 2025 Something is changing on the Polish IR scene. While the country’s economy has been booming – and booming – it is only in the past year […]

-

The CFO: ‘Good investor conversations are indicative of really good IR,’ says Essentra finance chief

Rowan Baker talks to IR Impact from inside the world of hidden – but essential – components In our first installment of The CFO for 2026, we talk to Rowan Baker, Essentra finance chief, about what she looks for from investor relations, why should moved out of the capital markets and back again and why being lower profile but essential helps drive a ‘great business’.

-

Proxy season 2026: What to expect from rule 14a-8 changes

Governance experts share their predictions for the upcoming proxy season following the SEC’s pullback around shareholder proposals Among the tumult of 2025 was a November announcement from the SEC stating that it would reduce oversight of shareholder proposal disputes. Blaming ‘current resource and timing considerations following the lengthy government shutdown,’ the regulator said that it would end ‘substantial’ reviews of no-action requests under rule 14a-8, with the change applying to the proxy season running from October 2025 to September 2026 – as well as anything it hadn’t got to before the decision was made. You can read more about the…

-

Janet Craig: Ten things I am doing to up my IR game in 2026

Predictably, as I moved into the New Year, I thought about what I wanted to accomplish over the coming 12 months. There are many opportunities for professional development, but my focus is on areas where I can hone my craft, build relationships and pay it forward. Here are 10 IR things I want to do in 2026:

-

Looking back at a year of ‘The CFO’: How finance chiefs measure IR success

We’re rounding up another year of IR Impact’s flagship interview series The CFO, where we talk investor relations with finance chiefs from around the world. January 2026 will mark two years of speaking to finance leaders about all things IR. Kurt Barton from Tractor Supply Company was first in The CFO seat two years ago and Dominique Barker, CFO and head of sustainability at Canada’s Lithium Royalties Corp, closed 2025. We always ask CFOs a question about how they measure the success of their IR program, as the nature of the profession makes it notoriously difficult to assess. But proving…

-

The CFO: ‘Too much material can be a detractor to investment,’ says Lithium Royalty Corp finance chief

When she took the top finance role at Toronto-headquartered Lithium Royalty Corp, Dominique Barker brought her experience on the buy side, the sell side and in ESG advisory – all of which feeds into her approach to investor relations and sustainability. In the closing interview of our 2025 series of The CFO, Barker talks to IR Impact about finding a host of women in charge at a high-altitude brine, bridging the gap between mining and the energy transition, and the supper club she’s part of with multi-award winning IR Impact Awards judge Janet Craig.

-

‘It’s an opportunity to bridge two fast-growing markets’: Lessons from Emsteel Group on engaging Middle Eastern investors

As IROs look beyond traditional financial hubs to diversify their shareholder base, the Middle East represents a new and strategic capital venture. But with sovereign wealth funds, family offices and institutional investors playing an increasingly influential role in international markets, many companies still find the road to meaningful engagement in this region unclear.

-

‘We have radically rethought how to look at sustainability’: Christian Granquist on AP7’s new outlook

Christian Granquist joined AP7, one of Sweden’s national public pension funds – into which some 6 mn Swedes pay – in August 2025. Working alongside Jessica Eskilsson Frank, Granquist is senior portfolio manager, impact investments, climate transition at the globally invested fund that has total assets of around $150 bn. Before joining AP7, Granquist – who has a master’s in economics from Uppsala University – had a 10-year stint at Lancelot and worked at Handelsbanken for 13 years in a number of roles including chief investment strategist and co-head, equities. He talks to IR Impact about how the fund is…

-

How pre-IPO investor relations shapes long-term market success

The IPO journey doesn’t start on listing day. Companies that treat investor relations as an afterthought until the opening bell often find themselves scrambling to build credibility when it matters most. The statistics tell a sobering story: approximately only one third of newly listed companies outperform their already-listed peers over the long term. Poor financial communication sits at the heart of this underperformance. Building relationships before you need them Establishing an effective IR function well before your IPO creates something money can’t buy on demand: trust. When analysts and investors already know your story, understand your business model and have…

-

Philosophy and numbers: IR Impact briefing explores how AI is – and isn’t – changing earnings

‘Investors, analysts – everyone in financial markets – is consulting a vast amount of increasing data sources to inform their investment decisions,’ said Laurie Havelock, IR Impact editor, kicking off the recent briefing that brought together Jesse Rose, head of IR at Reddit, Dave Bezanson, vice president of IR and pensions at EMERA and Christopher Napolitano, account executive at AlphaSense, the event partner. While data opens up a world of insights, Havelock pointed to the added pressure it brings when IROs must distil everything that is out there into something they can deliver to the board. This, said Napolitano, is…

-

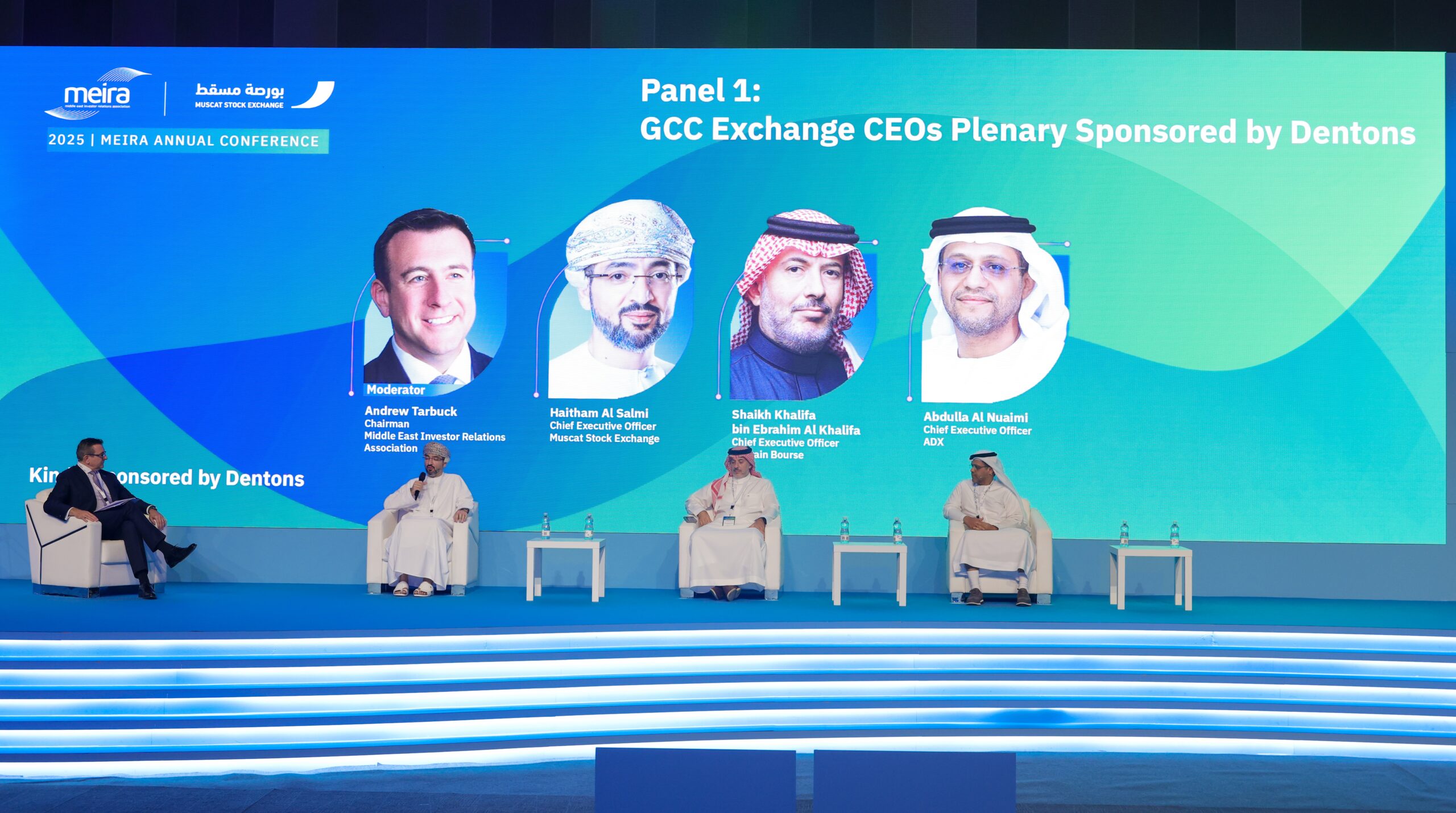

Meira Muscat 2025: From the role of the exchange to SWFs and debt IR

Over the past few years, the IR platform in the Middle East has been evolving quickly. Exchanges are maturing, listings are more regular and IR is moving beyond ‘results day’ toward a steadier focus on access, liquidity and clear communication. We’re seeing more structured targeting, more emphasis on guidance and capital allocation and better use of data that investors can actually work with. Sovereign funds are engaging in more targeted ways and many issuers are doing a better job of aligning the equity and debt stories. This came through clearly in Muscat. With more than 1,200 attendees in town, the…

-

Building an IR function: a strategic roadmap to success

From getting management buy in to running an IR audit and building an investor pipeline – a break down of the essentials that elevate the IR program Investor relations has come a long way. What used to be a compliance checkbox is now a strategic discipline that directly impacts your cost of capital, liquidity and valuation. The question isn’t whether IR adds value anymore, it’s whether you’re building the function correctly. This evolution changes how you build your team for success – whether you are expanding the IR department, coming in fresh, building out the team from scratch or growing…

-

‘I felt a mix of respect and fear’ going into IR, says Infineon’s multiple award-winning IR lead

German semiconductor firm Infineon Technologies has had a busy year. To start with, as revealed in the latest instalment of The CFO column, Dr Sven Schneider, the firm’s finance chief, told IR Impact about the 30 conferences and 20 roadshows the company has held this year. It has also been a year of huge success for the IR team, which took home some of the most prestigious IR Impact trophies at the Europe Awards in June, winning the best overall investor relations (large cap) category as well as the gong for best in sector, technology. The same night also saw…

-

Why listed companies should engage with hedge funds

I have been working as an IR professional for almost 15 years. To my continued surprise, I still meet peers who remain negative around hedge funds. In fact, they actively seek to minimize interaction. And if they do allow such meetings, they squeeze hedge fund managers into large group meetings, normally led by IR rather than management. To me, this approach is counterproductive. The role of the IR department is to safeguard a fair valuation of the share by communicating correctly to all relevant corners of the financial markets. I strongly believe that open doors and strong relationships improve liquidity…

-

‘IR is fun in good times but more important in bad’: Inaugural winner of the Best IR Impact award on managing a crisis

This is a story that is perhaps best started at the end, after Irina Zhurba of Mister Spex had won the inaugural trophy for Best IR Impact at the IR Impact Awards – Europe 2025. She took that gong in recognition of everything that makes IR so hard to measure, from rebuilding trust with dissatisfied shareholders – even taking calls at 5.00 am before climbing Machu Pichu – to supporting C-suite through leadership transitions, to managing a difficult activist situation. When that activist announced via press release its intent to sell a 7.6 percent stake in the German eyewear company,…

-

The sell side talks IR – part one: the value of research

Sell-side analysts occupy a pivotal position in financial markets. Through their in-depth research and recommendations, they exert influence on stock valuations, market liquidity and overall market dynamics. Their buy, hold or sell ratings can cause stock prices to rise or fall, impacting investor decisions. Upgrades often lead to price surges, while downgrades may result in declines.

-

AI for IR: How creating your own LLM could help you think and act like your investors

Recently Blackstone announced its plans to invest $500 bn in Europe over the next years. Did you see this coming and will some this capital flow into your company? Imagine if your IR department could predict with some certainty what your investors are going to think, say and do with respect to your company.

-

Activist nominees, ESG Trojan horses and tangible investor days: five things we learned at the IR Impact Think Tank – Europe 2025

Europe’s top IR leaders gathered in London to debate, discuss and learn in a series of panels, sessions and roundtables ahead of the IR Impact Awards – Europe 2025 What did more than 170 IR professionals head to London to talk about at the IR Impact Think Tank – Europe 2025? Everything from volatility and uncertainty (of course) to what makes an award-winning IR team and how to untangle yourself from the spilled alphabet soup of ESG and making the most of AI for IR. Panels were mixed with live polls, roundtable discussions, collaborative sessions and networking. We’ve picked five…

-

‘Prevention is better than remedy’: majority of investors say governance gaps attract activists, research shows

The majority of institutional investors credit poor governance practices as the biggest driver of shareholder activism, a new study from shareholder advisory firm SquareWell Partners has found. Some 84 percent of investors polled, who hail from North America, Europe (including the UK) and Asia, said that poor governance was the main driver of activist investor attention. The findings of SquareWell’s report, titled The Long and the Short of It: Institutional Investors’ Views on Activism, center around three key themes, views on activism, evaluation criteria and engagement dynamics. This finding means that the quality of a company’s governance framework is paramount and…

-

‘We’re thinking about what AI is going to destroy as much as what it’s going to create’: Jonathan Knowles of Compound Equity Group

Compound Equity Group (CEG) was founded in 2024 and seeks high-conviction, long-term ideas in global equities. The founder and portfolio manager in charge, Jonathan Knowles, spent more than 30 years managing money at Capital Group. At his time of retirement in December 2024, he was in charge of some $50 bn in assets and was the chief investment officer of the firm’s $70 bn small-cap fund – the largest such fund in the world. CEG has recently raised $500 mn in capital and is deploying a very long-term, highly concentrated approach: to have 20 to 25 investments with some positions…

-

Amid such a complex environment, IR’s job is to keep things simple

It’s certainly a wild time to be an IRO. While uncertainty is always present in the market, companies are dealing with major surprises far more frequently at the moment. On any day, corporate strategies and financial guidance could be thrown into doubt by a policy announcement, geopolitical shift or another factor.

-

The CFO: ‘You need to have a stomach of iron during times of volatility,’ says Block’s Amrita Ahuja

Many IROs hope that their time in the profession might set them up well for a C-suite position well one day. But for Amrita Ahuja, CFO and COO for payments company Block, the transition happened directly during her time as head of IR for interactive entertainment firm Activision Blizzard, where she was called upon to become finance chief of its video-game publishing wing Blizzard Entertainment in 2018. Fast forward a few years and she now holds the dual posts of CFO and – for the past two years – COO at Block, the financial technology company founded by Jack Dorsey,…

-

How long do you have to be ‘short’? Recent debate puts spotlight on the movements of short sellers

Short seller reports can have a huge impact on the stocks they target. Everyone from regulators to law firms and even Netflix are looking to the impact of shorting stocks – with one law firm arguing free speech is being put at risk In the stock market, the traditional way to make money is to buy shares in a company and wait for the share price to rise. Another way is to short a company and wait for the share price to go down and buy back the cheaper shares. If the share price goes up, those shares must quickly…

-

Taking management on tour: What’s the sweet spot for investor meeting attendance?

‘We’re spending more time with investors without our management team,’ Naji Baydoun, director of IR at Innergex, told IR Impact editor Laurie Havelock in the Global Roadshow Report 2025. ‘Maybe at the beginning of the [2024] we were spending 10 percent of our investor engagements without management and now we’re up to about 25 percent with just the IR team,’ explained Baydoun. ‘That’s because we’ve built relationships and trust with those investors, so I’m happy about that.’ According to IR Impact’s 15th annual research report into the who, where, how and why of corporate roadshow activity, there has been a…

-

How to talk tariffs: IR in the new era of uncertainty

The US economy is in ‘a period of transition,’ US President Donald Trump told Fox News on Sunday. By close of trading on Monday, the US S&P 500 had dropped almost 3 percent, with tech stocks taking a particularly heavy hit. Weeks of back and forth as Trump threatened tariffs, paused tariffs, reintroduced tariffs – and saw retaliatory levies by affected markets – finally came to a head.

-

IR Impact Masterclass: how to maximize your relationships with the buy side

Stephen Yiu, fund manager and co-founder of the Blue Whale Growth Fund, reveals how IR teams can make the most of their buy-side connections. Welcome to IR Impact’s Masterclass video series, where leaders and experts from across the capital markets share their insights, strategies and experiences to provide you with in-depth knowledge and practical skills to excel in your IR journey. Each IR Impact Masterclass will delve into critical topics, offering valuable perspectives and actionable advice. Whether you are looking to enhance your expertise, stay ahead of industry trends or gain a competitive edge, these long-form videos are your gateway…

-

Why UK and European corporates are building investor relations capabilities in the US

In an increasingly interconnected global economy, many UK and mainland European corporates are strategically expanding their investor relations capabilities beyond their home market