IR Impact Forum – AI & Technology Europe

Lead the change: AI strategies for tomorrow’s IR

America Square Conference Centre, London

About the event

Stay ahead. Harness AI. Transform IR.

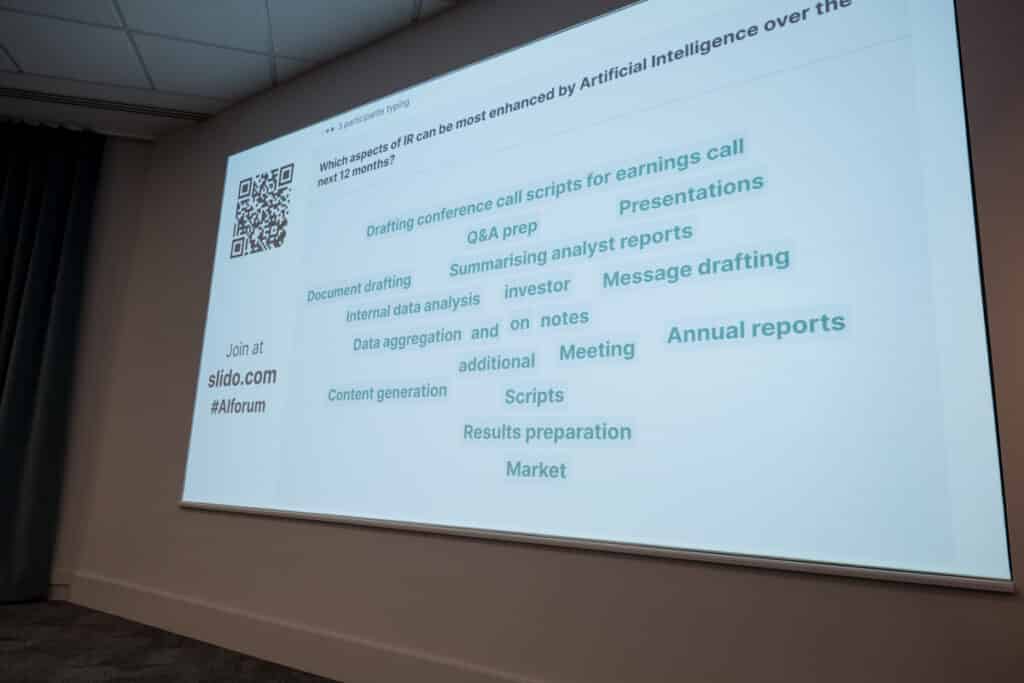

In today’s rapidly evolving financial landscape, AI is transforming how IROs engage with investors, analyze market sentiment and deliver insights. Yet, many IR teams face challenges in understanding and employing these tools effectively.

WHEN

WHERE

America Square Conference Centre, London

The IR Impact Forum – AI & Technology Europe on Thursday, March 12 in London is designed to give you the knowledge and confidence to lead the AI-driven transformation that is happening in IR. It is not just theory, it’s practical guidance from buy-side veterans, technology innovators and IROs already successfully using AI.

Through hands-on workshops and practical demonstrations, you’ll leave with structured guidelines that help you implement AI responsibly to enhance and develop your IR strategy.

If you want to stay competitive and future-proof your role, this is the event you cannot afford to miss.

New for 2026!

Prior to the event, all attendees will receive an eBook containing background reading on the programme and speakers and reference materials.

Agenda: 2026

If you are interested in being a panelist, please contact Andrew Gibbons on [email protected].

Times are shown in Greenwich Mean Time (GMT).

Timings are subject to change.

8.15 am

Registration, refreshments and networking

8.55 am

Welcome to the forum

Steve Wade, head of content, IR Impact

9.00 am

Navigating the AI and tech evolution: what IR professionals need to know now and next

AI is influencing businesses, communications and investor relations… this much you already know! However, you may ask yourself if you’re being left behind or want to get ahead of the curve.

That’s where our first session comes in: We forensically examine the current state of AI and tech in investor relations and predict future trends and use cases that IR teams should explore to keep ahead of the curve in this rapidly evolving area.

- Examine what today’s IROs need to succeed and evaluate whether recent changes among technology providers are truly delivering on those expectations

- Understand what an award-winning IR strategy looks like and benchmark your own usage against your peers

- Gain strategic insights into managing the regulatory complexity surrounding AI and learn how to anticipate disclosure requirements for AI ethics, bias and data governance

- Explore best practices to find, evaluate and implement the most relevant tech for your business needs

- Debate where the market is going and what the future will look like.

9.30 am

Workshop – Decoding the new buyside mindset: how language shapes investor perception

Investors have long relied on technology to analyze the words and tone used by public companies and this practice is now advancing at speed, with new tools making analysis more sophisticated and widespread across the investment community.

In this workshop, you’ll learn how investors are leveraging these capabilities and what that means for your communications strategy. Discover practical ways to refine your messaging and get hands-on experience with tools that assess language in both secure, private environments and through deeper analysis of public disclosures.

10.05 am

Building trust and governance within your AI-driven workflows

AI is becoming an essential tool for IR professionals. It can help with earnings call preparation, investor targeting, ESG reporting and real-time sentiment analysis, but as adoption grows one challenge remains constant: trust. AI cannot be a black box within your company, for IROs to use it effectively and responsibly it must be explainable, transparent and well governed.

This panel will show you how to integrate AI into your IR workflows in a way that builds confidence with stakeholders, encourages further AI usage while still meeting regulatory expectations.

- Gain strategic insights into navigating a fragmented AI regulatory landscape and understand where these evolving regulations impact the use-cases within investor relations. Allowing you to maintain up-to-date in-house usage policies and educate stakeholders on security and compliance issues

- Discover how to accurately disclose AI usage in your workflows, both internally and externally

- Best practices for overcoming internal resistance and building trust in AI among management and stakeholders.

10.35 am

Networking break

11.05 am

Workshop – Boosting IR efficiency in market intelligence with Google NotebookLM

This workshop focuses on the free features in Google Notebook LM that can help you improve efficiency and accuracy within your IR workflows.

By the end of this session, you will have real-world experience in:

- Organizing investor decks and reports for quick AI-driven insights

- Creating mind maps to simplify complex financial narratives

- Generating audio summaries for earnings calls and presentations

- Using multilanguage support for global investor communication

- Collaborating securely with your team in real time

- Summarizing large documents and extracting key points efficiently.

11.40 am

Showcasing the impact: How to build a clear AI for IR strategy that demonstrates measurable ROI

Artificial Intelligence is everywhere, but turning hype into implementation and measurable ROI needs a solid plan in place.

This panel will dive into what it really takes to craft a successful AI strategy that aligns with your business goals, receives stakeholder buy-in and delivers results that you can prove through clear metrics.

- Discuss what makes an AI strategy successful, who needs to be involved and how to keep it current

- Examine the benefits of moving from experimentation toward integrating AI in broader IR workflows instead of leaving them as isolated tasks

- Debate the best fit AI format – build in-house or buy off-the-shelf

- Explore what ROI really means and discuss why both tangible and intangible benefits matter

- Learn which KPIs IR teams are using to measure AI’s impact and show clear proof of improved efficiency, accuracy, quality and productivity

- Hear what strategies your peers are using and how they are effectively monetizing AI.

12.15 pm

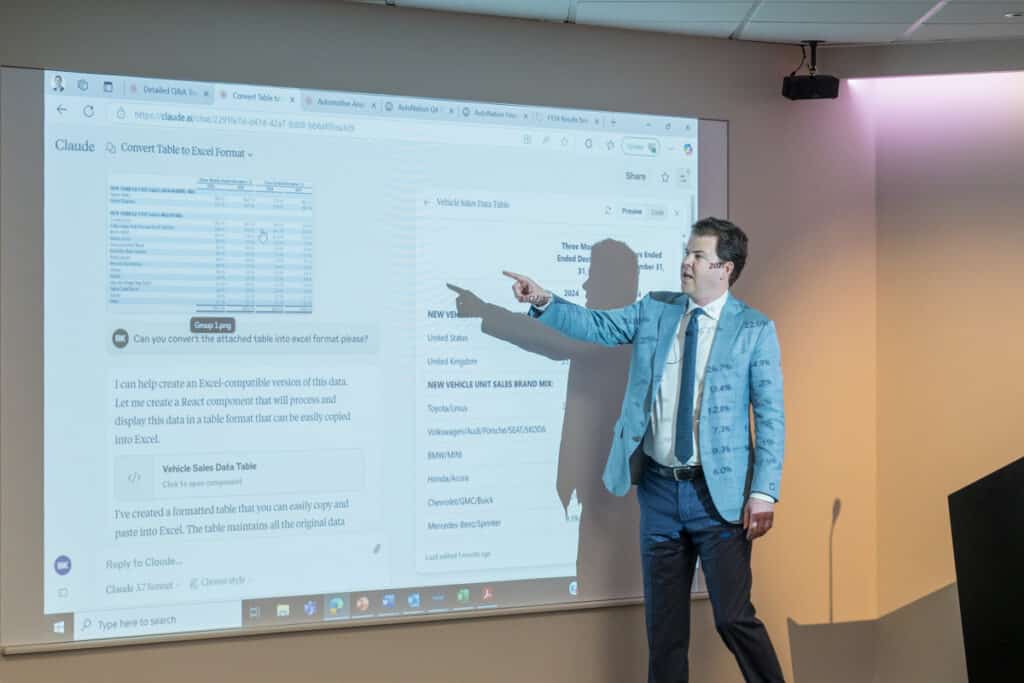

Demonstration – prompt engineering: starting, building and achieving desired outcomes

Successful prompts are the foundations that make AI work for you effectively. This demo will give you a step-by-step guide to create prompts to help create IR content that matches your company’s voice. Hear actionable insights into how to continually nurture them and train models to get clear, useful answers. You’ll also learn how to make sure prompt responses are accurate and reliable, so you can trust what you share.

- Understand best practices for preparing, creating and using successful prompts that IR teams can use.

- Learn how to craft prompts that have the correct tone, structure and language to mirror your company’s strategy

- Discover actionable strategies to avoid hallucinations and biased data

- Gain practical insights into ensuring your prompts include all relevant data points and context.

12.50 pm

Lunch

1.50 pm

Agentic AI: what is it and what are the opportunities and risks

Agentic AI promises smarter workflows and deeper engagement giving IROs more time to be creative and strategic, but it also raises new challenges. Listen to thought-leading IROs explore what Agentic AI is, why it matters and how it will affect you.

- Define what Agentic AI is and consider the regulatory uncertainties surrounding its implementation

- Explore how Agentic AI supports real-time engagement analytics, strategic communication and intelligent data analysis to deliver actionable insight

- Examine ways to develop and scale that are well governed and compliant

- Discuss how Agentic AI can help IROs measure how effective their outreach is, spot areas that need improvement and fine-tune engagement strategies

- Consider the limitations and future developments of Agentic AI.

2.25 pm

Workshop – Leveraging AI and technology to modernize earnings call preparation and execution

Earnings calls are no longer just about reporting numbers. Success now depends on how quickly and clearly you communicate. Stakeholders expect instant access to information and authentic commentary from management without delays or resistance. They want to engage in real time and have the flexibility to revisit the content later in formats that suit them whether that’s live audio video or on-demand transcripts.

This workshop will give you a practical guide to overcome these challenges by helping you –

- Recognize how to leverage AI for drafting scripts, rehearsals and real-time analytics without disrupting your established processes

- Learn strategies to sift through the noise of all the financial and market data to craft clear, investor-focused messages

- Explore tactics to manage volatile market sentiment and prepare for unexpected questions during live Q&A

- Understand how to use AI-driven post-call analytics to capture investor feedback and sentiment for continuous improvement.

3.00 pm

Deciphering how investors and analysts use AI and how to keep ahead of the curve

AI is shaking up the way investors spot opportunities, dig into companies and decide where to put their money. For IROs, that means a whole new set of challenges. Figuring out how these AI-driven strategies work, making sure your company is attractive to algorithm-driven searches and keeping your story consistent in a world obsessed with data, to name a few.

In this panel, we’ll talk about how the buyside and sell side are really using AI, what that means for IR teams and share practical tips to help you stay ahead of the curve.

- Understand what specific data the analysts are looking for when deciding where to invest and which AI-powered channels they are using to gather this information

- Learn how to use AI internally to audit your communications, benchmark against peers and understand how investors’ algorithms might score your company

- Gain practical strategies for creating stronger investor relationships in an environment that increasingly relies on AI to discover, analyze and summarize information

- Discuss tactics to anticipate investor questions and prepare rapid-response tactics to manage narratives before algorithms amplify misinterpretations

- Learn how to craft AI-friendly messaging without losing authenticity

- Consider the role that Search Engine Optimization (SEO) and Generative Engine Optimization (GEO) play in maximising visibility.

3.30 pm

Networking break

4.00 pm

Workshop – Harnessing AI for investor targeting and shareholder analysis

IROs need to identify and engage the right investors. In this hands-on workshop, we will look at how IROs are using AI to analyze ownership patterns, predict investor behavior and segment prospects based on their interests for example ESG focus, growth vs. value strategies.

Here you will use AI to –

- Analyze shareholder registers and institutional holdings

- Predict investor churn or interest based on historical data

- Build investor profiles with AI-driven insights

- Explore tools for prioritizing outreach and engagement.

4.30 pm

AI-Driven market intelligence and benchmarking for the modern IRO

IR teams are under pressure to deliver insights fast. Understanding the market and effective benchmarking are essential skills to do so, but the processes are often slow and manual with the required data scattered across countless sources. This panel explores the challenges IR professionals face and how AI can make the process smarter, faster and more effective.

- Learn practical ways to make peer benchmarking consistent and comparable

- Consider how predictive analytics can support the shift from reactive communication to proactive engagement – helping control the narrative, anticipate investor concerns and improve risk management

- Discuss the limitations and opportunities of applying AI to interpret market signals, understand investor expectations and forecast emerging patterns in behavior and performance.

5.00 pm

Summary and closing remarks

5.10 pm

Drinks reception

6.10 pm

End of drinks reception

Speakers: 2025

What our attendees say

Who attends our events

Our attendees are leading IR practitioners with an established track record and strategic IR role within their company.

Below is a sample list of our past attendees:

| JOB TITLE | COMPANY |

|---|---|

| Associate | Carlyle |

| CFO | Hexagon Composites ASA |

| Corporate development director | Pollen Street Capital |

| Deputy, head of IR | Halma |

| Director, communications | Oxford Nanopore Technologies |

| Director, IR | Fevertree Drinks |

| Director, IR | GSK |

| Director, IR | YouGov |

| ESG IR manager | ArcelorMittal |

| Group head of IR | BAT |

| Head of IR | Afentra |

| Head of IR | Close Brothers Group |

| Head of IR | Subsea7 |

| Head of IR, M&A, ventures | Aperam |

| JOB TITLE | COMPANY |

|---|---|

| Head, sustainability | B2 Impact |

| IR analyst | Deutsche Rohstoff |

| IR analyst | Scancom (MTN) |

| IR and strategy | Workspace |

| IR manager | Bekaert |

| IR Manager | Severn Trent |

| IR operations director | GSK |

| IR, senior manager | Schneider Electric |

| Manager, IR | Sanoma Corporation |

| Senior IR manager | BAT |

| Senior IR manager | BP |

| Senior IR manager | Foresight Group |

| Senior M&A and IR analyst | Solid State |

| VP, IR | BP |

Venue information

Accommodation

We have arranged preferential rates for attendees at nearby hotels. View the hotels and rates by clicking here.

Thinking of becoming an event partner?

Our events provide a unique opportunity to get in front of some of the most influential people in the IR community. As a partner, you will gain an extensive amount of exposure through a wide range of print and digital marketing materials, both pre and post event, as well as on the day itself. Additionally, you can use the event to align yourself with IR excellence and network with key decision makers from across the region – the ones pushing the profession forward through innovation.

Book your place

If you have any questions, please contact Thomas Williams on [email protected] or +44 208 090 2156.

CORPORATE TICKET

£495

£195

FIRST RELEASE RATE

- All panel discussions

- All networking sessions

- All catering including breakfast, lunch and breaks

- Networking drinks reception

- Post-event access to the workshop materials

10 tickets remaining at first release rate

NON-CORPORATE TICKET

$1,295

$595

FIRST RELEASE RATE

- All panel discussions

- All networking sessions

- All catering including breakfast, lunch and breaks

- Networking drinks reception

- Post-event access to the workshop materials

5 tickets remaining at first release rate

Gallery

Key insights into the latest trends and best practices

Why IROs need to understand generative engine optimization, or GEO: a beginner’s guide to the AI best practice

I probably shouldn’t admit this, but while I was gardening the other day – pruning a rather unruly hydrangea – I found myself mentally reviewing my IR program for the year. Yes, I do have a life outside of investor relations, but sometimes the brain wanders where it pleases. There I was, shears in hand, quietly checking off the usual suspects: upcoming press releases and investor campaigns, roadshows, the media strategy, stakeholder engagement, ESG reporting, etc. It all felt satisfyingly under control – until I realised there was one thing I didn’t know much about: generative engine optimization (GEO).

AI for IR: How creating your own LLM could help you think and act like your investors

Recently Blackstone announced its plans to invest $500 bn in Europe over the next years. Did you see this coming and will some this capital flow into your company? Imagine if your IR department could predict with some certainty what your investors are going to think, say and do with respect to your company.

‘A chatbot can’t capture the CEO’s voice’: The real role of AI in earnings prep

The technology can streamline the earnings process, experts agreed on a recent IR Impact briefing How can AI best be employed in your earnings preparation? According to leading IR experts, it’s best not to make a facsimile of your CEO, but the technology can certainly help save time and leave you to concentrate on more […]

Contact us

IR benchmarking tool

Instant comparison data at your fingertips. This advanced tool provides real-time analytics comparing your IR program to peers in your region, sector, and cap size. Evaluate your program’s strengths and uncover opportunities for growth with key IR metrics covering:

- IR budgets

- Team size

- Reporting lines

- Sell-side analyst coverage

- Investor meetings

Fast, intuitive and packed with tailored insights, it’s the ultimate resource for building a smarter, data-driven IR strategy.

Upcoming events

-

Briefing – Are investors finding your IR content in AI?

In partnership with WHEN 8.00 am PT / 11.00 am ET / 4.00 pm GMT / 5.00 pm CET DURATION 45 minutes About the event AI is transforming how investors and analysts access company information. Increasingly, earnings reports, disclosures and IR websites are being read first by algorithms and large…

-

Think Tank – West Coast

Our unique format – Exclusively for in-house IRO’s The IR Impact Think Tank – West Coast will take place on Thursday, March 19, 2026 in Palo Alto and is an invitation-only event exclusively for senior IR officers. Our think tanks are free to attend and our unique format enables participants to network extensively, and discuss, debate and dissect…

-

Awards – US

About the event The IR Impact Awards – US will take place on Wednesday, March 25, 2026 in New York. This very special event honors excellence in the investor relations profession across the US. WHEN WHERE Cipriani 25 Broadway, New York Celebrating IR excellence Since the annual event first launched…