Garnet Roach

Garnet Roach, an Aviva Investors Sustainability Media Awards winner, joined IR Impact in 2012. A City University journalism graduate, she previously freelanced across technology, politics, and finance, including reporting in Sana’a, Yemen. She has written for GlobalPost.com, PC Advisor, and The Big Issue.

Authored articles

-

‘The word ‘Texas’ means friend, and all are welcome!’ Barrow Hanley on its long-term value focus

Patricia Barron and Mark Giambrone talk about Texas, when IR-only meetings work and how often the investment management firm likes to meet before it buys in As companies eye Texas – and Dallas in particular – as a roadshow destination, the Lone Star State has been pushing forward its business-friendly appeal with the new Texas Stock Exchange poised to begin trading next year, listings already in place on NYSE Texas and new legislation. Patricia Barron, executive director, chief operating officer and head of risk at Barrow Hanley, and Mark Giambrone, the investment management firm’s executive director, head of US equities…

-

The sell side talks IR – part two: those crucial coverage numbers

In a series of anonymous conversations – with identifies protected in order to get frank responses – IR Impact talked to sell-side analysts about their relationships with IR professionals. In part one, we looked at the value of research – from both the IR viewpoint and from the sell side, including advice from analysts on how they felt IR could improve data sharing, face time, responsiveness and more – all the elements that go into a good IR-sell-side relationship.

-

The CFO: ‘We’ve done 30 conferences and 20 roadshows this year,’ says Infineon’s Dr Sven Schneider

Semiconductors and chips might be synonymous with Taiwan. But Germany’s Infineon Technologies is not only growing its own market share in key industries but is helping to drive forward the EU’s goals on chip manufacturing – captured in the European Chips Act, which aims to double the bloc’s share of global chip production to 20 percent by 2030. Infineon also happens to excel at investor relations, taking home some of the most prestigious awards at this year’s IR Impact Awards – Europe. The firm won the gong for best overall investor relations (large cap); best investor relations officer (large cap)…

-

‘IR is fun in good times but more important in bad’: Inaugural winner of the Best IR Impact award on managing a crisis

This is a story that is perhaps best started at the end, after Irina Zhurba of Mister Spex had won the inaugural trophy for Best IR Impact at the IR Impact Awards – Europe 2025. She took that gong in recognition of everything that makes IR so hard to measure, from rebuilding trust with dissatisfied shareholders – even taking calls at 5.00 am before climbing Machu Pichu – to supporting C-suite through leadership transitions, to managing a difficult activist situation. When that activist announced via press release its intent to sell a 7.6 percent stake in the German eyewear company,…

-

People moves: Jeannie Ong joins Temasek and Tom Waldron moves to Springer Nature

Jeannie Ong, the multiple IR Impact Award winner and South East Asia Awards judging regular, has announced her new position at Temasek, which manages a Singaporean government fund with a portfolio worth S$434 bn ($339 bn). In her new role as operating partner, investor relations, Ong tells IR Impact that she ‘leads initiatives to build capabilities and drive alignment across Temasek’s portfolio companies in the area of investor relations.’ She adds: ‘Super excited to be doing what I love again to raise the bar for IR in Singapore!’ Ong brings more than 25 years of experience in the telecommunications, media…

-

The sell side talks IR – part one: the value of research

Sell-side analysts occupy a pivotal position in financial markets. Through their in-depth research and recommendations, they exert influence on stock valuations, market liquidity and overall market dynamics. Their buy, hold or sell ratings can cause stock prices to rise or fall, impacting investor decisions. Upgrades often lead to price surges, while downgrades may result in declines.

-

The CFO: ‘When there’s profit, we’ll be ready’ – Norcod’s finance chief on being a pre-profit company in uncharted waters

Nordcod, listed on Euronext Growth and the Oslo Stock Exchange, is seeking to do with cod what the seafood industry has already done with salmon: turn it into a year-round, accessible food source. There are challenges, ranging from the biology of the Atlantic cod to the growing media scrutiny that surrounds seafood and fishing. Still, Stian Vollan-Hansen, the Norwegian firm’s CFO, believes that Norcod can make cod farming work – for the company and its investors, for the customer and, crucially, for the fish and their surrounding environment.

-

From IR to finance chief: Sinclair Names Narinder Sahai as CFO

Media firm Sinclair – which owns, operates or provides services to 185 television stations in 85 markets – has announced former IR professional Narinder Sahai as its new executive vice president and CFO. Sahai joins from Arcis, a leading leisure and hospitality operator, where he led financial planning, accounting, tax, treasury and debt investor relations as the company’s CFO. He was also previously CFO at powersports platform RumbleOn, a role that saw him work on transformative acquisitions. Before working at RumbleOn, Sahai was at Amazon Web Services, where he serves as head of worldwide go-to-market finance for compute and AI/machine…

-

Activist nominees, ESG Trojan horses and tangible investor days: five things we learned at the IR Impact Think Tank – Europe 2025

Europe’s top IR leaders gathered in London to debate, discuss and learn in a series of panels, sessions and roundtables ahead of the IR Impact Awards – Europe 2025 What did more than 170 IR professionals head to London to talk about at the IR Impact Think Tank – Europe 2025? Everything from volatility and uncertainty (of course) to what makes an award-winning IR team and how to untangle yourself from the spilled alphabet soup of ESG and making the most of AI for IR. Panels were mixed with live polls, roundtable discussions, collaborative sessions and networking. We’ve picked five…

-

‘European investors are better prepared than US ones’: Inside the one-woman IR show at Central Garden & Pet

How did Friederike Edelmann end up where she is today? The West Coast-based IR lead for Central Garden & Pet has two decades of global IR experience under her belt – working on everything from IPO preparation to pandemic IR and micro-cap to mega-cap companies – but it all started back in Germany ‘way back when’. She speaks to IR Impact about juggling IR with other responsibilities (she manages ESG and external communications for Central), managing in-person engagements when your operations are remote and what she would have been doing if she hadn’t gone into corporate finance. You can also…

-

‘She significantly shaped IR in Germany’: in memory of Magdalena Moll

Magdalena Moll, or Maggie as many called her, recently passed away. She remains at the top of the IR Impact Awards league tables, having dominated the most prestigious positions in the Europe Awards year after year as the lead for German chemicals giant BASF. Some years there were humorous groans as she stepped up to claim yet another trophy. Once, when this writer asked for her views (yet again), she said quite seriously that she had nothing left to say, having been tapped for her thoughts on IR best practice too many times. Laurie Havelock, IR Impact editor, recalls Moll…

-

All wrapped up: how Deutsche EuroShop sparked conversation with AI action figures

What did it take to turn Patrick Kiss, IR Impact Award-winning investor relations lead at Deutsche EuroShop, into a fully boxed action figure? Well, it needs a spark of creativity, a ChatGPT Pro account plus a lot of patience. ‘To give you an idea of the work involved, the final optimized prompt for my own action figure had 304 words in 66 lines with more than 2,200 characters,’ says Kiss. This is something of a side step from the usual conversations around AI for IR, where the focus is on saving time for IROs paddling against the current of increasing…

-

People moves: Standard Lithium charges up IR with new hire

US lithium producer Standard Lithium has announced two new names to its executive team, including a new investor relations lead. David Rosen joins the Arkansas and Texas-focused firm as its new vice president of strategy and investor relations, with the company also naming Tim Sobel as vice president of health, safety, social and environment (HSSE). Rosen joins Standard Lithium from a director of integration role at Rio Tinto, a position that saw him play a ‘key role in the post-acquisition integration of Arcadium Lithium’ into the mining company, according to a press statement. In that capacity, Rosen led ‘cross-functional initiatives…

-

The CFO: ‘Don’t wait too long to make changes,’ says Central Garden & Pet finance chief

Visit the executive page of Central Garden & Pet, the Walnut Creek, California-headquartered company, and you get an immediate sense of just how much the C-suite is tied to the company: instead of the typical suit-in-a-boardroom shot, it’s a case of bring-your-pet-to-work day. Brad Smith, who was promoted from his role as finance chief for the firm’s pet segment to group CFO eight months ago, brought in his French bulldog. Elsewhere there are labradors, maybe a couple of poodle mixes and a cat, though Smith points out that dogs are definitely the more cooperative choice. Smith talks to IR Impact…

-

People moves: Autodoc names new IR lead as $2.8 bn IPO looms

Stefanie Steiner has taken up the IR reins at Autodoc as it prepares an IPO expected to value it at $2.8 bn. Writing on LinkedIn this week, she says: ‘I am excited to share that I will embark with #AUTODOC on the next stage of my journey. About a week ago, I joined the new team and had a very warm welcome. In such a technology-driven company I have to familiarize myself not only with business model, strategy, financials and the large market that has enormous potential in the years to come, but also with many new programs and tools.…

-

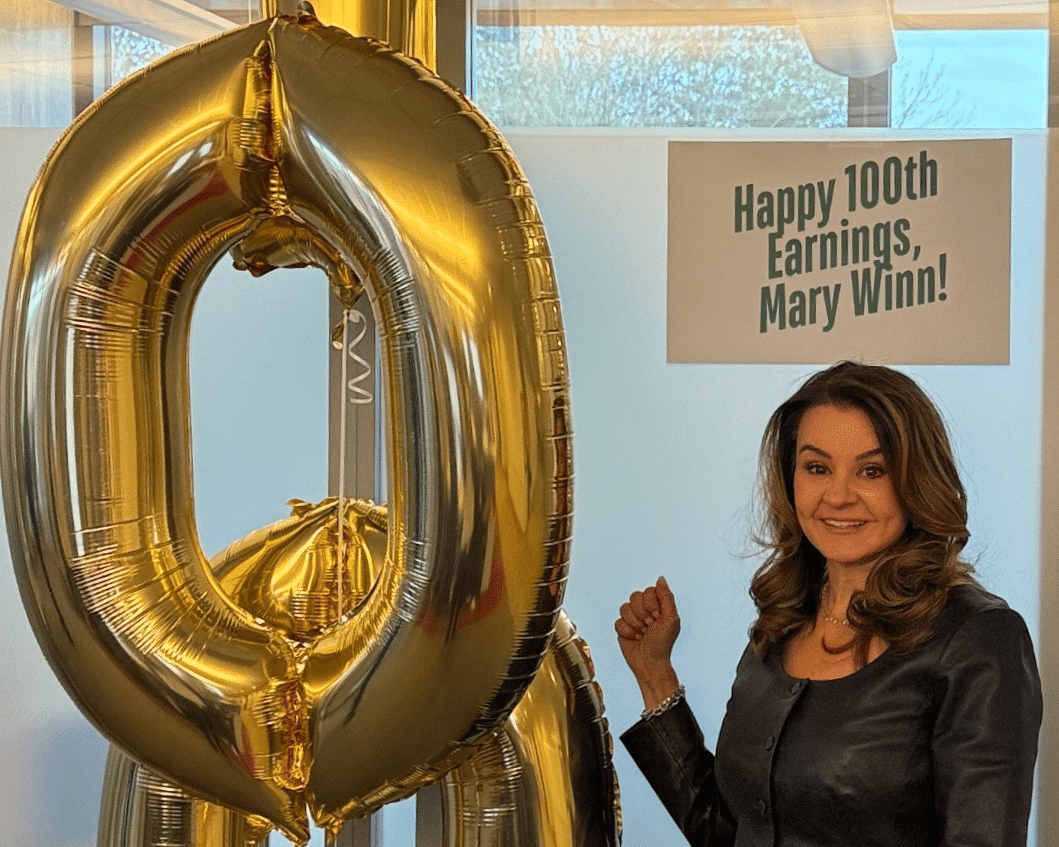

‘Earnings are our Super Bowl halftime show’: Tales from 100 quarterly updates with Mary Winn Pilkington

Earlier this year, Tractor Supply Company (TSC)’s Mary Winn Pilkington celebrated her 100th earnings call – with balloons, cake and the typical quarterly stress to match. ‘In IR you touch on everything – that’s probably part of the reason I have stayed in investor relations for 25 years,’ she says. ‘Every day is different and you get to work with the smartest people inside the company. ‘You’re working with people that are on the board or the management team, you’re working with high potential individuals that have been given strategic projects to work on,’ she adds. ‘Then, outside of the…

-

‘People aren’t robots’: How can companies support mothers in their IR teams?

How do you keep a mother in investor relations? How do you support her in a way that keeps diversity of knowledge and experience climbing the corporate ladder? This is a very difficult act to balance, with our recent article on the topic hearing from high-functioning, street facing women who hold senior positions while also raising children. And as Debbie Nathan of Debbie Nathan Associates explained, the issue of childcare is not one that men ever raise in the recruitment process: this is predominantly a female issue. So what should companies be doing to make sure that women feel they…

-

IR time management: the holy grail for today’s investor relations professionals

It’s no secret that the IR workload has been expanding – even as resources fail to match pace. At the same time, market uncertainty has made the day-to-day less predictable. The result is that the modern IRO is busier than ever. This was something Erik Carlson, chief operating officer at Notified pointed to early in a recent webinar titled: Strategic time management for today’s IRO. ’If look at the challenges in the market, the rise in distrust of the media, the proliferation of content – it’s becoming harder and harder to cut through the noise, to synthesize information and do…

-

The sustainability Taliban, the eco right and why we need a new language for ESG: down the rabbit hole with Robert Eccles

When Robert Eccles wrote a piece called Grift capitalism: The GOP’s brilliant strategy for ripping off ordinary Americans, it received the usual dose of online hate mail. It also led to a challenge: if you can find a conservative that thinks sustainability is good for capital markets, will you stop ‘writing nasty stuff’ about Republicans? That led him to the position he speaks from today: a liberal ex-hippy who has found common ground with the so-called ‘eco right’. Eccles, a well-known author and lecturer who has been writing about non-financial metrics since the early 1970s, had already become frustrated with…

-

Mothers of IR: From babies at conferences to the metaphorical ‘sticky floors’ beneath the glass ceiling

If you were at an investor event in May 2022 alongside alternative defense firm Axon, you might have spotted a rather unusual attendee: the softest of blonde hair, pacifier in place and no socks on their feet. This was Andrea James’ third child getting a fast-track induction to IR so that James could continue breastfeeding as she worked a high-profile, Street-facing job. Today, James is finance lead at Oncocyte. But she isn’t just a CFO, nor just an IR Impact Award-winning former head of IR either. On her CV she proudly lists the position of ‘co-founder at Family Inc’. Check…

-

The CFO: ‘My best advice comes from a former marine – embrace the suck,’ says Andrea James of Oncocyte

Earlier this year, Andrea James – the IR Impact Award-winning former investor relations lead at Axon – talked to us about taking a sabbatical from investor relations as she sought a new role. Having taken time to herself, then taken time think about what her next move might look like, she manifested a CFO position at a small cap. That small cap is Nasdaq-listed precision diagnostics firm Oncocyte. Here James talks to IR Impact about the skills you need to make the move from IR to CFO, what she looks for from her advisers and why stock-picking and finance appealed…

-

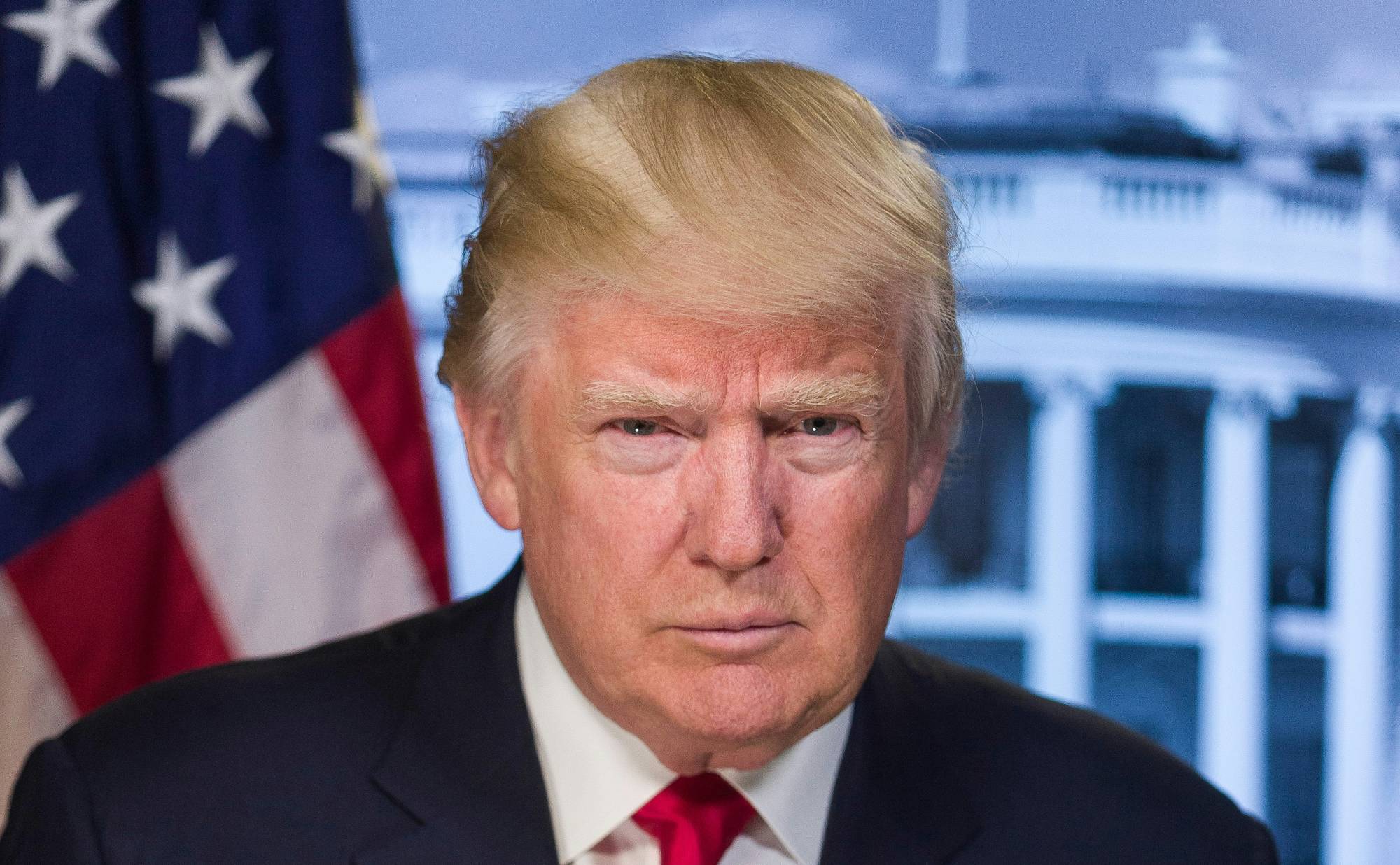

Talking DEI under Trump 2.0: how anti-woke investors are hijacking pro-ESG proposals

What does DEI mean to you? Here at IR Impact, we’ve stopped spelling out diversity, equity and inclusion, working under the assumption that this most tricky of news items is known to all. But it seems that other interpretations exist – on the White House official X account for example, where a post was recently put out stating ‘the only DEI we support is Deport Every Illegal’. That very much sums up the kind of narrative companies are up against with today’s very public broadly anti-ESG and specifically anti-DEI rhetoric.

-

Struggling for survival amid the noise: biotech webinar offers wider lessons for the IR community

While not everyone in the IR profession will be working in the environment that biotech IROs find themselves in today, everyone seemingly everywhere is battling the noise and uncertainty generated by tariff talks, geopolitical tensions and other macro headwinds. IR Impact recently sat down with Angela Bitting, senior vice president, corporate affairs at Twist Bioscience, Aron Feingold, vice president IR and corporate communications at Geron Corporation and Lynn Pieper Lewis, founder and CEO of webinar sponsor Gilmartin Group, to talk about the challenges the sector is facing. The fascinating discussion that followed is as useful to those in the broader…

-

ESG: Over or in it for the long haul? IR Impact Forum takes debate to Canada

Whether ESG is over or increasingly relevant, in need of reform or greater standardization is the great debate. Has the term become too ‘woke’? Is it too much of a political hot potato? Does good ESG equate to better share price performance, or has it been hijacked under the pretense of improving returns? Prabh Banga of Aecon Group (left) and Jack Mintz from the University of Calgary (middle) debate ESG with IR Impact’s Steve Wade These were the topics up for debate when Prabh Banga, vice president of sustainability at Aecon Group and Jack Mintz, president’s fellow of the school…

-

Huntington Bank names Eric Wasserstrom as IR lead and a flurry of posts open up across the profession

New names at Huntington Bank. Atos Group and Konecranes, while a flurry of posts open up across the profession. Eric Wasserstrom has been named as the new vice president, head of investor relations at Huntington National Bank, a $210 bn asset regional bank operating across 13 US states.

-

Small (and a mid) caps hit big: Aecon, Calian and TransAlta take three apiece at the IR Impact Awards – Canada 2025

In an event packed with the highest achieving IR teams in Canada, it was two small-cap companies and a mid-cap firm that punched hardest, with Aecon Group, Calian Group and TransAlta Corporation each taking home three IR Impact Awards at the black-tie ceremony in Toronto last night. TransAlta took the trophy for best overall investor relations and best investor relations officer for Tamara Cook – both in the mid-cap category – as well as winning its sector award in utilities. The two small-cap companies also won some of the most prestigious awards of the night, with Aecon claiming best overall…

-

Taking management on tour: What’s the sweet spot for investor meeting attendance?

‘We’re spending more time with investors without our management team,’ Naji Baydoun, director of IR at Innergex, told IR Impact editor Laurie Havelock in the Global Roadshow Report 2025. ‘Maybe at the beginning of the [2024] we were spending 10 percent of our investor engagements without management and now we’re up to about 25 percent with just the IR team,’ explained Baydoun. ‘That’s because we’ve built relationships and trust with those investors, so I’m happy about that.’ According to IR Impact’s 15th annual research report into the who, where, how and why of corporate roadshow activity, there has been a…

-

How to talk tariffs: IR in the new era of uncertainty

The US economy is in ‘a period of transition,’ US President Donald Trump told Fox News on Sunday. By close of trading on Monday, the US S&P 500 had dropped almost 3 percent, with tech stocks taking a particularly heavy hit. Weeks of back and forth as Trump threatened tariffs, paused tariffs, reintroduced tariffs – and saw retaliatory levies by affected markets – finally came to a head.

-

‘Without my Bloomberg screen, I have to be creative’: Five things we learned from IROs who switched from the sell side

It’s news to no one that investor relations is increasingly appealing to former sell siders. Events from the financial crisis to the introduction of Mifid II in Europe have combined with trends around the increase of passive investing and a squeeze on the sell side to drive some to look elsewhere – with many landing on IR

Explore

Articles

Stay informed on critical issues affecting IR teams, gain expert analysis of market trends, buy-side insights, career advice, and more.

Peer comparison

Our new tool lets you benchmark your IR program against peers in your region and sector, uncover strengths, and identify areas for growth.

Playbooks

Packed with industry trends and insights that define best-in-class practices across key, practical, and timely aspects of an IRO’s role.

Research reports

Powered by the world’s largest survey of the buy side, sell side, and IR professionals, discover data-driven insights on running a successful IR program.