Going public

Our knowledge bank of resources for IR professionals approaching an IPO.

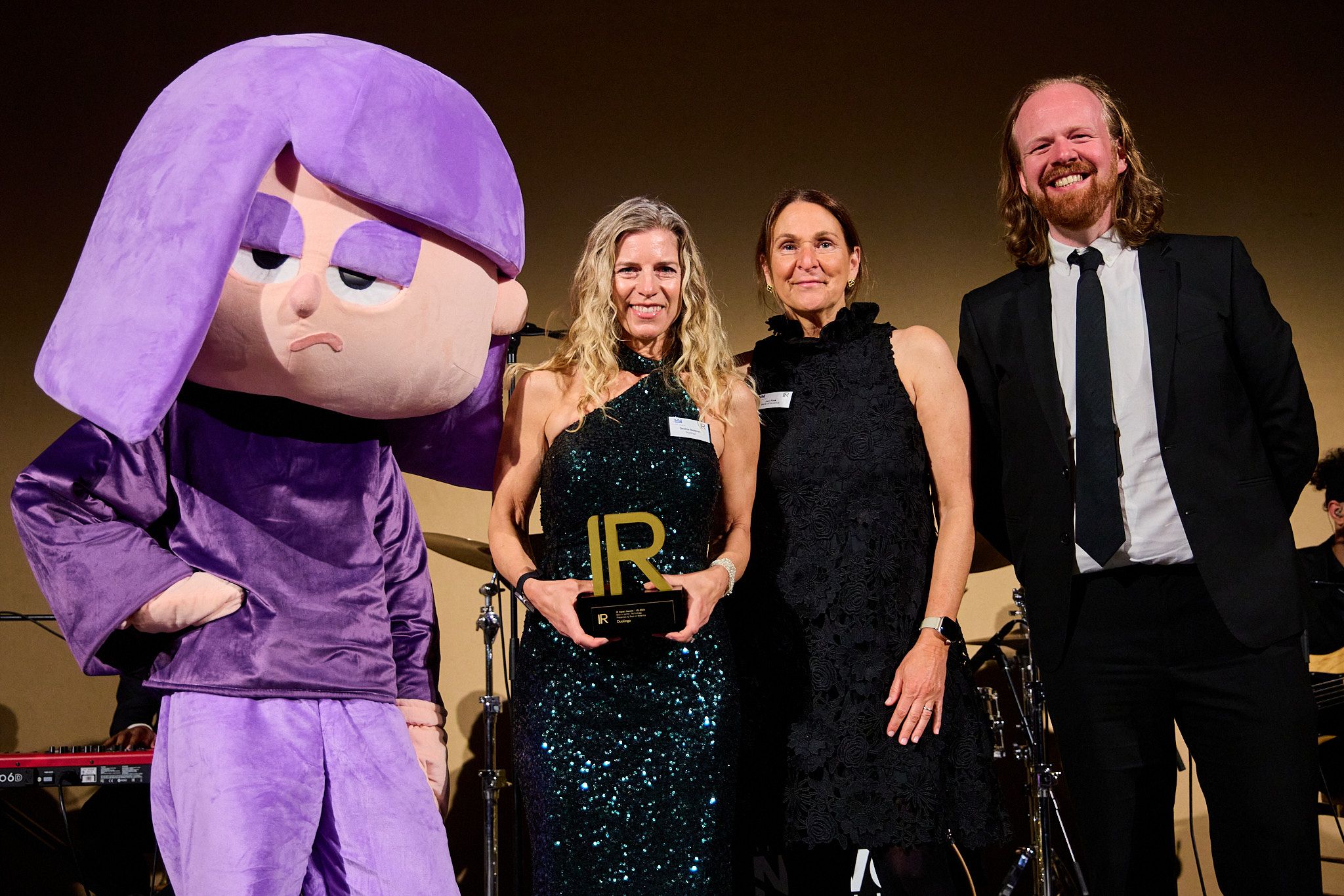

‘I love when investors start a meeting by showing me their streak’: Duolingo’s Debbie Belevan on life after an IPO

At this year’s IR Impact Awards – US 2025, Duolingo’s head of IR Debbie Belevan swept the board, picking up trophies for best overall IR – mid cap, best IRO – mid cap and best in sector – technology. All of this came just a few years after Belevan joined the language learning app in 2021 as its VP, IR two weeks before the company’s IPO. Since then, Duolingo has seen exponential growth in both its share price and subscriber base. Debbie has become an active member of the IR community, serving as a board member for NIRI.

People moves: Autodoc names new IR lead as $2.8 bn IPO looms

Stefanie Steiner has taken up the IR reins at Autodoc as it prepares an IPO expected to value it at $2.8 bn. Writing on LinkedIn this week, she says: ‘I am excited to share that I will embark with #AUTODOC on the next stage of my journey. About a week ago, I joined the new team and had a very warm welcome. In such a technology-driven company I have to familiarize myself not only with business model, strategy, financials and the large market that has enormous potential in the years to come, but also with many new programs and tools.…

Forecasting discipline: The cornerstone of IPO readiness for IR teams

An IPO isn’t the finish line; it’s the start of a new playbook where credibility and execution become critical drivers of long-term value. Among the many pillars of IPO readiness is a sound and disciplined forecasting methodology. Companies that thrive after going public are the ones that start practicing disciplined forecasting early and consistently hit the targets they set, long before the S-1 is even filed.

People moves: eToro promotes PR manager Ilaria Pattareeya Luca to IR role after IPO

Trading platform eToro has promoted its former global PR and communications manager Ilaria Pattareeya Luca to its IR team following its recent IPO.

Reddit leads nominations just one year after its IPO ahead of the IR Impact Awards – US 2025

Other companies topping the shortlists include Duolingo, Moody’s Corporation, JPMorgan Chase & Co and GE Aerospace The IR team at Reddit will hope to turn a successful IPO year into a successful night of award wins, after the social media company picked up six nominations at the upcoming IR Impact Awards – US 2025. The […]

Risk vs return: Weighing up the pros and cons of pre-IPO IR

We hear from IR, recruitment and consultants on how a lack of IR stands out as a ‘natural IPO-readiness gap’

Opening bell: The story of the only company to complete an IPO on TSX in 2023

Lithium Royalty Corporation’s president and CEO discusses listing success and the business model that allowed it to buck the trend

Why Puig Brands’ post-IPO performance shows confidence must take precedence over the stock price

High valuations followed by disappointments lead to years of broken trust, says Ricardo Jiminez The greatest asset for any listed company is investor confidence. It is the fundamental pillar that encourages fund managers to invest their money. But companies often believe that their best asset is to keep the share price as high as […]

The opportunity and risk of an IPO: How IR can navigate public floats

An IPO always marks a significant milestone in a company’s trajectory. At this point, the business model is validated by the market assigning it a price and a valuation. Regardless of the reasons motivating a company, however – whether it is for the founders to partially divest, finance growth through a capital increase, use the […]

Making waves: Eco Wave Power CEO on building trust through the IPO

Founder of Nasdaq First North-listed firm on weathering the fossil fuel rally and why stock price matters less in such a new sector

How Reddit’s IPO and direct share program will impact the market’s momentum

Enjoy access to this and more – for free! Log in or create your free My IR – Essentials account to: Get access to 3 free IR deep dives More than 100 pieces of insight, plus our exclusive CFO interviews Save favorites and get personalized content on your dashboard Enjoy 10% off all IR forums […]

Google: the IR behind its IPO

‘Google is not a conventional company,’ reads the the company’s S1, which was filed with the SEC on April 29. And conventional is certainly not the route the company is taking with its IPO.Google has chosen the Dutch auction method to list its shares on Nasdaq, which allows prospective investors to enter a bid for […]

Create your ‘My IR’ profile

Customize your experience by signing up for a free or paid account below:

- Create your own MY IR personalized dashboard tailored to your interests

- Bookmark your favorite articles and access them anytime

- Compare your IR program against your IR peers with an interactive benchmarking tool

- Dive into expert articles on emerging trends and IR challenges